Re: Forex Analysis by LiteForex

GBP/USD: updating weekly highs

Current trend

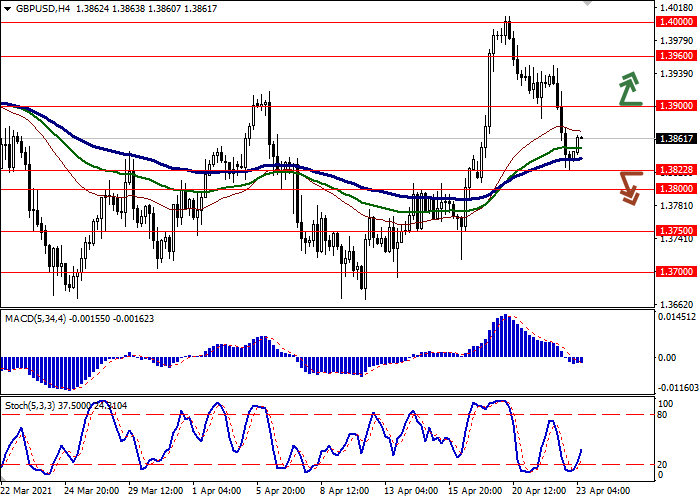

GBP is marginally strengthening against USD in today's morning session, ending the week at new local highs since March 23.

Market activity remains rather low due to the Easter holidays. Investors' interest is fueled only by the forthcoming publication of data on the US labor market for March. After an impressive report on private sector employment from ADP, investor optimism increased markedly, although the overall picture was smoothed by statistics on jobless claims. The number of initial jobless claims for the week ending March 26 increased from 658K to 719K, which turned out to be worse than the market forecasts of growth to 680K. The number of continuing jobless claims for the week ending March 19 decreased from 3.84M to 3.794M, while forecasts assumed a decrease in the indicator to 3.775M.

GBP positions on Thursday were supported by positive macroeconomic statistics on business activity in the UK manufacturing sector. Markit Manufacturing PMI rose from 57.9 to 58.9 points in March, which turned out to be better than the neutral forecasts of analysts.

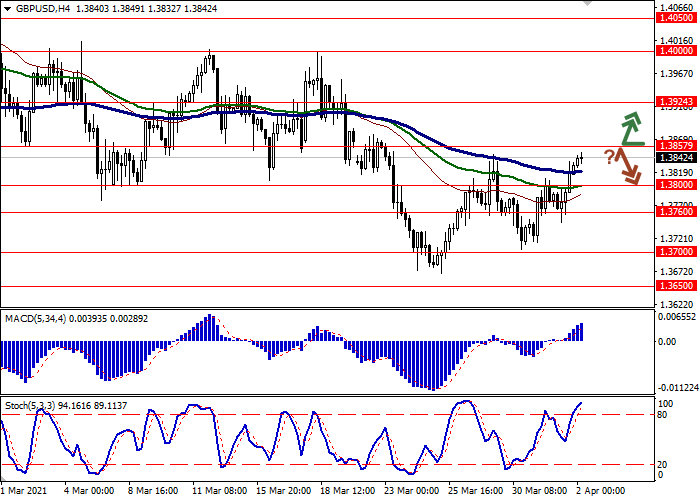

Support and resistance

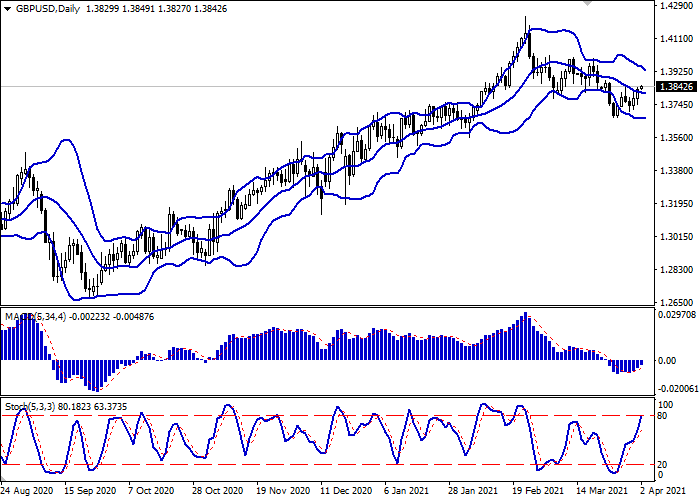

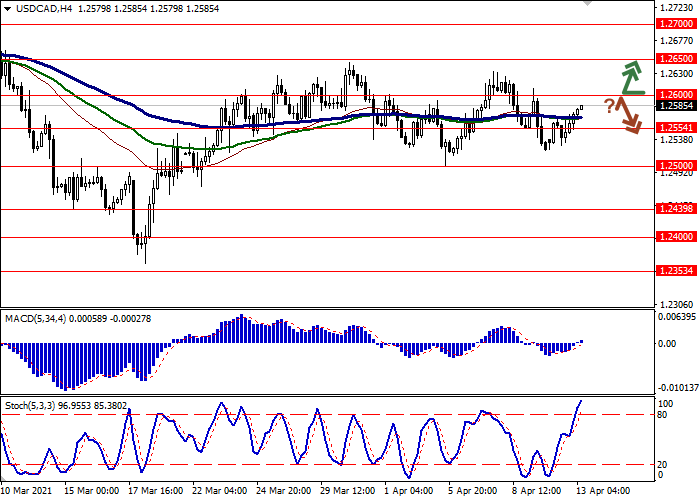

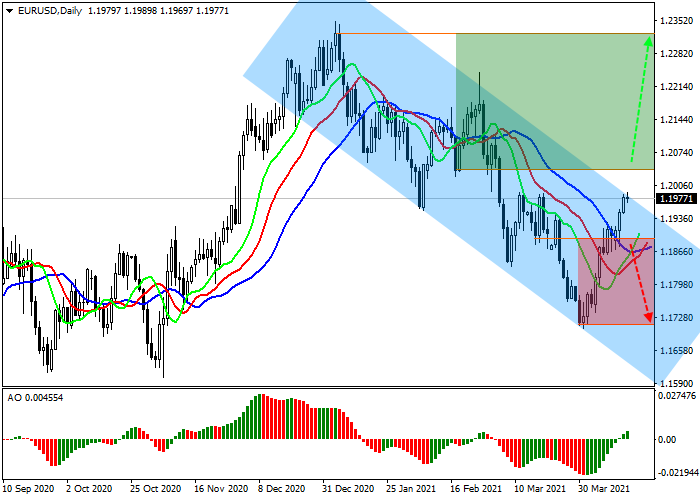

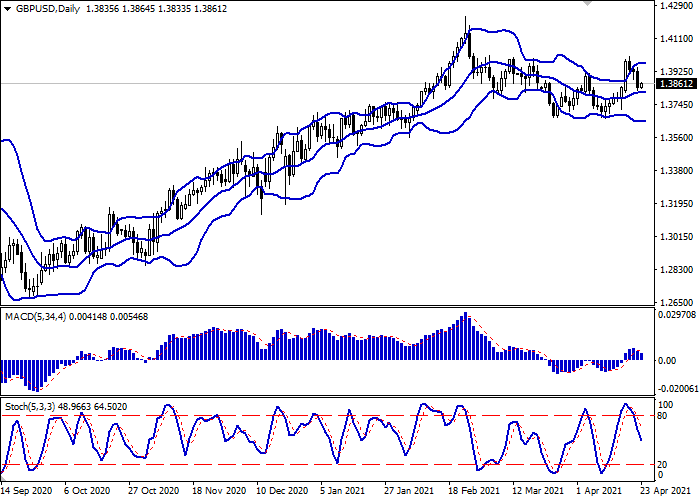

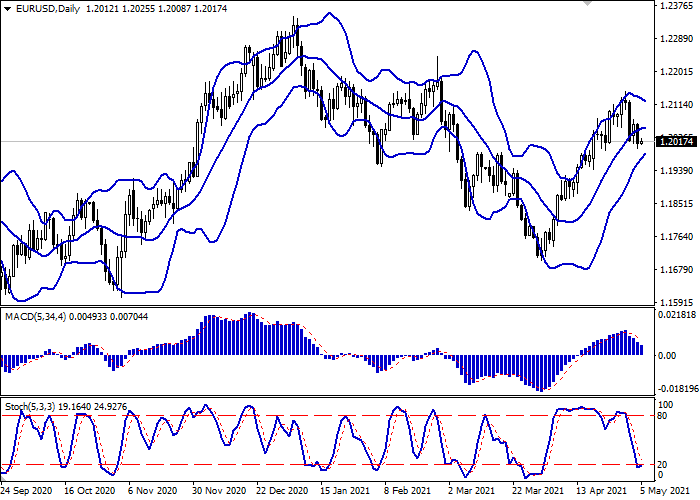

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is narrowing from above, reflecting the emergence of ambiguous dynamics in the short term. MACD indicator is growing preserving a rather stable buy signal (located above the signal line). Stochastic keeps its upward direction but is rapidly approaching its highs, which reflects the risks of overbought GBP in the ultra-short term.

Resistance levels: 1.3857, 1.3924, 1.4000, 1.4050.

Support levels: 1.3800, 1.3760, 1.3700, 1.3650.