timpa wrote:If there is a mismatch between them and EA Studio not showing the same result as live with the same history data, how can I then know that the generated strategies will perform live?

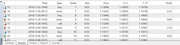

The EA has performed well in the demo and also live but why the different result? So it's performing well live but I´m puzzled with the mismatch in the backtest.

I´m not by any means well experienced in Popov's world, but It should show the same result without Monte Carlo?

The data is the same and the execution should be the same?

But now I made an mt4 backtest and it also did not show the live trades 30 November, same as EA Studio..?

It is an M5 strategy, is it to "fast"?

It´s all fine if it passed the Monte Carlo tests I´ve mentioned. The reason is very simple: all your backtests use a FIXED spread, but all your live trades use a dynamic spread. That mainly affects strategies that are built "on the edge" - for example, in your backtest at the open of the new bar, the price might have been 1.23001 and 1.23006 (so a fixed spread of 0.5 pips (or whatever you´ve set) that is used throughout the complete backtest) and the indicators will use these both prices to calculate their values to determine a possible entry. But, on your live trade at that exact bar open time, the prices might have been 1.23001 and 1.23010 (so a spread of 0.9 pips at that exact same time as in the backtest) and that little difference CAN cause another entry because the indicators gave different values live because of the different spread than in the backtest - so no trade or A trade was triggered that does not match the backtest. You can´t avoid that at all, it´s absolutely normal - I have it day in and out since 10 years of EA trading with all my strategies and it´s nothing you need to worry about, because, in the long run, these small differences will not matter for a STABLE strategy. And that is the important point: you need to make sure that your strategy is STABLE via Monte Carlo by randomizing spread and slippage by meaningful values - if the strategy is still profitable with randomized spread + slippage, randomly skipped trades and a randomized starting bar (to avoid trade chain dependency), you can go ahead and trade it live - at least you can rest assured it will not fail because it is highly spread, slippage or trade-chain sensitive. Do the same for the entries and exits, skip 5% of them in the Monte Carlo simulation - this basically simulates these missed / wrong trades. If the strategy is stable with all 4 of those (spread, slippage, randomized starting bar and skipped entries / exits by at least 5%), you can be sure that you can now trade it live, even if trades will sometimes differ.

Good luck :-)

P.S.: The backtests between EA Studio / Metatrader 4 (haven´t tested 5) should match almost 100%, at least for the amount of trades, as net profit can be a little different based on your account currency used in EA Studio / MT4 and the current base value if the pair you trade is not denominated in the currency of your account (both EA Studio and MT4 might use different exchange rates for your account currency in that case). Also Metatrader takes into account commission (pulled from your broker from when you´ve last connected to their server), so profit will not be an exact match. But the amount of trades + equity curve "by eye" should be very close between both (at leats it is for all my *stable* strategies).