EUR/USD: US consumer confidence weakened the dollar

The dollar index froze in flat today: on the one hand, the indicator was able to return to the area of 96 points, but on the other hand, further growth was questionable. The fundamental background for the US currency is quite controversial, so traders are in no hurry to open large positions - neither in favor of the greenback nor against it.

Bulls of EUR/USD situationally took advantage of the situation, making up for yesterday's losses, however, the northern dynamics is also under a certain question. Throughout the trading day, traders stormed the 14th figure, but it is not yet possible to finally gain a foothold in this area. The European currency was not able to attract investors even against the background of the shaken demand for the dollar. As a result, the EUR/USD pair was also stuck in a flat, despite the predominantly bullish sentiment of investors.

In general, the foreign exchange market today is balanced between two border states. In the morning, there was clearly a thirst for risk in the background of recent events. Traders "changed their anger to mercy" when the main indices of the US stock market showed rapid growth. News from China also encouraged the market, as the date of talks between Beijing and Washington became known: the American delegation will visit the Chinese capital in the second half of January. This fundamental picture has weakened the interest of traders in the dollar, which has recently enjoyed the status of a "defensive asset".

In turn, this situation allowed the EUR/USD bulls to return the pair to the area of the 14th figure, although the northern dynamics of the price were under serious threat. The reason for this is the economic bulletin, which was published today by the ECB. The European equivalent of the "minutes" of the Federal Reserve rarely causes strong volatility in the market, but against the background of an almost empty economic calendar and low liquidity, today's release played a role for the euro.

By and large, the published Bulletin in many respects duplicates the already voiced information from the last meeting on monetary policy. Today, traders did not see anything new in the report: according to members of the central bank, the eurozone economy still needs significant amounts of stimulation against the backdrop of increasing downward risks. The central bank expects to see further expansion of the economy, although the momentum of growth by the end of the year slowed noticeably. In addition, the regulator is quite pessimistic about the dynamics of the EU economic growth in 2019 against the background of the expected slowdown in the global economy.

All these theses were almost literally voiced by Mario Draghi at the ECB's last meeting this year. However, he was more optimistic in his assessments, while the Bulletin compiled only negative factors. Therefore, among the experts today there is a fairly reasonable assumption that at the beginning of the year the European Central Bank will soften its rhetoric.

In their opinion, the regulator will first of all change the wording regarding the approximate term of the rate increase. If at the moment the ECB plans to tighten the monetary policy "not earlier than autumn 2019", then in the text of the January or March accompanying statement of the wording may be subject to adjustment. The essence of the possible changes is obvious: the regulator will move the date of rate increase for an indefinite period, so that, on the one hand, not to entertain the market with unrealistic illusions, and on the other hand, not to drive itself into the framework of its own forecasts.

In my opinion, these concerns are justified, but only if the key inflation indicators show a further decline in the first quarter of next year. That is, the ECB can adjust its position only at the March meeting, while the January meeting is likely to be "passing". Apparently, the market also came to the conclusion that it is too early to worry about this, so after a small southern pullback, the EUR/USD pair shot up, after all having overcome the price outpost of 1.1400.

This price movement contributed to the US statistics. The consumer confidence indicator published today turned out to be much worse than forecast: with the forecast of 133.7, it came out at 128.1 - this is the weakest result since July of this year. The indicator has weakened quite sharply and unexpectedly, since over the past five months it has not decreased below the 130th mark.

As you know, this index is a leading indicator of consumer spending, so traders returned to the problem of inflation growth in the United States. The market was again concerned about the pace of the rate hike next year – after all, according to some experts, the Fed may even pause the process of tightening monetary policy - or just raise the rate once at the December 2019 meeting. And although these arguments are also too generalized, the dollar was under quite strong pressure.

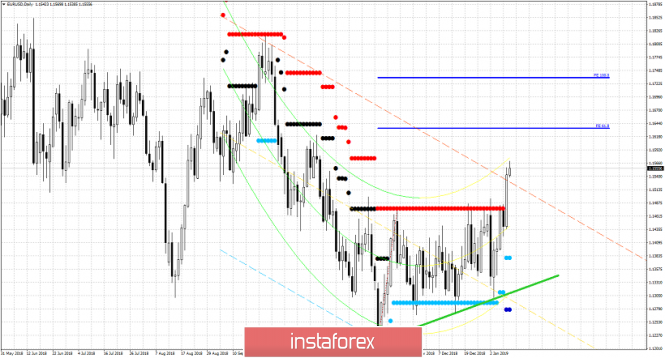

Technically, the bulls of the EUR/USD pair still need to consolidate above the upper line of the Bollinger Bands indicator on the daily chart (1.1430) and the upper limit of the Kumo cloud (1.1515). Having overcome these price barriers, traders will indicate the priority of the northern movement. Until then, there is a risk of a downward rollback to the middle line of the Bollinger Bands, that is, to the level of 1.1360.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex