Re: NPBFX - making money with us since 1996!

NZD/USD: New Zealand dollar is in the correction 28.11.2018

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on NZD/USD for a better understanding of the current market situation and more efficient trading.

Current trend

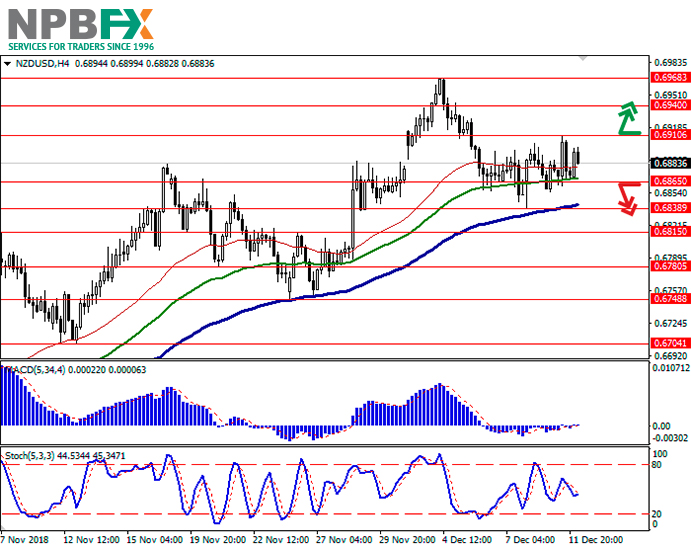

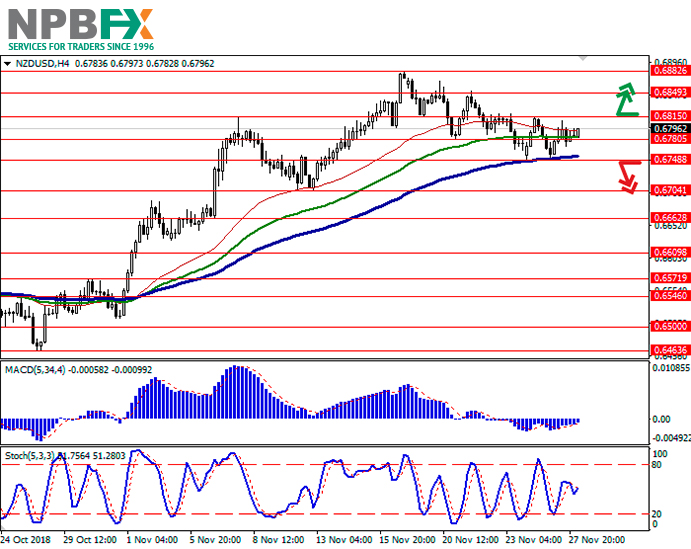

Yesterday, NZD rose against USD, continuing the development of the corrective “bullish” impulse formed at the beginning of the week, due to quite strong data on New Zealand exports and a weak US macroeconomic background.

Thus, in October, exports from New Zealand increased from 4.25 billion dollars to 4.86 billion, which was slightly better than the average market forecasts. Imports increased even more: from 5.85 billion dollars to $6.15 billion, which led to a worsening of the trade deficit. The October figure reached –5.79 billion YoY against –5.33 billion YoY in September.

Today, the pair is strengthening, waiting for new drivers to appear. Investors are focused on the speech of the head of the RBNZ, Adrian Orr, and a block of US statistics, followed by the speech of the Fed Governor Jerome Powell.

Support and resistance

On the daily chart, Bollinger bands reverse horizontally. The price range narrows, reflecting the ambiguous trade nature of the recent days. MACD indicator is reversing upwards, keeping the sell signal (the histogram is below the signal line). The dynamics of Stochastic are similar, which indicates the potential for the development of corrective growth in the super-short term.

It is better to wait for the final formation of the "bullish" signal.

Resistance levels: 0.6815, 0.6849, 0.6882.

Support levels: 0.6760, 0.6748, 0.6704, 0.6662.

Trading tips

Long positions can be opened after the breakout of the level of 0.6815 with the target at 0.6882 or 0.6900. Stop loss is 0.6780.

Short positions can be opened after the breakdown of the level of 0.6748 with the targets at 0.6662–0.6650. Stop loss is 0.6780.

Implementation period: 2–3 days.

Use more opportunities of the NPBFX analytical portal:E-book.

If you just recently started to be interested in trading on FOREX and would like to deepen your knowledge, an electronic Beginner's Guide to FOREX Trading will be an excellent helper for you here. The book consists of 5 chapters and reflects fundamental concepts of the foreign exchange market to start successful trading. From the main chapters of the E-book you can learn about the concepts and history of FOREX, currencies and trend lines, technical indicators, types of orders, trading on news, psychology of trading, risk management and much more.

You can read a Beginner's guide to FOREX Trading online or download it free of charge from the NPBFX analytical portal in the "Education" section. In order to get unlimited access to the E-book and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on NZD/USD and trade efficiently with NPBFX.