Topic: Change in market conditions

Hi all,

please contribute to this thread with your ideas.

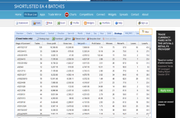

My results over the last two weeks have been bad. Last year I built many EA Studio strategies most of them with a very high winning rate (80-9x% win rate). They have worked quite well until last weeks. I understand to build 80% and higher winning rate strategies that needs (usually) a TP considerably smaller than the SL, and these strategies work better in range periods or they are usually "mean reversion" strategies or "hit and go" strategies and so on. But, as during the last weeks very strong movements in USD pairs have appeared, many of my EA Studio high winning rate strategies have gone bad. I think this can be considered as normal ![]()

I wanted to ask you all what you think about this, how you deal with these situations and how were your results last weeks.

For example, I guess if Steve's Sidekick users have also high winning rate strategies you might also have experienced similar bad results, although probably better than mine because of the stop trading in the real account once a loss happens and wait for a new winning streak to start trading the real account again. But, please can you post if your results have been bad too?

In the end I guess what happenned last weeks is simply that market conditions changed and thats why the losses appeared. For that reason I always think about detecting market conditions and using EAs adapted to those market conditions. But I think that the strategies in EA Studio, being so really simple, cannot be built on a specific market regime. On the contrary, in Forex Strategy Builder Pro it is a lot easier to build strategies when a higher timeframe (for example) is doing something. So what do you think? Are you able to build in EA studio strategies well adapted (only trading) to specific market regimes or you have experienced something similar: big movements and new trends make most of your EA Studio strategies fail once and again. We are building mainly mean reversion strategies failing with strong trends appear?. Can you build strategies in EA Studio that work the same in one type of market and other and how do you do that? I mean, maybe I could use some specific settings in EA Studio (for example, not TP and SL very different or so on). How are you dealing with this?

oF course my results could have been been better if I had a better balanced portfolio and not so many high winning rate strategies (small TP and big SL). How are you building your portfolio? Do you try to build different kind of strategies to have a balanced portffolio between trend strategies and mean reversion strategies? Is there a way to know if we have a balanced portfolio between different type of strategies?

I usually like high winning rate strategies because it is easy to notice if they are working well. On the contrary trend following strategies are a lot more difficult to ffilter out and determine if they could work in the future although they are failing now. So how do you work with trend following strategies: can you give us some advice on how to build them and when to remove themo from the real account?

Thanks a lot for your contributions all of them are of help

Regards