Volatility Explosion

Delta positive option structures are the best to use when you expect higher volatility ahead. You can use either straddle (same strikes usually at-the-money) or strangles (different strikes). If you trade with binaries straddles are not appropriate because the pay out is limited. In order to make profit with strangles, future realized volatility should be higher than the current implied volatility. On of the best times to expect this is when a major market event is expected. Such event could be the ECB press conference. Of course, you must know what could be expected and analyze the current market situation.

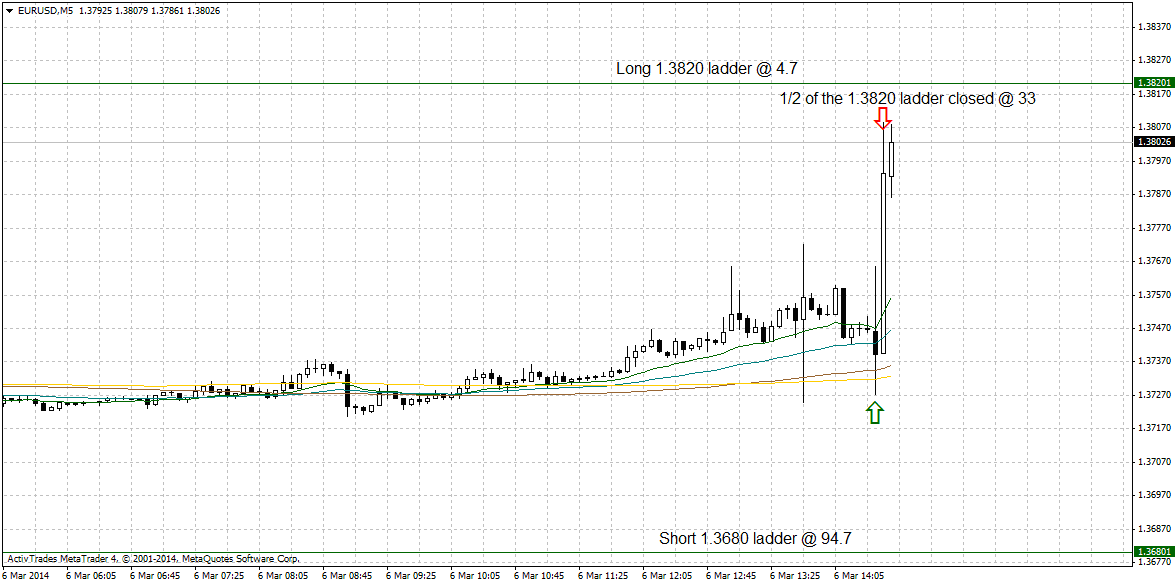

Before the ECB press conference, the market participants were short as EUR/USD fell from 1.3825 to 1.3705 and steadied just above the latter level. If Mario Draghi didn't sounded as dovish as expected, a short squeeze was probable. If Mario Draghi hinted a new rate cut or LTRO, a sell off should follow. In both cases a price move of 50 to 100 pips could be expected.

Just before the press conference we could structure a strangle (short 1.3680, long 1.3820) with expiry at the London fix. Total cost was only pts for max profit of 90 pts. Risk/reward ration of 1:9 if on of the ladders provided the maximum profit. Not bad. The good part is that you just needed a 70 pips move in one direction, which is not impossible when Super Mario speaks. Actually, I close half of the position when the profit could cover the total costs and this way I have a free trade and make profit whatever happens later. In this case I closed 1/2 of the 1.3820 ladder at 33 pts, and 1/2 of the rest of the position (or 1.4 of the original size) at 89. The option expired in-the-money for 100 pts pay out.

Volatility Explosion: