The Forex Market

The foreign exchange market (forex or FX) is the largest and most liquid financial market. It was originally created to assist the international trade and investments, enabling the free exchange of currencies of different countries. In recent years the development of technologies and access to cheap financial resources have shifted the focus of the foreign exchange market and now it is mainly used for speculation. I will try to point out some important points related to the nature of the international currency trading that I think need to be understood very well by every trader. One of the common mistakes is that the traders don't know the market they trade.

The currency market is over-the-counter (OTC), and unlike the stock and futures markets, trading is not centralized and therefore the contracts are not standardized. This feature has its advantages and disadvantages. On the one hand, the market participants have more flexibility. Big banks and brokers can offer very quickly any financial product to meet the needs of a particular group or even individual customers. Mini contracts (10,000 units of the base currency) are available for several years for smaller retail forex brokers' customers, while such futures contracts were introduced only a couple of years ago. In the field of the option structures difference is even greater. On organized exchanges are traded only plain vanilla options while banks offer their customers barrier and digital options and a variety of options products designed to meet specific needs for hedging or speculation. Of course there are disadvantages that are associated with the fact that the currency market is OTC. Regulation is much smaller and there is increased counterparty risk, while for the futures trading for example, the exchange has its own very strict rules and is a party to all transactions. For the organized exchanges the price at every moment is one and the same for all participants, while at the Forex market each market maker can provide a different quote depending on the specific client.

Trading on the forex market takes place five days a week and 24 hours a day. This is another difference from the traditional stock and futures markets, where there are specific times of opening and closing. This is a very important feature that is rather an advantage for the forex market participants. If the market has limited working time and an important event happens before the opening, prices may move in a direction substantially exceed the daily limits for change. In such cases, the market is called “limit down” or “limit up” and may not open at all for the day. If a trader has a position he or she could suffer severe losses. Nowadays exchanges have electronic trading systems (e.g. GLOBEX), working almost around the clock, but some time ago it was a very serious problem. I recommend you to read Jack Schwager 's interview with Mark Weinstein from his book “Market Wizards”. Mark had a large position in soybeans futures and the market opened a few days in a row with a gap against him outside the limits of daily price change and thus he could not close his position and realized a serious loss. I encourage you to carefully read this interview, as it has other helpful stories and tips. On thee currency markets at the present time we can not have such problems because we can follow the price action constantly or use pending orders to open or close a position. The market can only surprise us on Monday, but anyone who has left position for the weekend should be aware of this risk and take measures to reduce the potential negative effects.

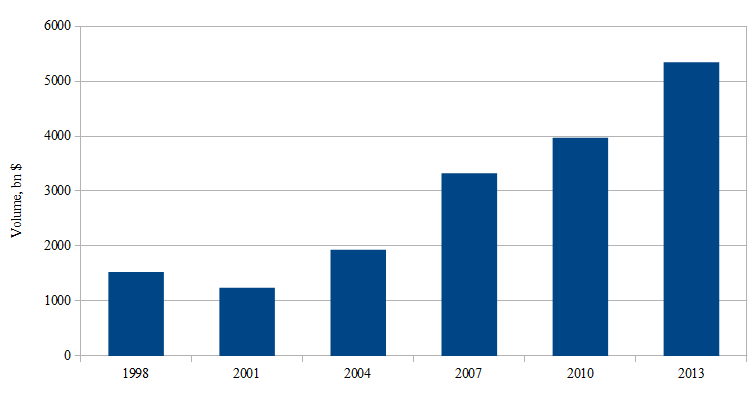

The currency market is characterized by very high liquidity. Actually it is the most liquid financial market, which is a prerequisite for low trade costs and fast order execution. Bank for International Settlements (BIS) every three years is preparing its Report on global foreign exchange market activity, the last survey was conducted a few months ago but the results are not published yet. For the survey banks and other financial institutions provide information about the volume of the foreign exchange trading - spot, forwards and swaps and other OTC currency and interest rate derivatives. According to the last survey (2013) “Trading in foreign exchange markets averaged $5.3 trillion per day in April 2013. This is up from $4.0 trillion in April 2010 and $3.3 trillion in April 2007. FX swaps were the most actively traded instruments in April 2013, at $2.2 trillion per day, followed by spot trading at $2.0 trillion.”.

Daily volume of the foreign exchange market:

It is interesting to be noted that the higher global foreign exchange market turnover is associated with the increased trading activity of “other financial institutions” – a category that includes non-reporting banks, hedge funds, pension funds, mutual funds, insurance companies and central banks. If you follow the news you should have noticed that the Asian and Mid East sovereign funds were fairly active during that period and often controlled the market. More information about this survey can be found on the website of the BIS www.bis.org.