trading:short-straddle

Short Straddle

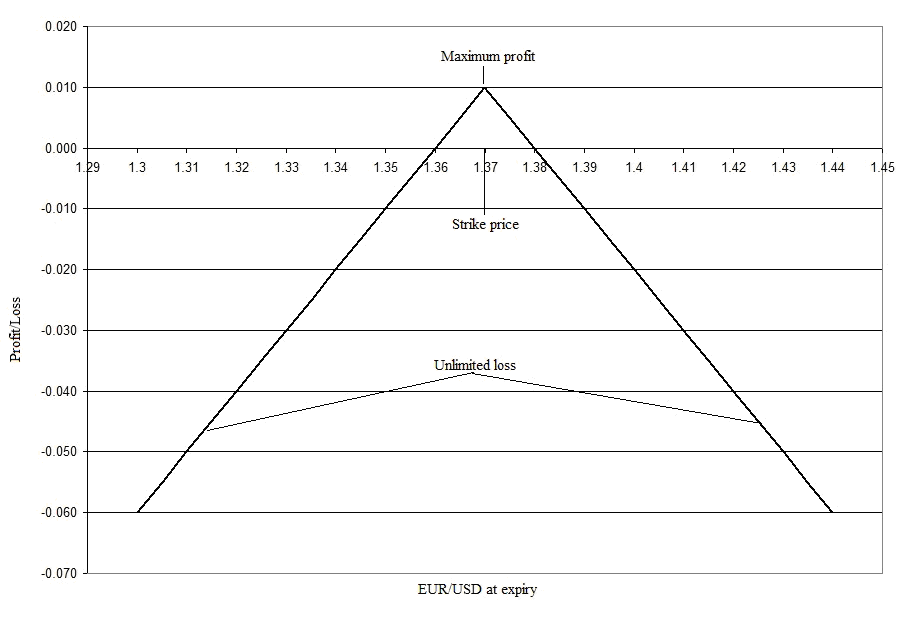

This is a simple options strategy and involves simultaneous selling of at the money put and call option with same strikes and same expiry. Short straddle is used when the the price of the underlying asset is expected to stay in a tight price range around the strike of the options or when there is expected decrease in volatility (e.g. before major economic data release or central bank decision, or during the summer months). Potential profit is limited to the sum of the premiums received, while the maximum loss is unlimited. If you trade such strategies you must have very good money management and position adjustment rules.

P&L at expiry