Order flow trading with binary options

When you swim, it is best to go with the flow. The same rule applies for trading. When you buy, you should by where the large market participants buy, and when you sell, where the large market participants sell. If you do this, your trading will be much easier and much more successful. What you have to do is to identify these price levels, wait for the price to go there and look for confirmation by the quote reading or price action. Trading is really that simple, but that's what is making it so difficult. There is no way to know exactly where the larger orders are placed. The FX market is OTC and there is no central exchange. However, you can identify the stronger support and resistance levels and read in the news feed if large bids and offers are placed there. The quote reading must confirm that around these levels are actually executed large orders. When you see this, you can trade with spot position or binary options.

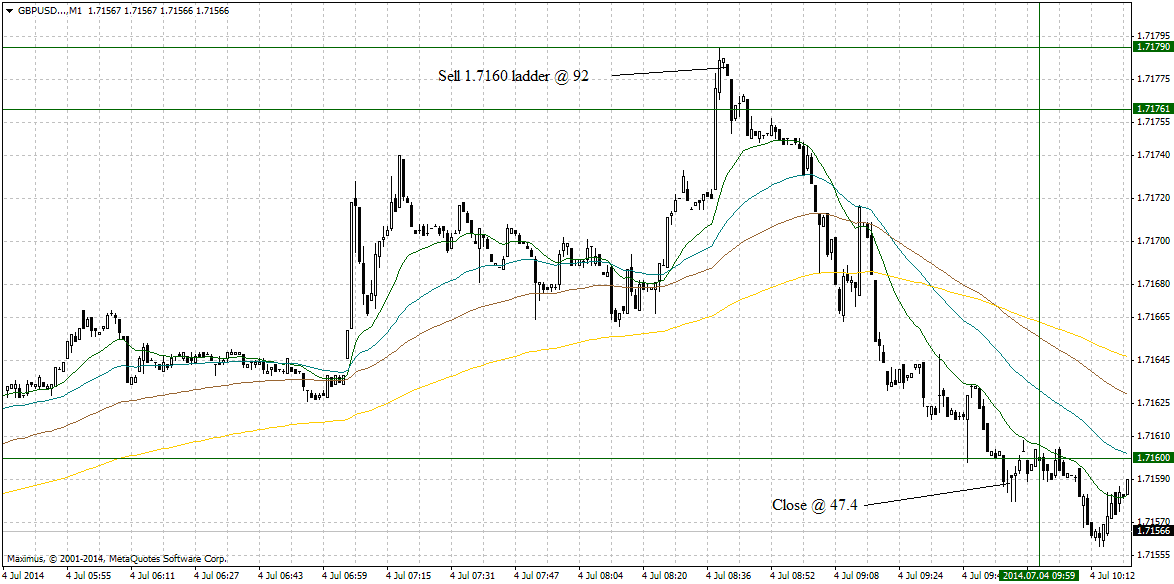

Let me show you with one example how you can trade the order flow around support and resistance levels. Strong offers were reported for GBP/USD in the 1.7170/75 area. Friday was public holiday in the US, which meant that the liquidity would be lower. When the liquidity is lower, it is more difficult strong levels to be broken. GBP/USD rallied towards the offers and some of them were filled. This was before the London open and the probability for a valid break was low. You could sell the pair, with a stop above the last swing high, or sell a ladder with strike 1.7160 and expiry at 8:00 London time for 92 pts. For the ladder position the maximum risk was 8 pts, while the maximum profit 92 pts. GBP/USD retreated form the high and you could close part or all of your ladder position at prices between 60 and 35 (I covered at 47.4). It was a good 44 pts profit for 8 pts risk.