Opening Range Breakout

Opening Range Breakout could be used as a standalone strategy or as additional filter for opening of the positions in other strategies. Rules are very simple, but there are many variations depending on the underlying asset and traders risk preferences.

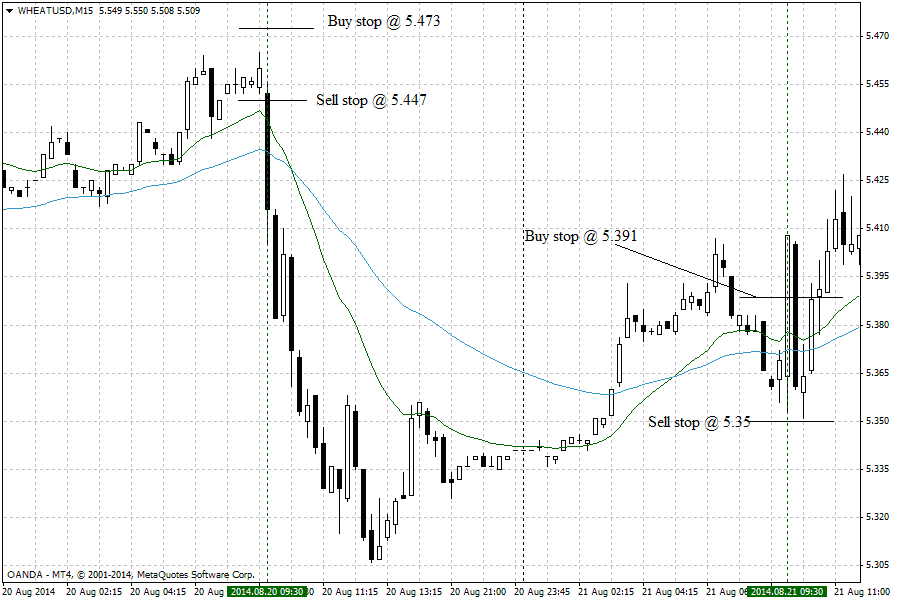

A few years ago, I was waiting 15 to 30 minutes for the opening range to form. Then high and low were used to calculate the entry points. Buy stop was placed above the high of the range, while a sell stop was placed below the range.

Now electronic trading of the futures is much more popular and liquid and I made some amends to the rules. For some of the underlying assets I trade the breakout not of the opening range of the open outcry session, but the range of the electronic session. Of course, if you want to avoid some false breakouts you can wait 15 minutes after the open before you place your entry orders.

There are many ways to trade after the opening of the markets, but you will have much better results if you add some filters. Some of these could be:

- trade only in the direction of the trend if there is any (if the trend is down, place only sell stop below the low of the opening range).

- trade only after NR4, NR7, and/or ID forms (after volatility contraction, the breakout could be stronger).

- trade the second breakout or the pullback towards the breakout point.

- use the correlation between the assets to avoid false breakouts (if the soybeans break higher, don't sell wheat).