How to use the binary options?

Many traders think that the binary options are gambling rather trading. They are right to some extent, because there are a lot of binary options brokers that are not regulated. Anyway, this is not a good reason to avoid this type of options. Their greatest advantage that they provide you a leverage with regards to the size of the price move. This means that even the price moves are much smaller than usual you can trade your set ups with much better risk/reward ration. Let me show how this works with an example.

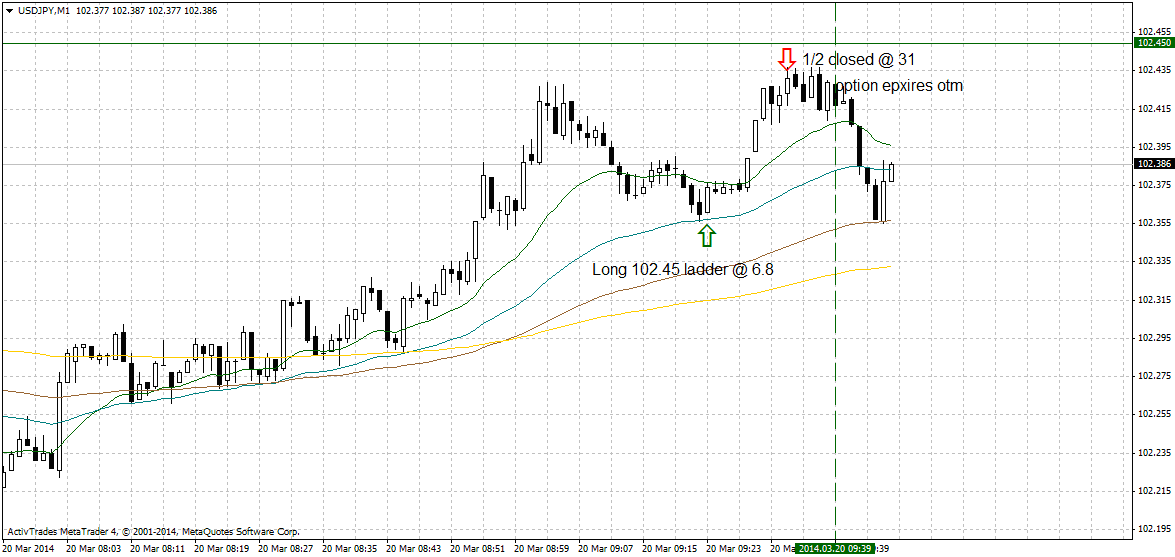

USD/JPY was going up and the EMAs were confirming this. Conditions for a STEAMM set up were perfect. All we needed was a pullback towards the 20 or 50 EMA. Slight problem was that the pullback was only 7 pips. This makes the risk/reward ratio worse. Of course this is valid if you trade only spot. When you add this will not be a problem. The trick is that there must be the right binary option when you see the set up. This time everything was perfect. When USD/JPY tested the 50-period EMA you could buy a ladder with expiry after 15 minutes and strike 102.45 (8 pips away from the spot). The price was between 6 and 7 points (actually I bought it at 6.8) for a payout of 100. USD/JPY rallied and you could close your position (or part of it) at a price between 30 and 32 points. I closed 1/2 of the position at 31 points. The rest expired OTM, but my initial costs were covered and even mad some profit. If I closed my entire position, I would end up with risk/reward of 1/4, which is not that bad. Profit of 24 pips when the price moves only 7 pips is not that bad.