How to trade in December?

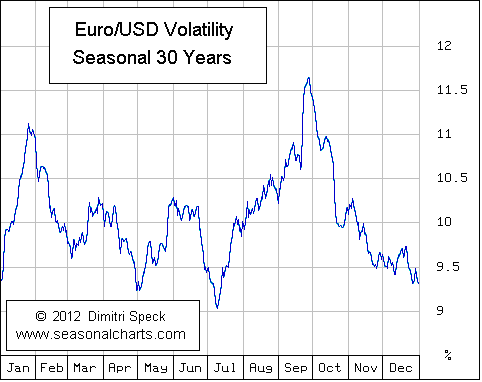

Volatility of the EUR/USD shows clear seasonal patterns. Usually it is very low during the summer and at the end of the year. In December, coming holidays are not the only reason for this. Most of the bank dealers and fund traders just don't care about the markets in the last month of the year. Their bonuses are calculated as of the end of November and whether they profit or lose in December they won't make more money for themselves. If there is no any major fundamental event, price move in the last month of the year are rather random and accidental. None of the large market participants has the incentive to take huge position unless something very important happens.

EUR/USD volatility seasonal chart

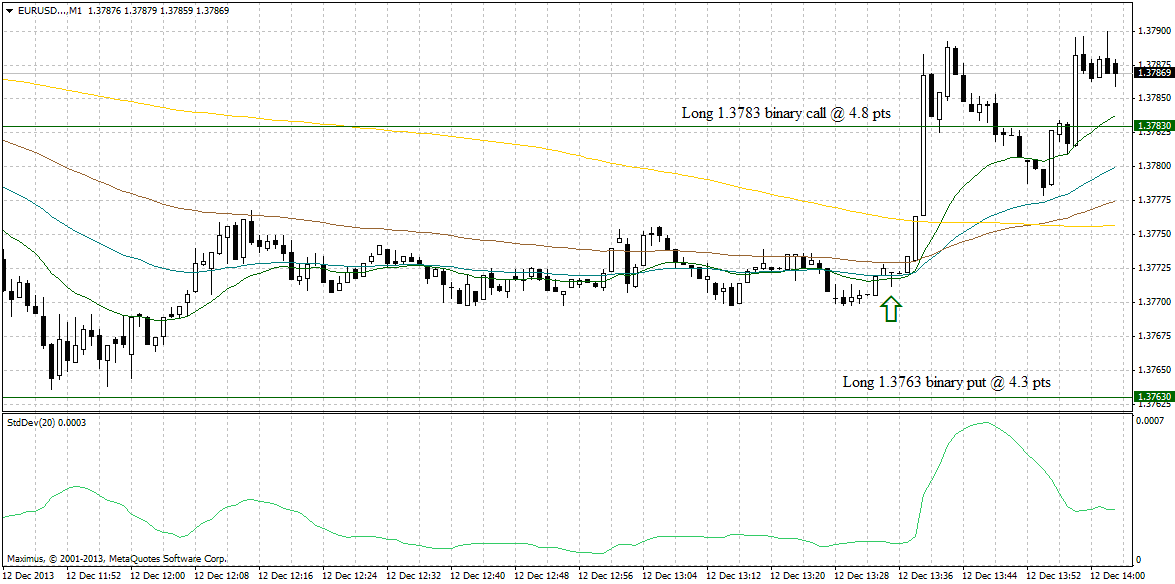

In such market environment it is not reasonable to expect prolonged price moves in one direction with good retracements providing entry opportunities. Sometimes they could happen, but in trading, we should emphasize on repeatable patterns. Some traders choose to stay out of the market in December, but that is not necessary. It is much easier to trade volatility and the Christmas market creates good opportunities for this. Usually in December trending price moves stop suddenly and then the price is moving in a range. Then it breaks out of the range and new directional price moves starts. It is not worth it to try to guess the direction of these price moves. It is much easier to trade the increase in volatility. The best strategies are the strangles and straddles. Better results you can have with binary options, because of the leverage effect. My advice is to wait for prolonged period of low volatility and buy the strangle closer to expiry to save some time decay. Also you should work on the timing of your entries. Just before the top of the hour there is increased probability of a trending price move. When you pick the strikes try to trade with at least 1/5 risk/reward ratio, although I usually open positions with at least 1/10 as was with the example on the chart below.

EUR/USD volatility trade