Forex Market Transactions

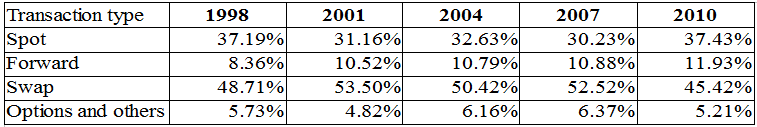

The main types of FX market transactions are spot, forwards, swaps and options. In the table below you can see the results of the Bank for International Settlements triennial study.

Spot transactions in the forex market are a direct exchange of one currency against another and the quotes you see on your platform are valid for this type of transactions. Spot value date is 2 business days and each party to the transaction must provide to the respondent, the agreed amount of currency in this period. For example, US based company exports its products to the Eurozone and has in its bank account 10,000,000 euros. On Wednesday, this company has to pay the salaries of their employees, and so on Monday it sells these EUR 10,000,000 against USD to bank ABC's FX dealing desk at the spot rate of 1.4000. On Wednesday, the bank takes from the EUR account of the company 10,000,000 euros and transfers to its USD account 14,000,000 dollars. Each currency transaction always involves two currencies, the first one is called the base and the other quoted currency. For example, in the currency pair EUR/USD, the base currency is the euro, while the quoted currency is the US dollar. Traders always buy or sell the base currency, and the P/L of the position is calculated in the quoted currency.

The FX forward is an agreement between two parties to buy or sell an asset at a predetermined price on a specified future date. These financial products are not standardized and are traded on the OTC market. The specific conditions are negotiated for each transaction. The value date of the forward transactions is over 2 working days in contrast to the spot transactions. Many people ask me how to trade futures contracts, so I'll explain a little about them. Futures are also financial instruments with future delivery, but unlike forwards, these contracts are standardized and traded on organized exchanges only. The futures contracts are always traded for a specific volume and predefined maturity dates. The underlying asset must comply with strict contract specifications. For example, the currency pair EUR/USD can be traded through the Eurocurrency futures, that quoted on the electronic market of CME Globex. The standard contract is for €125,000, and the symbol is 6E. Maturities are always in the months of March (H), June (M), September (U) and December (Z). For example, the symbol of the euro futures maturing in December 2013 will be 6EZ3. Standard trading session in this contract is from 7:20 AM to 2:00 PM CT (15:20 to 22:00 GMT), while the electronic trading is from 5 PM to 4 PM CT. With the futures contracts we can trade the same strategies that we are dealing at the spot, but you should bear in mind that the quotes will vary because of the forward points. The benefits of the futures are that they are traded on an organized exchange and they have better price transparency. They broker cannot hunt just your stop or delay deliberately your order fills.

Forward points are a number that is added to or subtracted from the current spot rate in order to obtain the forward rate. They are calculated using the following formula:

1 + Interest of the quoted currency * (Days to maturity / 360) Forward rate = Spot rate * ---------------------------------------------------------------- - 1 1 + Interest of the base currency * (Days to maturity / 360)

The FX swaps are also derivatives, and are actually an exchange of cash flows of any currency pair. In practice, swaps can be structured on everything that can be exchanged, but we are more interested in the FX swaps. In such transactions there is simultaneous buying and selling of two currencies with two different value date. The closer value date usually is spot while the farther is forward. It is possible both to value dates to be forward (ie more than 2 days). Each transaction is called a leg and is executed at the market rate for the respective value date. If the first leg is for spot value date the deal will be done at the current spot rate. If the second leg is for one month the deal will be executed at the forward exchange rate for the same maturity. If today is April 15th, the current spot rate 1.3020 and the one-month forward points are +5 pips we can have the following two simultaneous deals for structuring of a FX swap (transactions are from the perspective of one of the counterparties to the swap):

- purchase of EUR against USD with April 17th value date at a rate of 1.3020

- sale of EUR against USD with May 17th value date at a rate of 1.3025

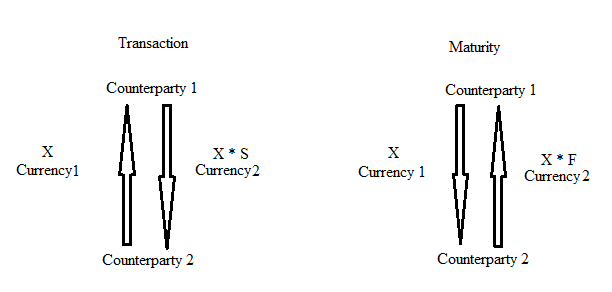

FX swap cash flows

On the above chart are displayed the cash flows of FX swap. With X is denoted the amount of the base currency (eg Euro, if the swap is for EUR/USD). With S is denoted the rate of the first leg, which is usually the spot (value date up to two business days from the date of the transaction), while F denotes the forward rate at which will be exchanged the second leg at maturity.