Don't gamble, just trade

In this article, I will share my humble opinion whether trading is like gambling. Actually, trading, like anything else in life, is what you make it. When you buy and sell just because you feel that the price is too low or too high, that's rather gambling. If you want to trade, you have to open a position only if there is high probability that the price will rise all fall. However, your trading doesn't end with the position opening (actually this is the mistake most of the losing traders make). Active position management could make the difference between losing and winning. Everything in your trading should be based on simple and sound logic. When you trade off 1-minute chart, you shouldn't wait for hours to take your profit or loss. If the currency pair is not doing what you expect, just reduce the size of your position or close it.

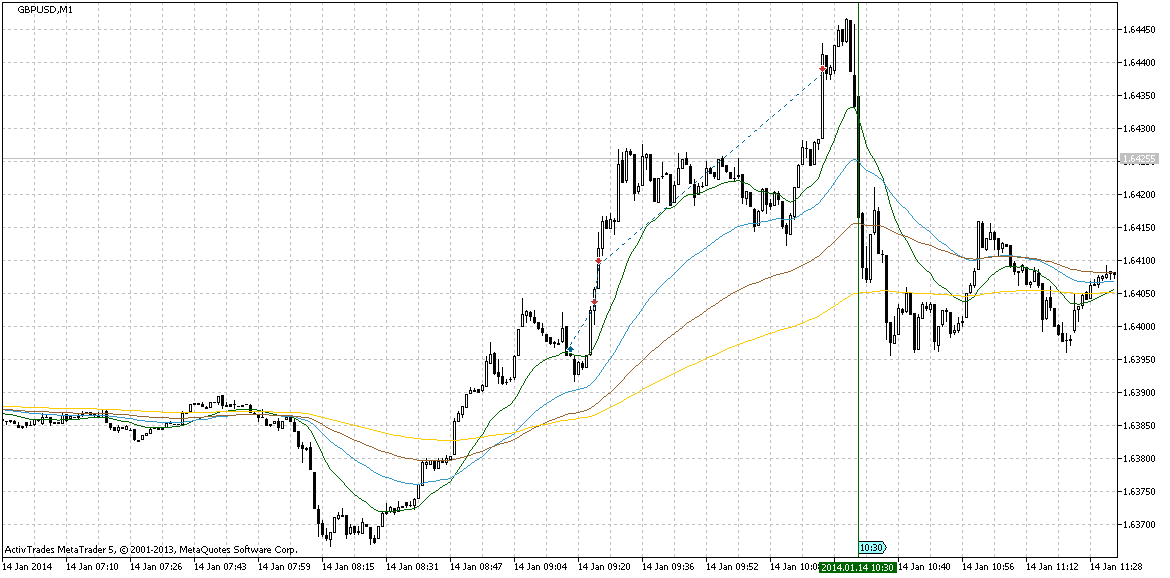

This is one of my positions. I bought GBP/USD on the 20 EMA. The initial stop was 6 pips and the 1st part was closed for 6 pips profit. The pair rallied and the second part was closed for 12 pips profit. Stop was moved at +1 pip. It is very important to protect your trading capital and profits. After some consolidation GBP/USD rallied again. A few minutes before the UK inflation data the profit of the position was around 40 pips. If I left the position for the data release you could make bigger profit if the pair goes up, or lose the profit if it went down. This is gambling for me because you can't control the events. My decision was to closed the rest of the position for 41 pips profit. After the data release I could enter the market again if a good set up is present.

GBP/USD news trading