Calendar spread

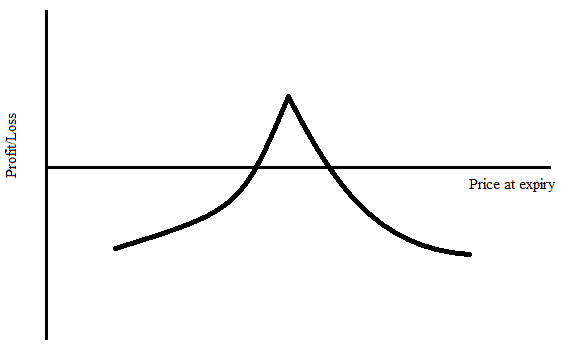

Calendar spread is an option strategy that uses the different speed of time decay of the options that have different expiries. Time decay accelerates one month before the expiry, all else being equal. This effect is used in the calendar spreads. Calendar spread is established by selling a call (put) option with a closer expiry and buying a call (put) option with a later expiry and the same strike. For example, sell a call option with strike 1.3300 and expiry after 1 month and buy a call option with strike 1.3300 and expiry after 3 months. Options are usually at the money, as it is expected that the underlying asset will stay in tight range. However, if we have a different view of the market we can choose a higher or lower strike. Usually when the short option expires, the long option position is closed. Calendar spread is a debit strategy, because we pay the difference between the premiums of both options. The risk is limited to the amount of the net premium paid, and the profit is greatest, when at the expiry of the short option, the price is exactly at the strike.