Table of Contents

Fractal

The Fractal indicator is available in the “Opening point of the position” and “Closing point of the position” slots of Forex Strategy Builder.

Its source code is published in Fractal Source Code Internet page.

If you have any questions concerning the Fractals, ask in the program's Forex Forum.

Introduction

According to “Encarta Dictionary” Fractal is a repeating geometric pattern: an irregular or fragmented geometric shape that can be repeatedly subdivided into parts, each of which is a smaller copy of the whole. Fractals are used in computer modeling of natural structures that do not have simple geometric shapes such as clouds, mountainous landscapes, and coastlines. Microsoft® Encarta® 2008. © 1993-2007 Microsoft Corporation. All rights reserved.

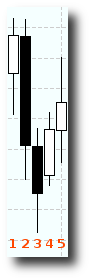

In technical analysis a Fractal is a figure which consists of five bars minimum.

There is an up fractal and a down fractal:

An up fractal consists of five bars where the bar in the middle has the highest price. The chart shows that the highest prices of bars 1, 2, 4 and 5 are lower than the highest price of bar 3. The highest price of bar 3 is called the fractal top. This is also the critical price used to enter or exit the market.

A down fractal consists of five bars where the bar in the middle has the lowest price. The chart shows that the lowest prices of bars 1, 2, 4 and 5 are higher than the lowest price of bar 3. The lowest price of bar 3 is called the fractal bottom. This is the critical price for this fractal.

Calculation

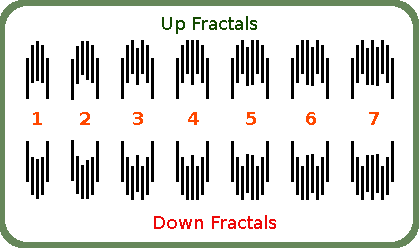

A fractal is determined when the highest or the lowest price of each bar is compared to that of the previous two or the following two bars.

Forex Strategy Builder distinguishes between 7 types of fractals, depending on whether they contain bars with the same extreme prices:

Parameters

Logic - the logic followed when applying the indicator:

As an opening point of the position:

- Enter long at an Up Fractal;

- Enter long at a Down Fractal.

As a closing point of the position:

- Exit long at an Up Fractal;

- Exit long at a Down Fractal.

Visibility - shows whether the fractal is visible from the point of view of the entry price:

- The fractal is visible - the chart does not go between the fractal extreme price and the entry price;

- The fractal can be shadowed - the fractal may not be directly seen by the entry price.

Default values

- Logic - Enter long at an Up Fractal;

- Visibility - The fractal is visible;

Application

1. “Opening point of the position”

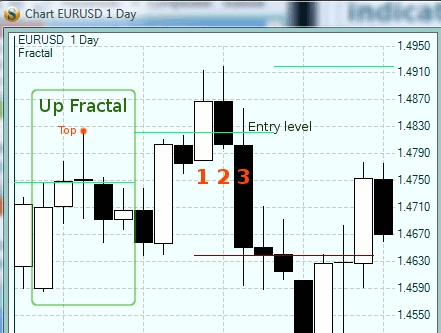

In this slot, the Fractal indicator sets the price at which you can open a new position, add to or take from an already opened position. The entry price is at the top of Up Fractal or at the bottom of Down Fractal. It is important to keep in mind that a fractal consists of five complete bars minimum. This means that between the moment of opening of a position and the top of the fractal there must be at least two complete bars.

The direction of the position is set by this indicator's logic. Permission to open (add to or take from) a position is granted by the entry logic conditions. All of them need to be fulfilled so that the entry order can be sent and executed.

2. “Closing point of the position”

When positioned in this slot, the Fractal indicator sets the close price of an already opened position.

Example:

This chart shows an Up Fractal. Since minimum five complete bars are necessary to make a fractal, the price for opening a position (“Entry Level”) is active from the bar following the fractal and remains so up to the last bar of the next fractal. The entry price is at the level of the fractal top.

In this example, bar 1 is the first bar which crosses the entry level. From this bar, the fractal top is visible.

Bars 2 and 3 also cross the entry price but for them the fractal is shadowed. These entry levels will be active only if the “Visibility” parameter has the following value: “The fractal can be shadowed”.