Table of Contents

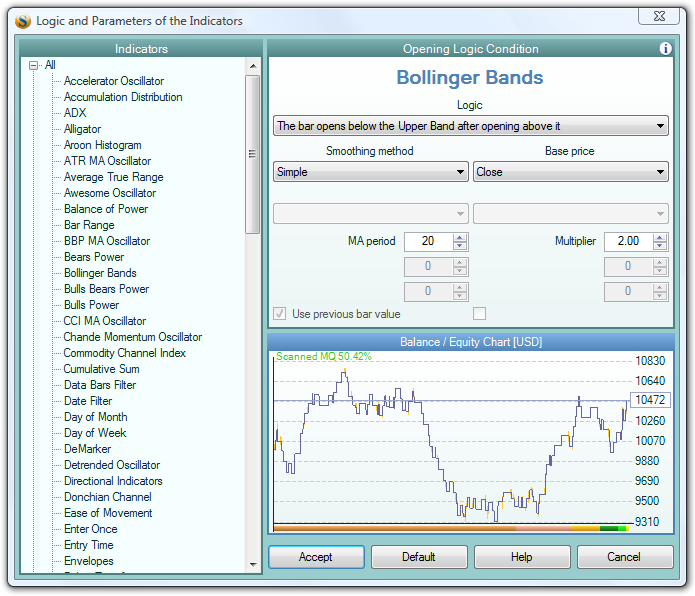

Logic and Parameters of the Indicator

This dialog window contains all indicators, which are applicable for the particular indicator slot. Here you set the logic rule and the parameters of the indicator.

You open this window by clicking on an indicator slot or on a button for adding additional logic conditions.

All indicators, which can be put in the slot type you are editing, are arranged in the tree menu on the left. The indicators are separated in groups depending on their kind.

The indicator chart you see on the window shows always a calculated result. Every time you change a parameter or a logic rule, the program accomplishes backtest and updates the chart. When you accept the indicator changes, you will see the same result on the main programs window.

There are some other effects:

- If you choose “Close and Reverse” indicator for the “Closing Point of the Position” slot, the program automatically set the “Next opposite signal behaviour” to Reverse.

- If the strategy uses closing logic conditions and you decide to change “Bar Closing” indicator from the “Closing Point of the Position” slot to some other indicator that does not allow closing conditions, the program will remove all closing logic conditions automatically.

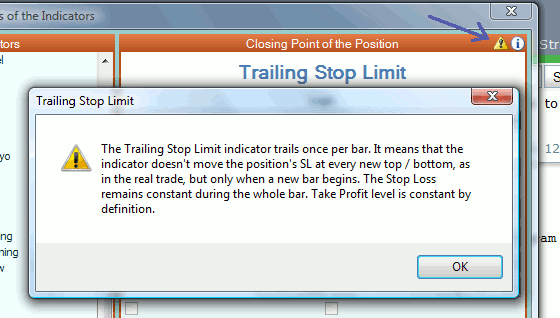

Information and Warning Messages

If you put the mouse cursor over (or click on) the round (i) icon in the upper right corner of the indicator window, you will see information about the indicator logic rules.

Some indicators have a warning message. If that case a warning icon appears on the title bar, next to the information icon.

Indicator Parameters

Logic

Every indicator has logic of application. Depending on the slot, the logic can describe an entry or exit point or a logic conditions.

Opening Point of the Position

An indicator placed in this slot determines the position's entry point. We have two types of indicators:

- Indicators that determine one entry price (Moving Average, Bar Opening, Entry Hour…). The logic of these indicators shows an entry price that is valid for both Long and Short trades. For example, the Moving Average indicator has only one logic option - “Enter the market at the Moving Average”. That means that the entry filters have to decide what direction we'll open when the market reaches MA.

- Indicators that have two prices (Bollinger Bands, Keltner Channel, Round Number…). These indicators has two options in their Logic menu, which determines at what of the indicator prices we'll enter Long. For example, the Bollinger Bands indicator has two options:

- “Enter long at the Upper Band” - this means that we'll open long position when the market reaches the upper BB band and if the market reaches the lower band, we'll enter short.

- “Enter long at the Lower Band” - this logic also determines the position of the long entry. The short entry will be at the upper band.

Opening Logic Condition

The logic of the indicators put in an Opening Logic Condition slot is a logic rule. The program evaluates this rule every time when has to take decision for opening a position. The rules can be evaluated to two values - “true” or “false”. Since the logic conditions describe the long entry, when the condition is “true”, the indicator allows a long entry. In the other case, when the condition is “false”, the indicator allows a short entry.

Some indicators like “ADX” allow both long and short entry at the same time. For example, the logic “The ADX rises” means that when ADX rises, the indicator allows entry in both directions. When ADX falls, both trades are prohibited. Therefore this indicator cannot determine the position direction alone since allowing both trades makes a bar ambiguous.

You can always refer to the indicator information message (the (i) icon) or to the strategy overview window for help about the indicator logic rules.

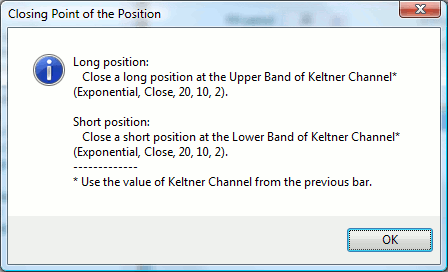

Closing Point of the Position

The indicators put here have one or two logic options depending on how many close price they determine. For example, the “Bar Closing” indicator has one logic option - “Exit the market at the end of the bar”. This option is valid for both long and short positions.

Closing Logic Condition

The logic parameter of the closing logic indicators is a logical condition. FSB evaluates it to true or false when taking decision for closing a position.

Smoothing method

Many of the indicators use some kind of smoothing, which is actually averaging of the values. Smoothing method determines the method of that averaging.

The options are:

- Simple;

- Weighted;

- Exponential;

- Smoothed.

These methods correspond to the method of calculation of a Moving Average of the selected type.

Base price

The base price is the market price used for calculation of the indicator. Most of the indicators use the closing price of each bar, but there are other options also:

- Open;

- High;

- Low;

- Close;

- Median = (High + Low) / 2;

- Typical = (High + Low + Close) / 3;

- Weighted = (High + Low + 2 * Close) / 4.

Use previous bar value

Use previous bar value option is extremely important for the reliability of the backtest. You can find its full description and several examples in the Use Previous Bar Value article.

In order to ensure proper use, we made Forex Strategy Builder controlling this option automatically. That's why the check box on the options screen is inactive. If you want to experiment with manual settings, you have to switch off the program control from the “Strategy” item of the main menu.