Table of Contents

Opening Point of the Position

Introduction

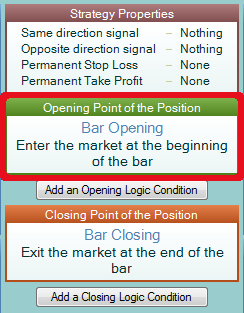

The Opening Point of the Position slot is situated above the other indicator slots and under the Strategy properties slot. There is only one Opening Point Slot for each strategy and it is used to set the price for entering the market using an indicator or a particular time. At this price the program will open a new position or add to an existing one.

It is important to know that in the Opening Point Slot and in the Opening Logic Condition Slots you are creating rules for long entry and the rules for short entry are calculated automatically by the software. Those rules are usually set by indicators that determine a certain entry price.

Some of the indicators, which can be placed in this slot, select the entry point based on a certain timing rule. Such indicators are: Bar Opening, Bar Closing, Day Opening or Entry Hour.

Other indicators set the exact price of the order: Moving Average, Pivot Points, Bollinger Bands…

In the Opening Point of the Position slot you can only put indicators which set the entry price. Indicators such as RSI or Accelerator Oscillator cannot be placed there. They do not set a definite price.

This slot's main function is to specify the entry price, not the direction of the position. Defining the direction of the position and giving permission to open a position is done by the Opening logic conditions slots. There are, however, exceptions to this rule. Some indicators specify two different entry points for the short and the long positions and enter the market according to which of those has been reached.

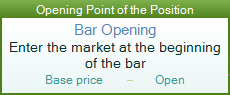

- Indicators that set only one entry price for long and short positions are: Bar Opening, Day Opening, Entry Hour, Moving Average etc. They do not determine the direction of the position so you have to add additional logic conditions slots in order to determine the trading direction.

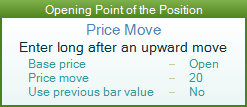

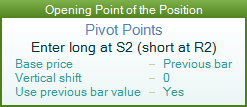

- Indicators specifying more than one entry prices are: Price Move, Stark Bands, Top Bottom Price, etc. They do not require additional logic conditions.

Examples

In the example above, Forex Strategy Builder will send two orders: Buy market entry order and Sell market entry order at Open Price for the respective bar. Which one of the two orders will be executed depends entirely on the conditions specified in the Opening logic conditions slots.

This indicator sets two entry prices and, respectively, FSB will send two entry orders: Buy stop pending entry order at a price 20 pips over the Open price and Sell stop pending entry order at a price 20 pips under it. In that case, the execution of the orders will take place if the market price reaches the price of the order, and the conditions specified in the Opening logic conditions slots allow it.

This indicator also sets two entry prices but, in that case, they are more profitable than the opening price of the bar. Those orders are as follows: Buy limit pending entry order and Sell limit pending entry order.

Summary

- The indicator in the Opening point of the position slot sets the price for opening a new position, as well as for adding or taking from the current position;

- Indicators which can set a definite entry price are placed there;

- The indicator's logic sets the long position price;

- If there are Opening logic condition slots, the transaction will be closed if all Opening logic conditions are met;

- If there are no Opening logic condition slots, the transaction will be closed when the market price reaches the price of the entry order;

- If the price of the order is the same as the Open Price of the bar, Forex Strategy Builder will send a Market order for immediate execution;

- If the price of the order is different from the Open Price of the bar, Forex Strategy Builder will send a Stop pending order or a limit pending order.