Re: Daily Analysis By FXGlory

XRPUSD analysis for 12.02.2024

Time Zone: GMT +2

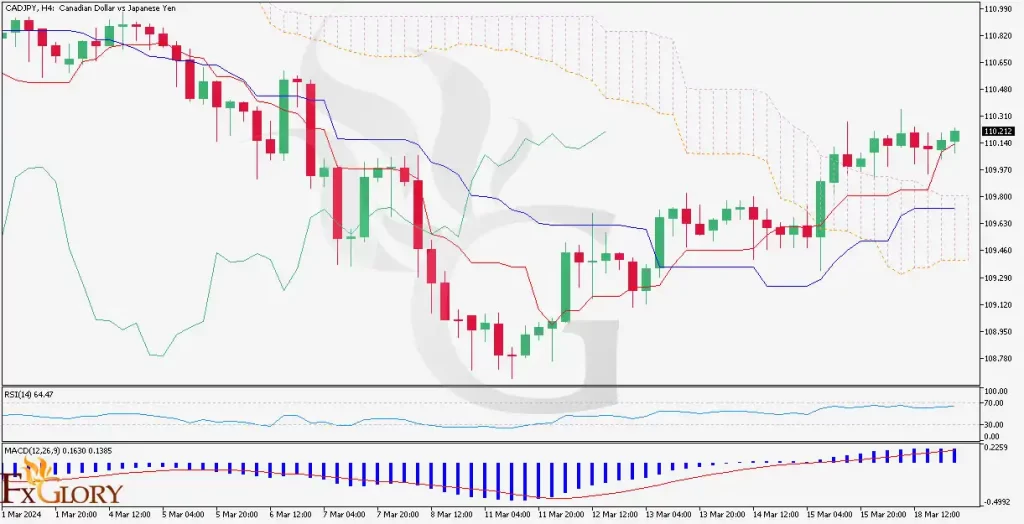

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The XRP/USD pair represents the value of Ripple in terms of the US Dollar. Key fundamental factors influencing Ripple may include regulatory news concerning cryptocurrency, overall market sentiment in the crypto space, and technological developments within the Ripple network. Additionally, macroeconomic factors affecting the US Dollar, such as Federal Reserve policy, inflation rates, and economic indicators, can also impact the pair. Investors' appetite for risk in the broader financial markets often correlates with the performance of digital assets like Ripple.

Price Action:

The H4 chart for XRP/USD demonstrates a bullish trend with price action forming a sequence of higher highs and higher lows. The market has sustained an uptrend after a period of consolidation, signaling a robust bullish sentiment. Currently, the price is persistently trading above the short-term moving averages, indicating maintained upward momentum.

Key Technical Indicators:

MACD: The Moving Average Convergence Divergence is displaying a bullish crossover with the MACD line above the signal line, suggesting continued bullish momentum.

RSI: The Relative Strength Index is above 70, indicating that the market may be approaching overbought territory, which could lead to a potential pullback or consolidation.

Parabolic SAR: The dots of the Parabolic SAR are below the price candles, signifying a bullish trend.

Support and Resistance:

Support: The nearest support level can be identified by the 50% Fibonacci retracement level, aligning with previous price consolidations.

Resistance: Immediate resistance is seen at the recent high, which is close to the 0% Fibonacci retracement level. A break above this could lead to testing new resistance levels.

Conclusion and Consideration:

The XRP/USD pair on the H4 timeframe presents a bullish outlook, backed by technical indicators such as the positive MACD and the bullish Parabolic SAR signal. While the RSI suggests caution for potential overbought conditions, the prevailing trend remains upward. Traders should consider the impact of upcoming economic announcements and regulatory developments in the crypto industry. Watching for a sustained break above current resistance or a retracement to support levels for entry points could be prudent, always with a mindful approach to risk management.

Disclaimer: This analysis is for informational purposes only and is not investment advice. Investors should conduct their own due diligence before engaging in trading activities.

FxGlory

12.02.2024