Re: Daily Analysis By FXGlory

NZDUSD H4 Technical and Fundamental Analysis for 10.09.2024

Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The NZD/USD forex trading pair, also known as the "Kiwi," always has its fundamental outlook heavily influenced by factors from both the New Zealand and U.S. economies. For the NZD/USD news analysis today, traders are focused on speeches by key Federal Reserve members such as Philip Jefferson and Raphael Bostic. Any hawkish tone could further strengthen the U.S. dollar, applying pressure on the NZD/USD forecast today. Additionally, the Reserve Bank of New Zealand (RBNZ) interest rate policy, along with global risk sentiment, particularly commodity prices, plays a crucial role in driving the Kiwi. Rising interest rates in the U.S. can create a widening yield differential, pushing the pair lower. Meanwhile, data on U.S. crude inventories and wholesale inventories can influence broader USD demand, affecting the pair's movements.

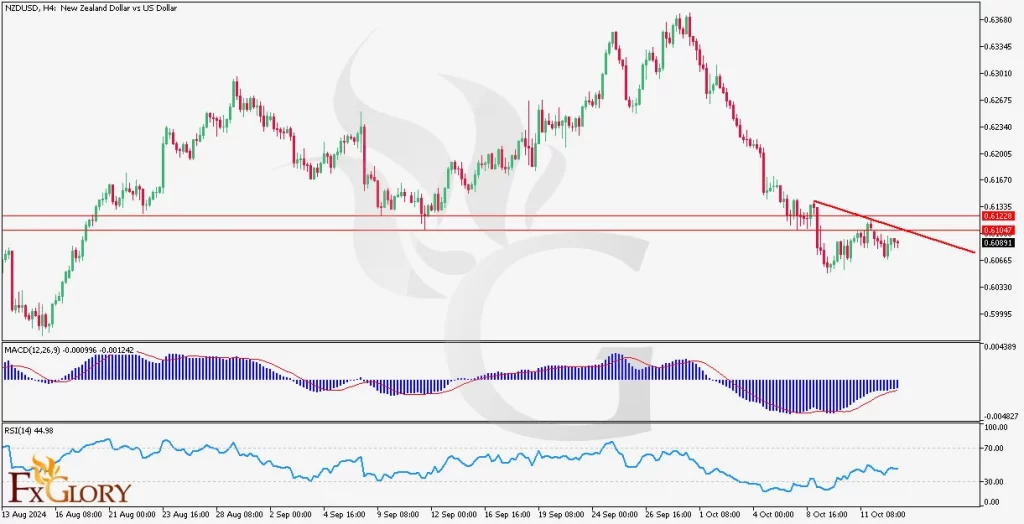

Price Action:

The NZD/USD H4 chart shows a clear downward channel, indicating the pair’s strong bearish trend over the past several sessions. The Kiwi’s price action has made consistent lower highs and lower lows, adhering closely to the boundaries of this bearish channel. Recently, the pair has found temporary support around the 0.6119 level, but it struggles to maintain any upward momentum. Short-term recovery attempts are capped, and the overall structure suggests that selling pressure remains dominant.

Key Technical Indicators:

RSI (Relative Strength Index):

The RSI is currently at 33.68, indicating that the pair is in the oversold territory. This could suggest a possible short-term corrective bounce; however, the overall bearish momentum might continue unless the RSI moves back above the 50 level, confirming a shift in the pair’s sentiment.

Ichimoku Cloud:

The Ichimoku Cloud shows a clear bearish sentiment, with the price well below the cloud, indicating continued downside pressure. The Tenkan-sen line (red) is below the Kijun-sen line (blue), reinforcing the NZDUSD bearish outlook. The Lagging Span is also below the price, confirming that the current trend is bearish. However, the pair’s proximity to key support levels may lead to some consolidation.

Support and Resistance:

Support Levels:

The key support levels are 0.6119 and 0.6070. If the price breaks below these levels, the next major support could be around 0.6000.

Resistance Levels:

On the upside, resistance is seen at 0.6141, followed by 0.6160. Any break above these levels may result in short-term bullish momentum, though the broader trend remains bearish.

Conclusion and Consideration:

The NZD/USD H4 candle chart analysis today confirms that the pair is firmly entrenched in a bearish trend, with key technical indicators like the RSI and Ichimoku cloud reinforcing this sentiment. Although the RSI is approaching oversold territory, suggesting a potential short-term bounce, the overall bias remains bearish unless there is a significant change in the pair’s momentum. Traders should closely monitor upcoming U.S. data and Fed speeches for any signs of USD strength or weakness that could influence the NZD-USD fundamental movements. It's crucial to keep an eye on key support levels, as a break below them could open the door to further downside. Conversely, a break above resistance might offer a temporary relief rally.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.

FXGlory

10.09.2024