Re: Solidecn.com

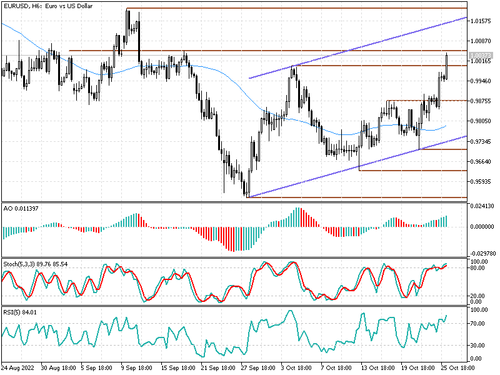

EURUSD

The European currency shows mixed trading dynamics, consolidating near 0.9730. Market activity remains relatively low as US stock exchanges are closed for Columbus Day. The single currency noticeably weakened in the second half of last week after the publication of Friday's report on the US labor market, which confirmed the commitment of the US Federal Reserve to the course of further tightening of monetary policy. Thus, in September, 263.0 thousand new jobs were created after 315.0 thousand recorded in the previous month. Analysts had expected growth of the indicator by only 250.0 thousand. At the same time, the Average Hourly Earnings in September maintained a monthly growth rate of 0.3%, but slowed down in annual terms from 5.2% to 5.0%. At the same time, the Unemployment Rate fell from 3.7% to 3.5%, while investors did not expect any changes. Weak macroeconomic statistics from Germany put additional pressure on the instrument. Retail Sales fell 1.3% in August after increasing 1.9% a month earlier, while analysts had expected a decline of 1.0%. In annual terms, the decline in sales accelerated from -2.6% to -4.3%, which turned out to be slightly better than experts' forecasts at the level of -5.1%.

GBPUSD

The British pound is trading with multidirectional dynamics, holding near the level of 1.1070. The "bears" took a break after a three-day decline in the instrument, which did not allow the GBP/USD pair to consolidate on new local highs from September 15. In turn, the pound remains under pressure after the publication of a rather strong report on the US labor market for September last Friday, which strengthened investor confidence that the US Federal Reserve will continue its policy of raising interest rates. However, the pace of monetary tightening is likely to depend on the specific situation at any given moment. Investors also expect tomorrow's publication of the report on the UK labor market for August-September. Forecasts suggest that the Average Hourly Earnings excluding Bonus in August could accelerate from 5.2% to 5.3%. At the same time, the Unemployment Rate is likely to remain at the same level of 3.6%, and the Claimant Count in September may fall sharply by 11.4 thousand after rising by 6.3 thousand in the previous month.

XAUUSD

Gold prices are falling at the beginning of the week, developing a "bearish" momentum, formed in the middle of last week, when the instrument updated its local highs from September 12. Pressure on the quotes of the XAU/USD pair is exerted by a strong report on the US labor market published at the end of last week, which gives the US Federal Reserve a certain degree of freedom in the matter of further tightening of monetary policy. The report showed a decrease in the Unemployment Rate from 3.7% in August to 3.5% in September, while Nonfarm Payrolls increased by 263.0 thousand, which was slightly better than the expected 250.0 thousand. According to CME Group surveys, more than 80% of analysts expect the US Federal Reserve to raise the rate by another 0.75% in early November, and about 18% believe that the value will be adjusted by 0.50%. Pressure on gold is also exerted by the actions of other global regulators. In particular, the Bank of England and the European Central Bank (ECB) are also set to continue aggressively raising interest rates as inflationary pressures intensify in the regions.