Re: HFMarkets (hfm.com): Market analysis services.

Date 6th July 2023.

Market Update – July 6 –FOMC archived, Jobs data ahead the next milestone.

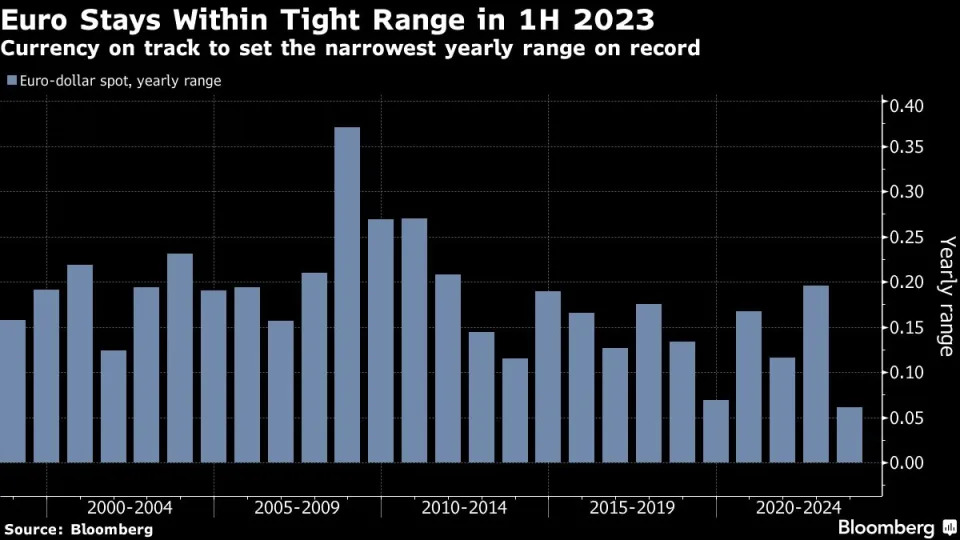

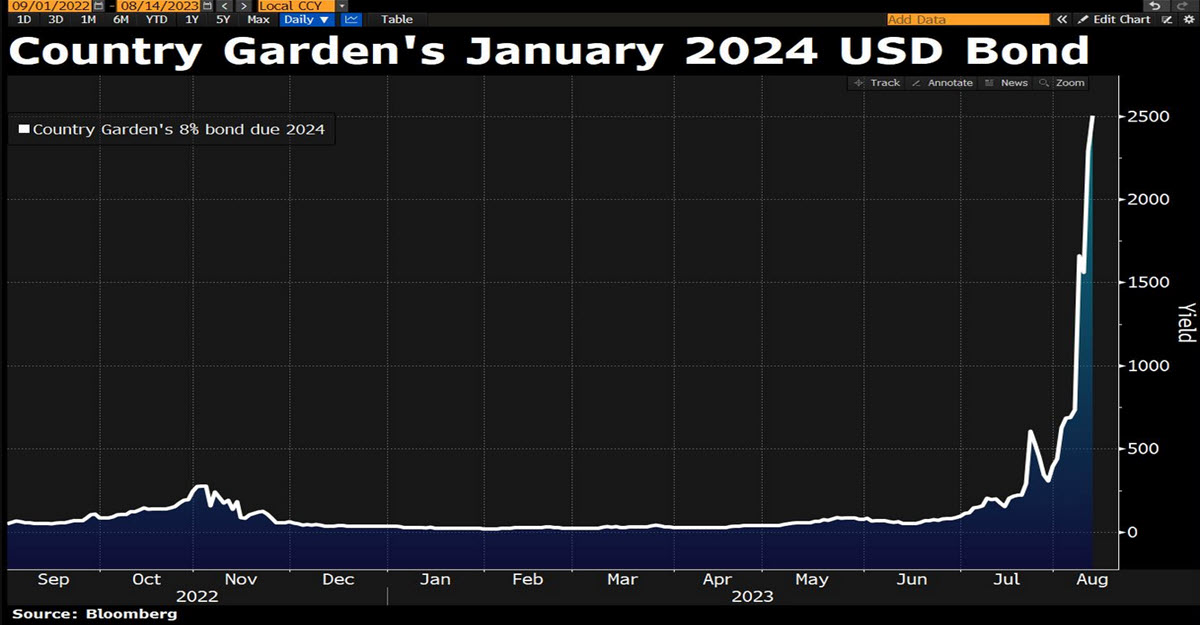

Last night, the FOMC minutes showed the FED sees more rate hikes ahead but at a slower pace. Policymakers decided against a rate rise, citing the lagged impact of policy and other concerns as reasons to skip the June meeting after 10 straight rate increases which have totaled 5 percentage points, the most aggressive moves since the early 1980s. However, 12 out of 18 participants expected 2 or more hikes in 2023. Markets showed little reaction with all the moves being gradual and constant during the day but it’s worth noting that Yields are higher (2y US close to 5%, 10y shy of 4%). Also very interesting yesterday was the deterioration of the Services but especially Composite PMI data in China and Europe, showing that the effects of monetary transmission are slowly beginning to be felt in the real economy. On the same note, US factory orders came out lower than expected (+0.3% vs. +0.8% exp); at least this morning the German ones unexpectedly bounced back and this is a much needed short-term relief. Today’s labour data will be preamble to the NFP tomorrow. Treasury’s Yellen is kicking off her trip to China after EU’s Borrell rejection.

PMIs heatmap, Bloomberg

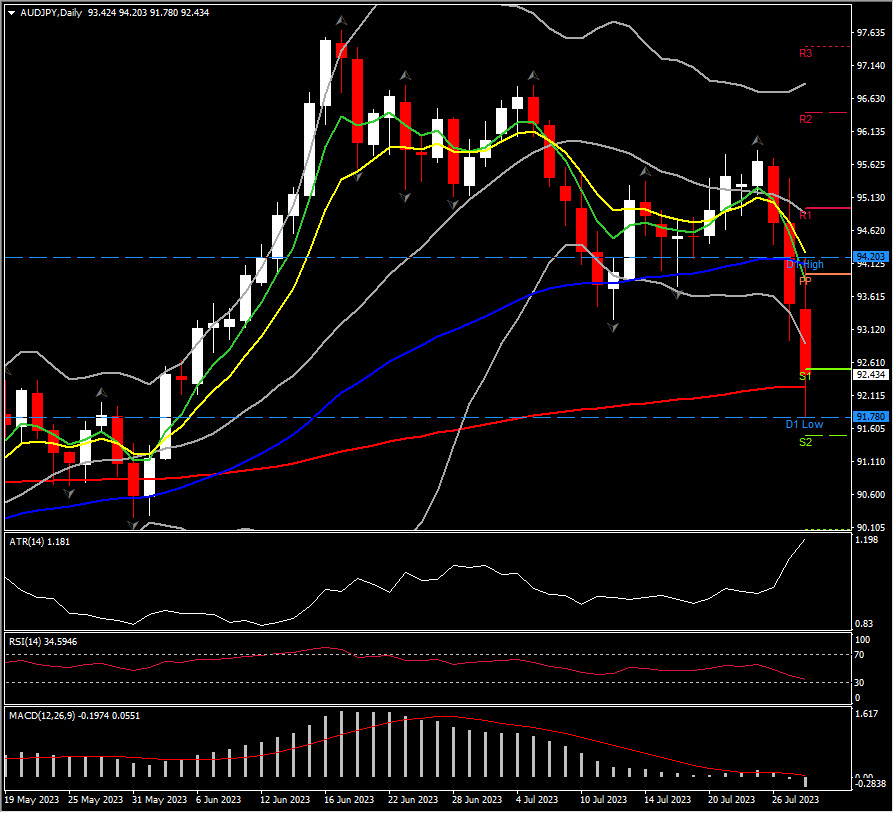

*FX – The USDIndex briefly regained 103 earlier this morning (102.93 now), GBP managed to stem losses yesterday (1.2713 now) while EUR (+0.24% yesterday, now trading at 1.0867) and AUD (settled at -0.57%, now 0.6674) were weaker. JPY is bid this morning and lost 144 (143.78).

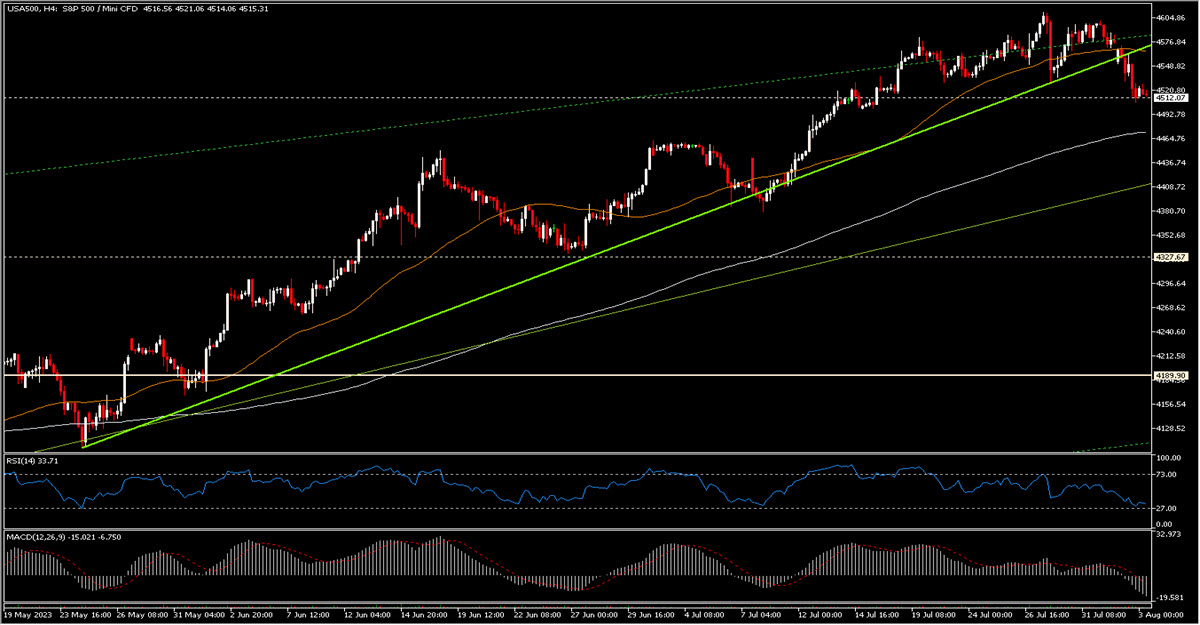

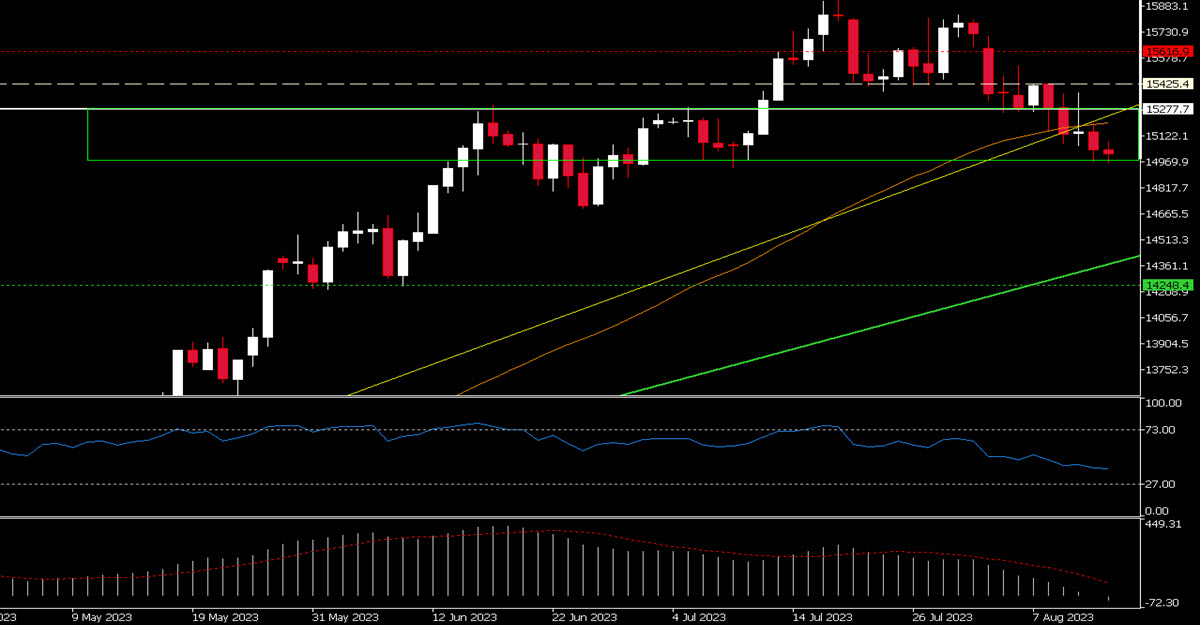

*Stocks – US Futures are negative again (US500 -0.29%, USA100 -0.38%). Asia is heavy and Goldman’s downgrade of Chinese financial institutions is weighing: China -0.67%, HK -2.92%, Nikkei -1.70% on a stronger JPY. Foxconn sales dipped by 14% in Q2.

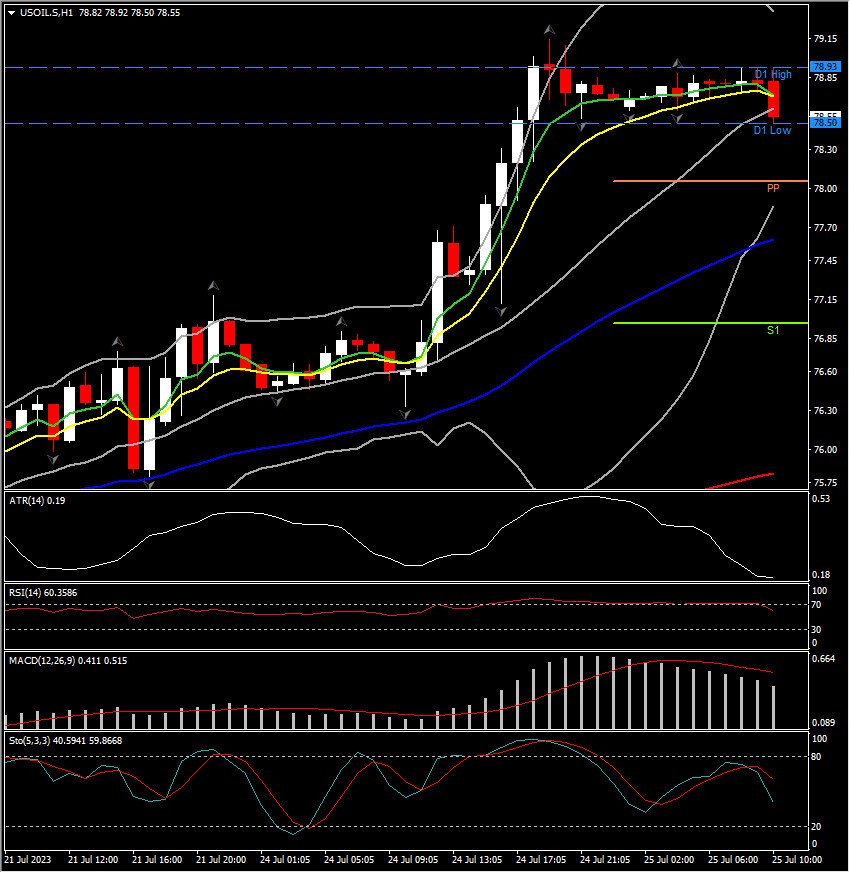

*Commodities – USOil has been supported by a consistent news flow from Saudi and OPEC yesterday, hit $72, now trading at $71.74. Gold was rejected by the ST trendline after touching $1935, trading at $1920 now.

Today – DE Factory Orders, EU Retail Sales, US ADP, Jobless Claims, Jobs Openings, Trade Balance, ISM Services.

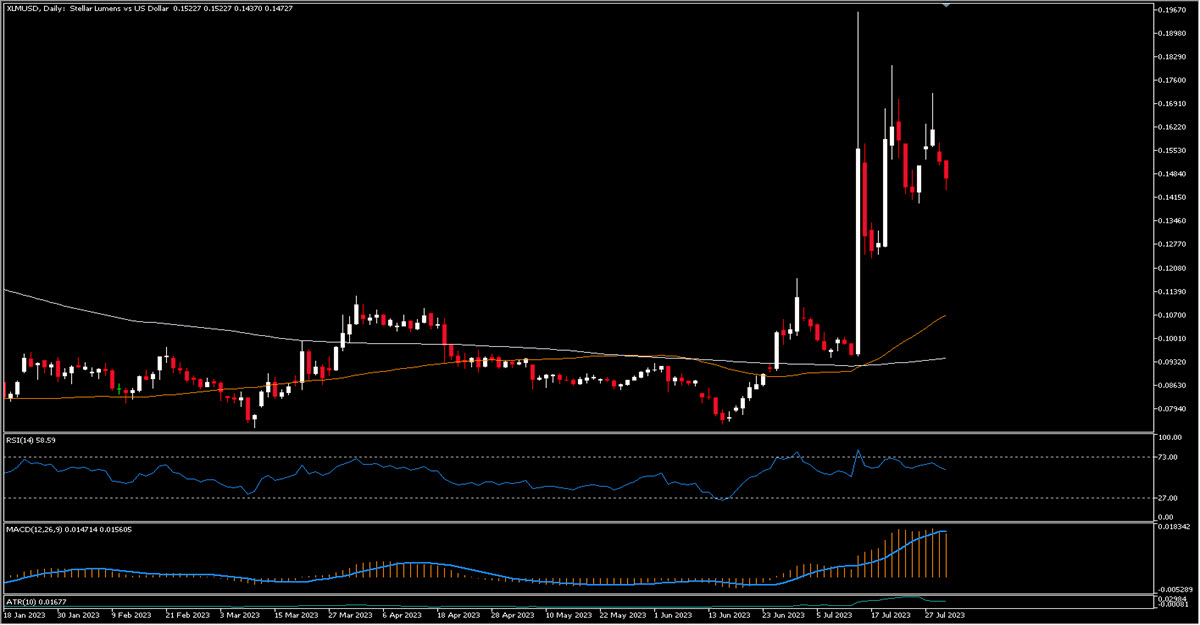

Biggest FX Mover @ (06:30 GMT) BCHUSD (+13.21%) keeps benefiting from its listing on EDX markets, now, RSI at 76.65, MACD positive, ATR 10 shows an average movement of 37.37 USD/day.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Marco Turatti

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.