Re: NPBFX - making money with us since 1996!

NZD/USD: the pair is growing 13.10.2017

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the NZD/USD for a better understanding of the current market situation and more efficient trading.

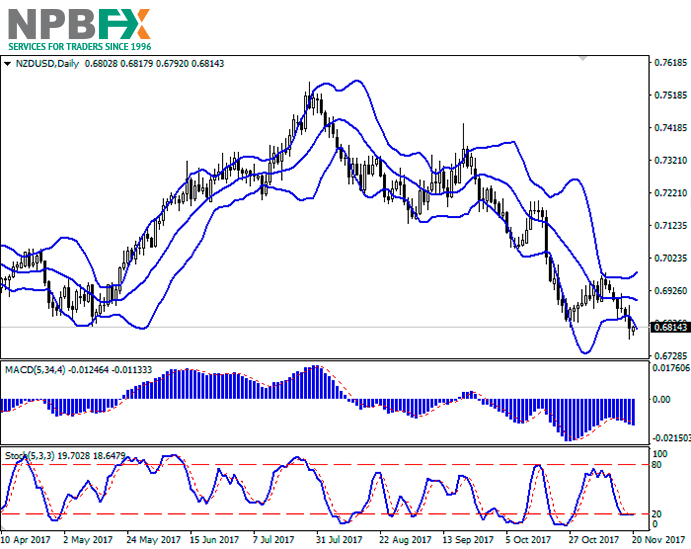

Current trend

During the trading session on October, 13, New Zealand dollar is strongly growing against the US one, renewing its highs since October, 5. The instrument is supported by the weak positions of USD, which is waiting for the consumer inflation data publication at 14:30 (GMT+2).

The more steady growth was prevented by the US Producer Price Index and Initial Jobless Claims data, published yesterday. The rapid growth of producer price let the investors hope that the consumer inflation will exceed the expectations in September.

During the Asian trading session on October, 13, the poor China statistics, which reflected the strong fall of the balance surplus, affect the NZD positions.

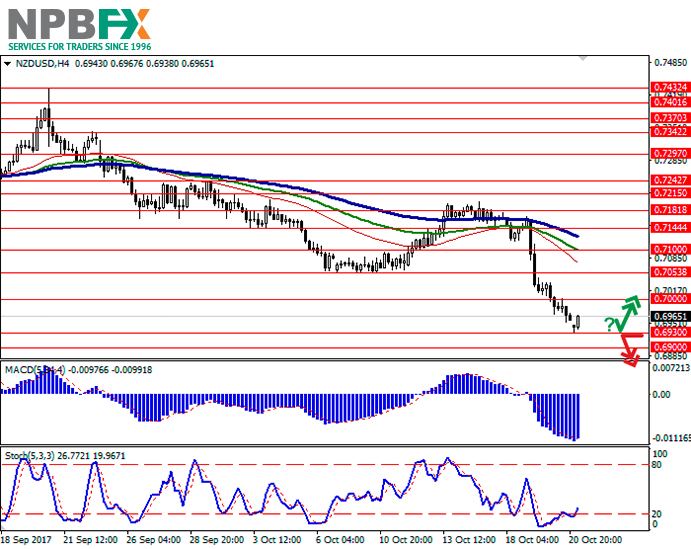

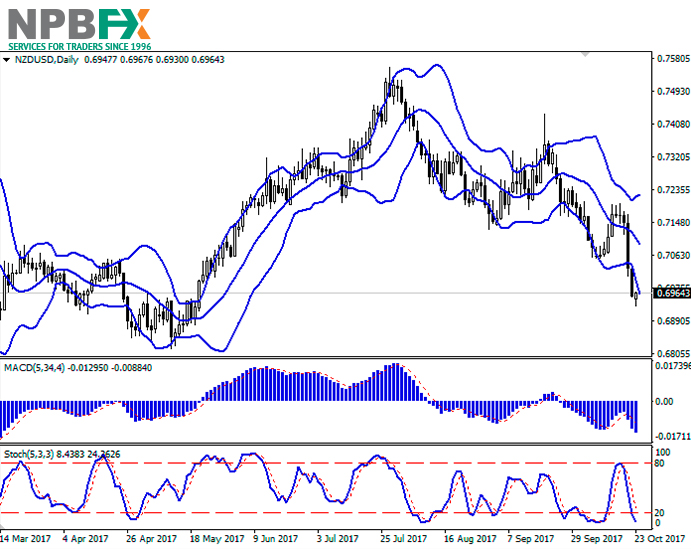

Support and resistance

On the daily chart Bollinger Bands are slightly reversing into flat. The price range is narrowing rapidly, reflecting the change of the trend in the short term. At the moment the indicator doesn’t contradicts with the further growth of the pair, but reflects the strong resistance level around the middle line of the indicator.

MACD is growing, keeping a strong buy signal (the histogram is above the signal line). It’s better to keep opened long positions and open new ones in the short or very short term.

Stochastic’s dynamics is the same, it’s reaching its highs. Despite the almost vertical growth, short term “bulls” have enough potential to development in the nearest two trading sessions.

Resistance levels: 0.7144, 0.7181, 0.7215, 0.7242.

Support levels: 0.7100, 0.7053, 0.7035.

Trading tips

Long positions can be opened after the steady breakout of the current resistance level, such as 0.7144, with the targets at 0.7215–0.7242. Stop loss is 0.7100. Implementation period: 2 days.

The rebound at the level of 0.7144 can be a signal to return into sales with the targets at 0.7053–0.7035. Stop loss is 0.7185. Implementation period: 2 days.

Use more opportunities of the NPBFX analytical portal: аnalytics

You can find more actual analytical reviews on other popular currency pairs, metals and CFDs on the NPBFX online portal. Daily analytics with charts, current market prognoses and trading scenarios in the Feed section are available. Get free and unlimited access to the online portal after registering on the official website of NPBFX Company.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on NZD/USD and trade efficiently with NPBFX.