Currency pairs vs. Commodities: which to start trading from in NPBFX?

Good afternoon, dear forum visitors!

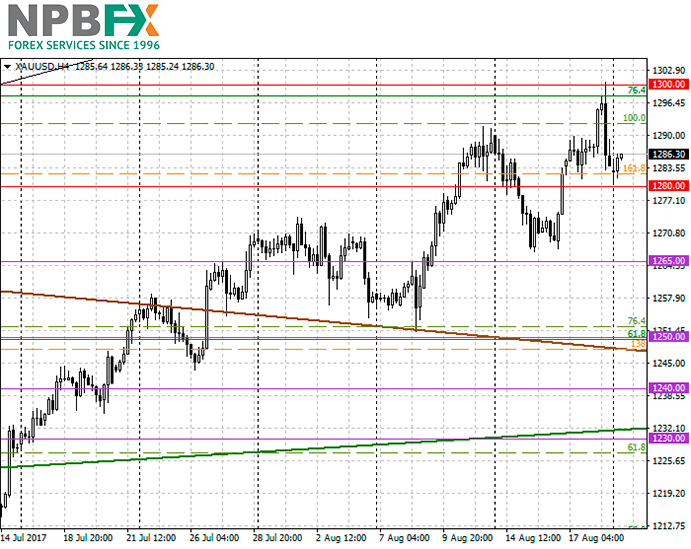

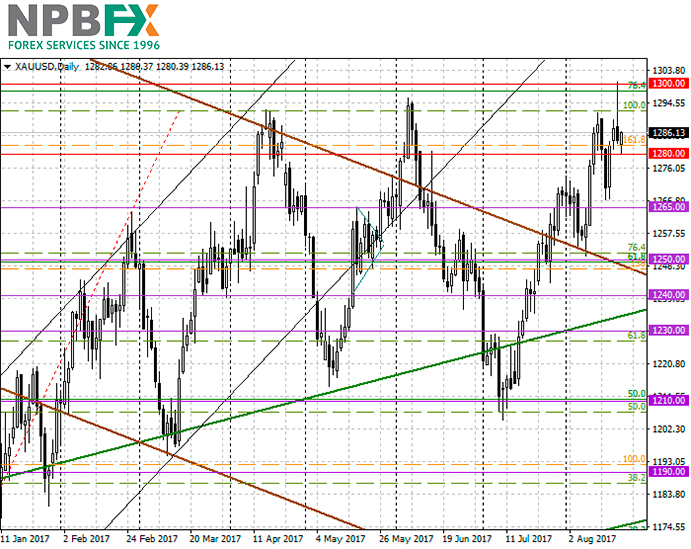

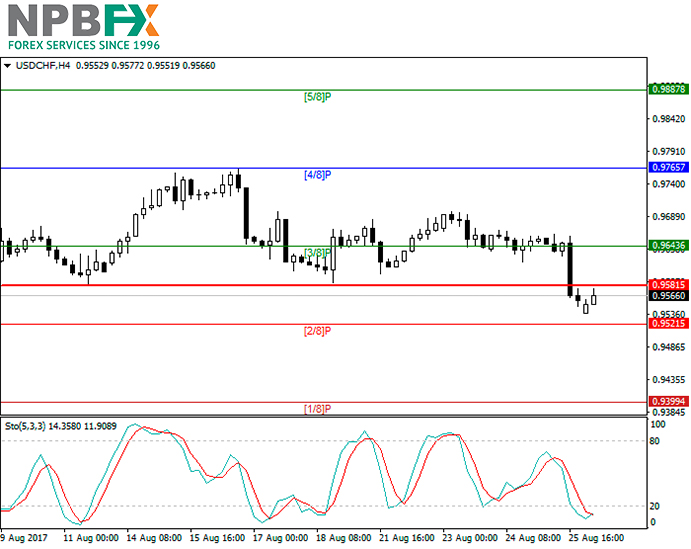

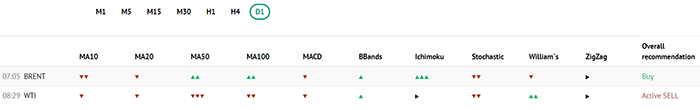

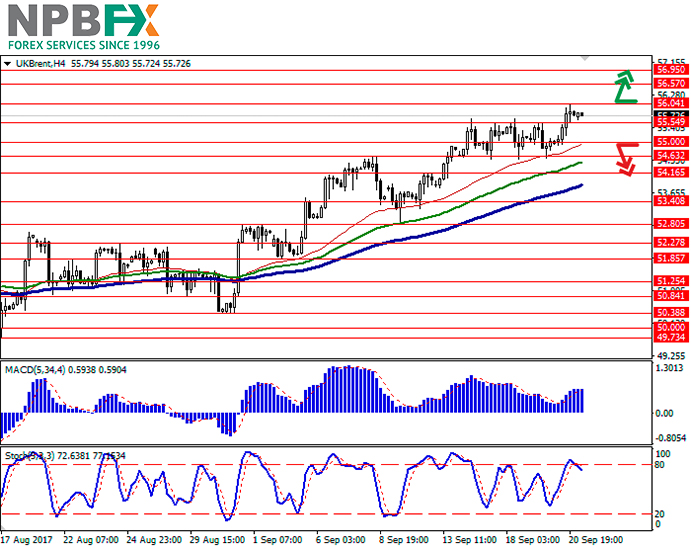

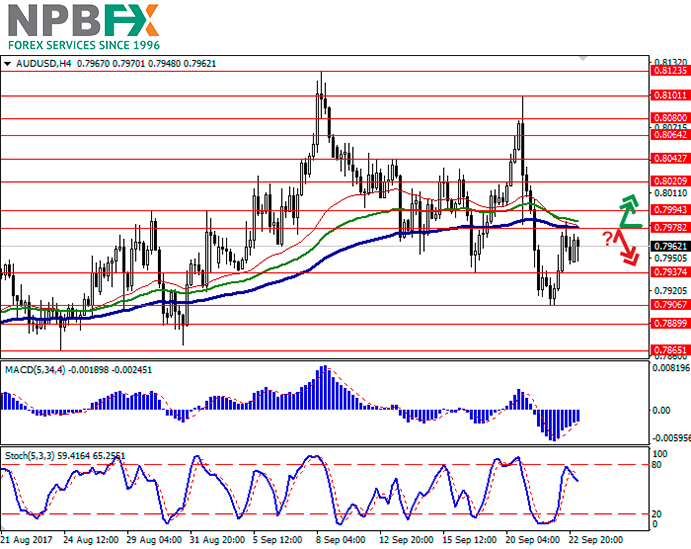

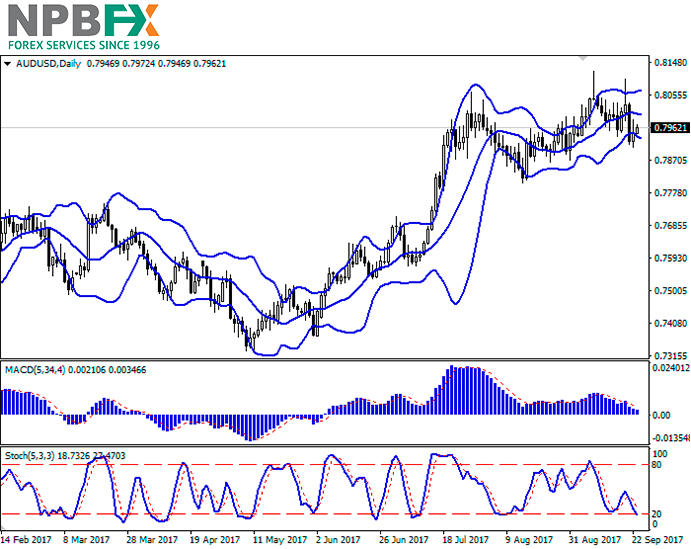

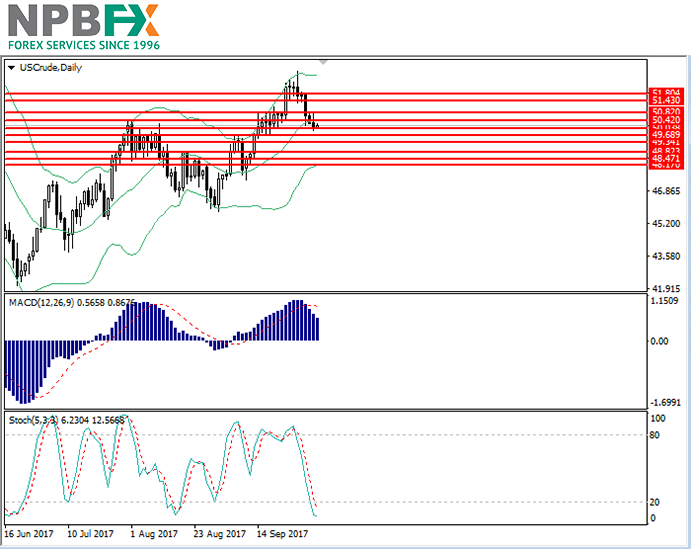

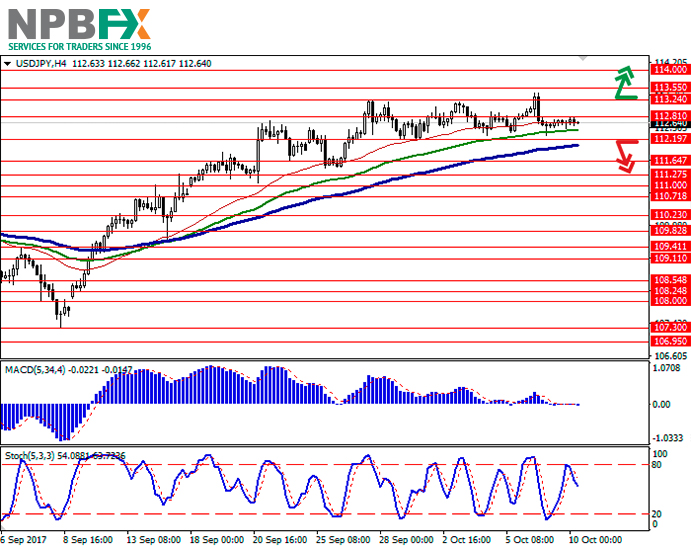

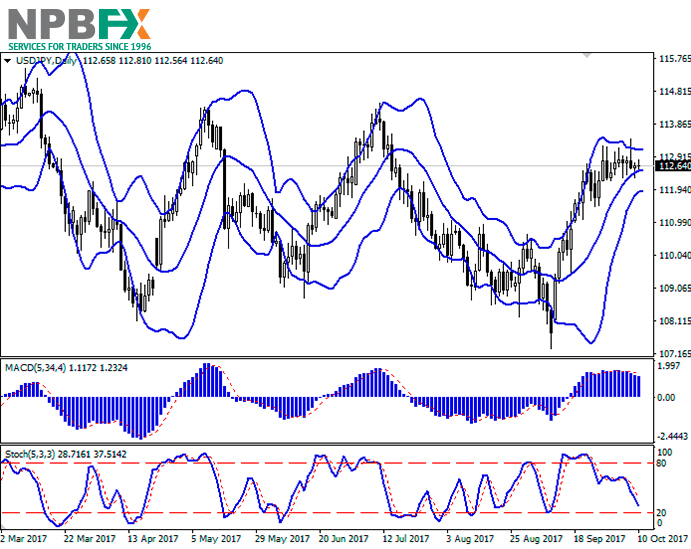

So, you are firmly aimed to start earning on the FOREX market, then you will have a logical question: "What instruments are a better to start trading with for a beginner trader? To choose currency pairs trading or spot trading of commodities, for example, with such highly liquid instruments as crude oil and gas?". NPBFX provides traders with both trading opportunities, offering 38 currency pairs and 5 commodities instruments: XBR/USD, XNG/USD, XTI/USD, XAG/USD, XAU/USD.

We offer to learn deeper the most important similarities and differences between the currency pairs trading and exchange commodities to the currency on the FOREX market.

Simply about comparing trading currencies and commodities on FOREX

Nowadays currency trading on FOREX is the most popular way of trading. As for the сcommodities trading, it is still gaining popularity due to its simplicity, accessibility, similar principles of trading operations in relation to standard currency pairs.

Similarities of FOREX and Commodities trading:

1) Place of deals execution. Deals with commodities, as well as with standard Forex currency instruments, take place on the over-the-counter market, where a buyer and a seller are looking for each other not on the real exchange, but through modern communication networks that unite all participants of over-the-counter stock markets.

2) Trading terminal. In NPBFX trading in both cases is carried out through the most popular trading terminal MetaTrader 4, which has gained popularity all over the world.

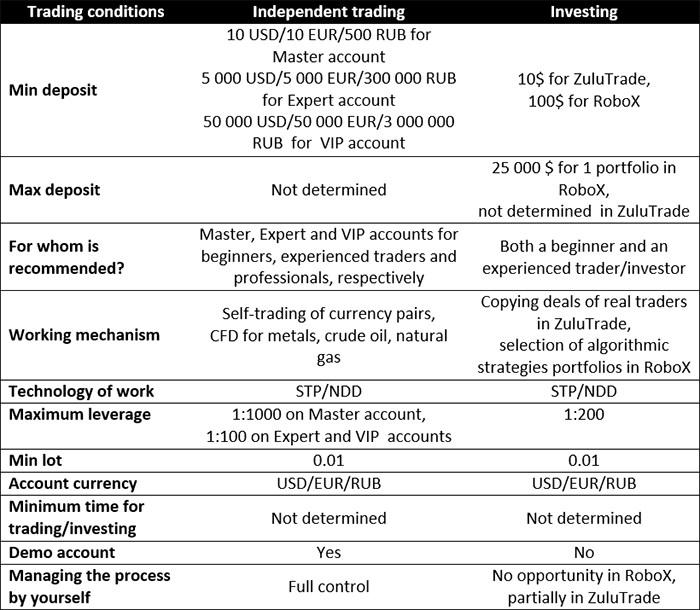

3) The size of a minimum deposit for trading in NPBFX is 10 USD/10 EUR, that makes trading both currencies and commodities, metals accessible to everyone.

4) The level of leverage. The size of a leverage for commodities trading is the same as for currency Forex instruments. In NPBFX, the maximum leverage on Master account is 1:1000, 1:100 on Expert and VIP accounts respectively. So to make a large operation, you will need the same amount of equity on your trading account, whether your choice is EUR/USD or XBR/USD.

At the same time, there are significant differences between FOREX and Commodities trading:

1) Time of deals conclusion, schedule in NPBFX. You can trade metals from 22.00 Monday to 21.00 GMT Friday, natural gas with WTI oil are traded later from 23.00, and at 1.00 GMT Brent oil is connected. At the same time, there are breaks from 1 to 3 hours on the Commodities market for these instruments. Forex currency instruments are available all around the clock on weekdays from 22:00 Monday to 21:00 Friday GMT. So you can choose an appropriate type of trading based on your current and desired employment schedule.

2) Volatility of instruments. Currency prices are sensitive to the state of the economy in the issuing country, and prices on the commodity market take into account other fundamental news relevant to a particular commodity. For example, the oil price is significantly affected by OPEC's decisions of its production limitation, the number of drilling rigs in the US, etc. For each commodity you need to know and understand its features. At the same time, currencies are much more flexible in response to different news and events. This should be taken into account when building your trading strategy.

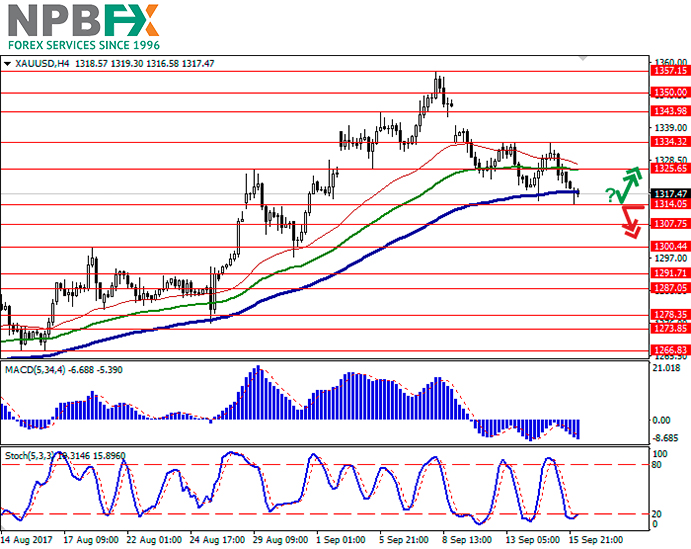

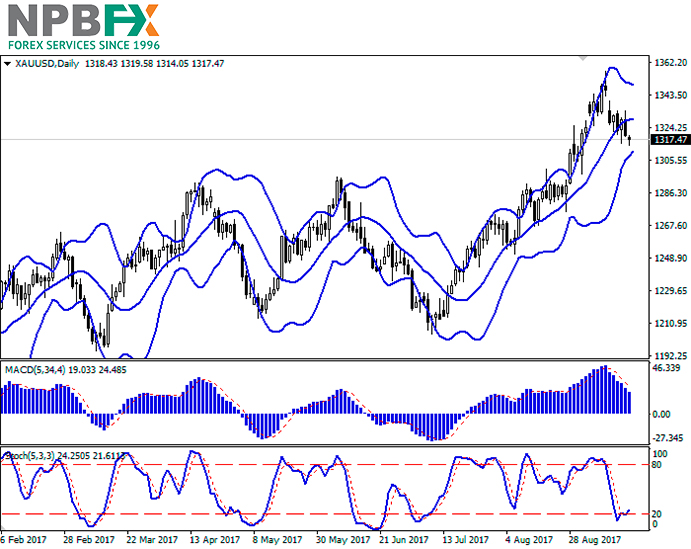

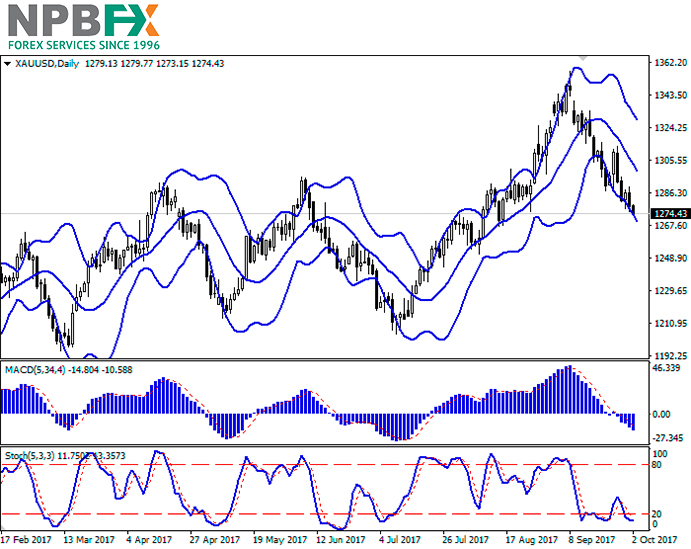

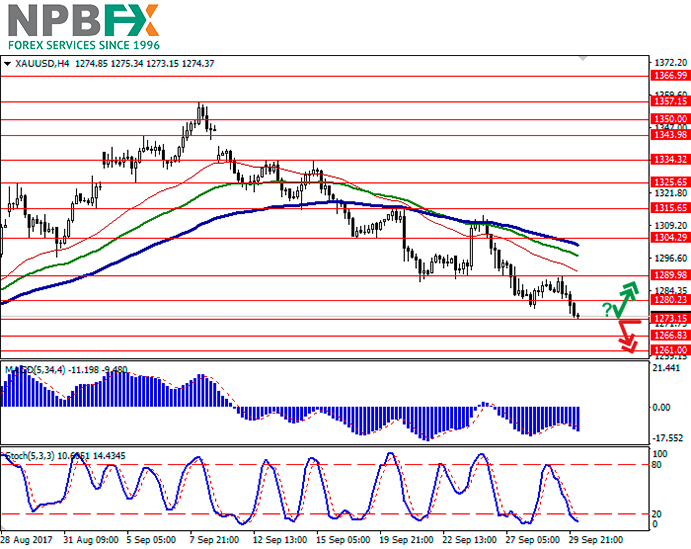

3) Liquidity. Available commodities instruments in NPBFX: crude oil, natural gas, gold and silver paired with the US dollar belong to a group of instruments with a high liquidity, that can not be said for all the currency instruments, for example, exotic currencies.

4) Risks. Commodities trading on FOREX is characterized by smaller risks than trading currencies, where there is usually a sharp reaction to a variety of news, statements, sentiments of market players.

5) Predictability. It is generally accepted that commodities in comparison to currency pairs could be more predictable because the impact on quotes is more limited by a set of previously known factors. But this could not be said about even the most liquid currency pairs on FOREX.

Where to start trading is more profitable?

Proceeding from all the above points, a beginning trader may find it easier to open a path to the world of FOREX with commodities trading. Of course, the choice of commodities or standard currency instruments is always yours, based on your individual preferences, convenient trading hours, propensity to fundamental or technical analysis, trading strategies, etc.

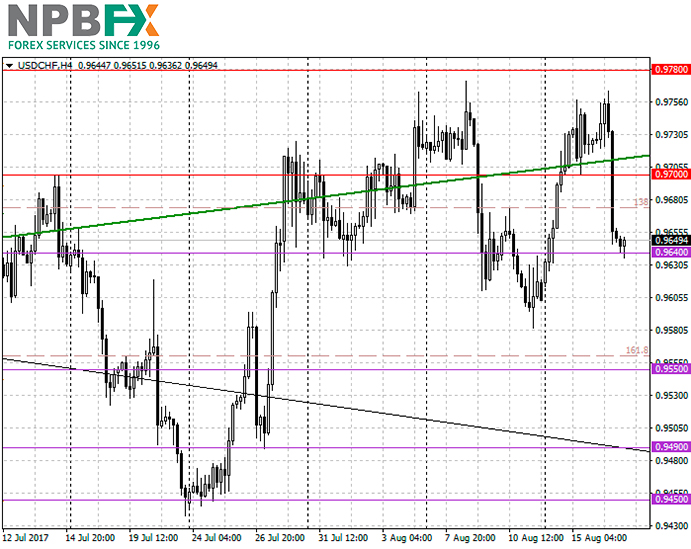

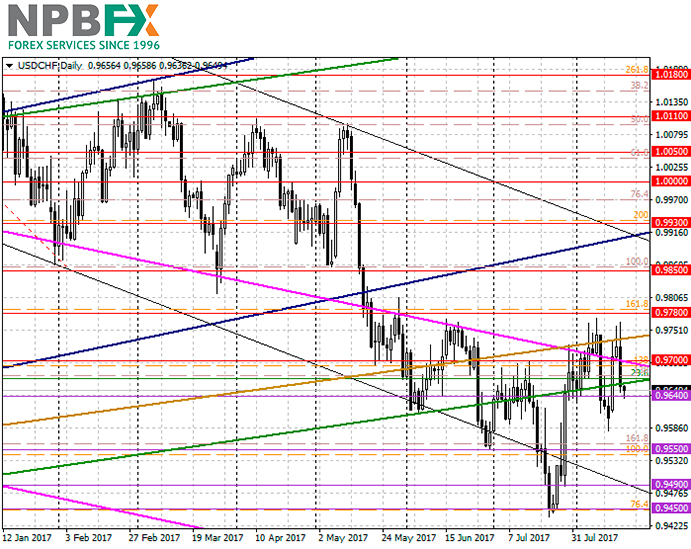

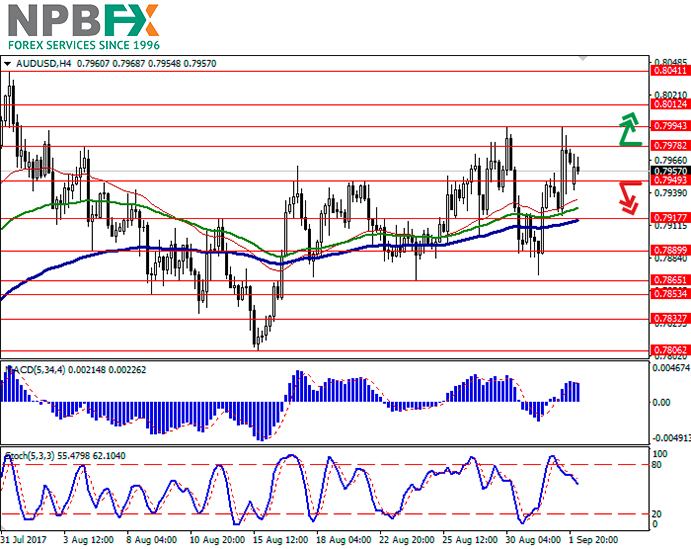

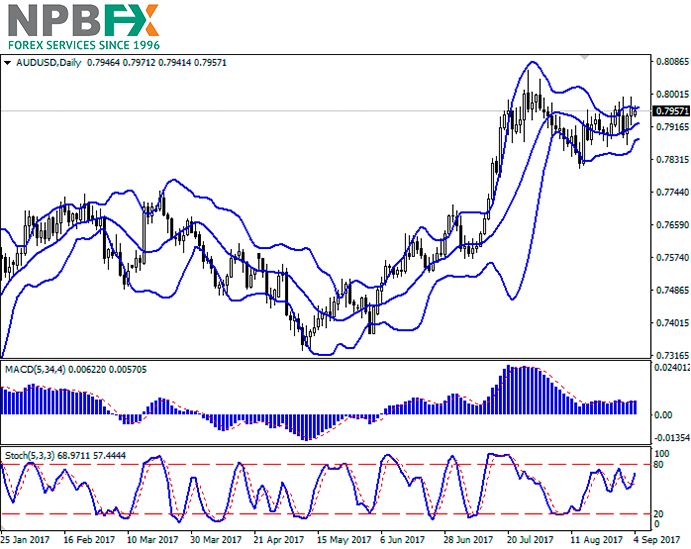

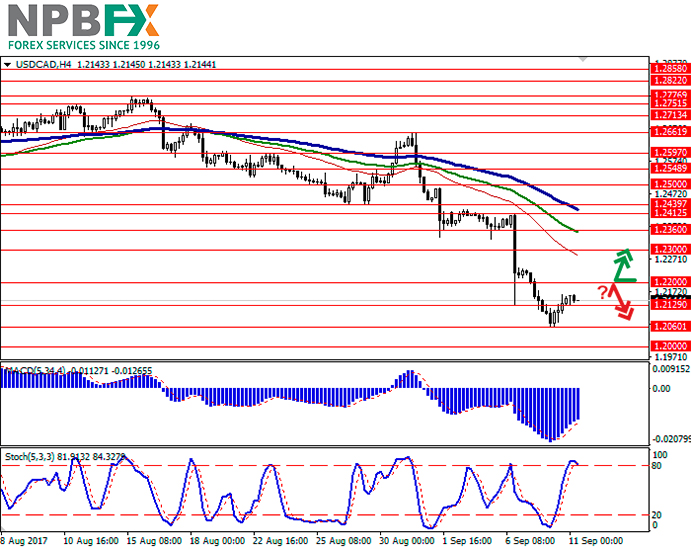

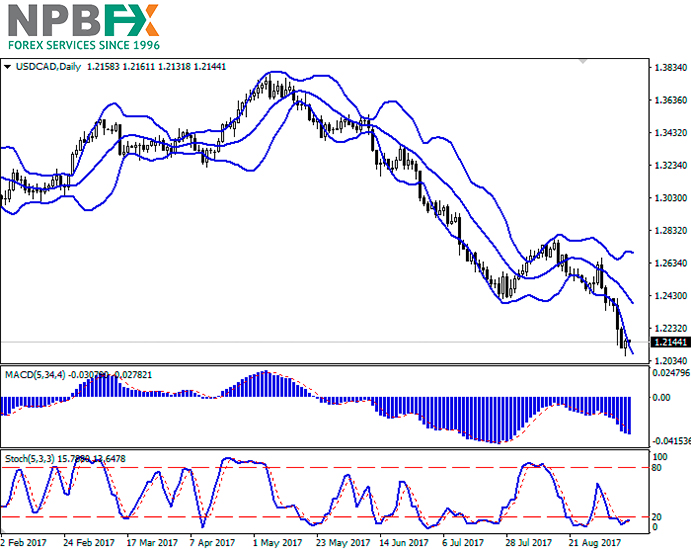

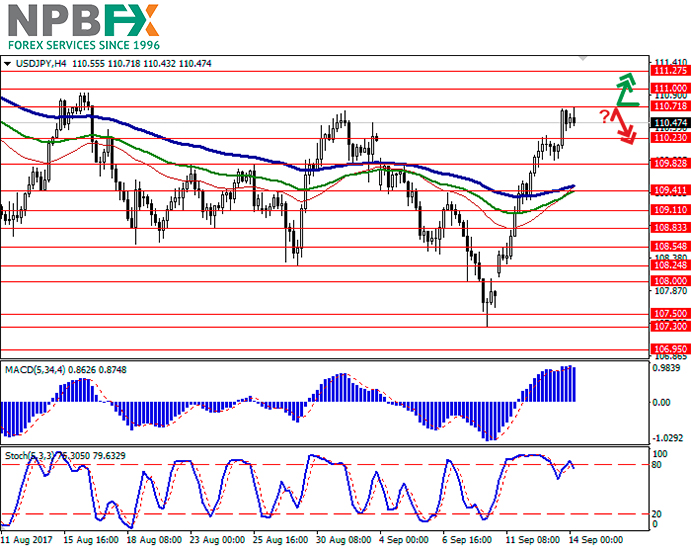

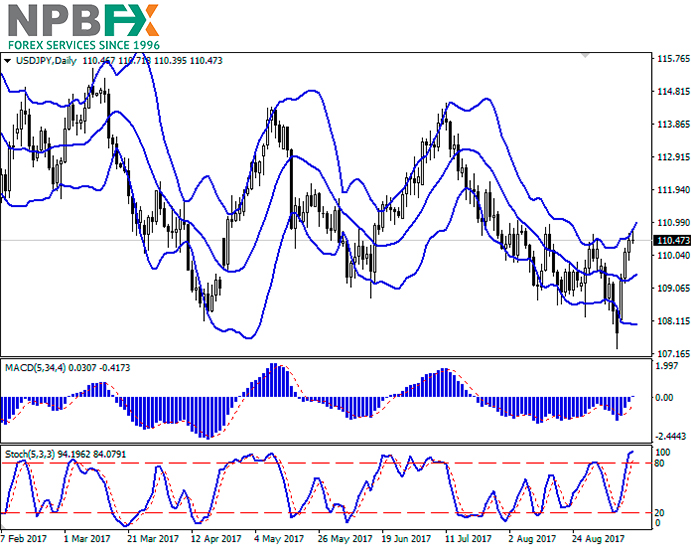

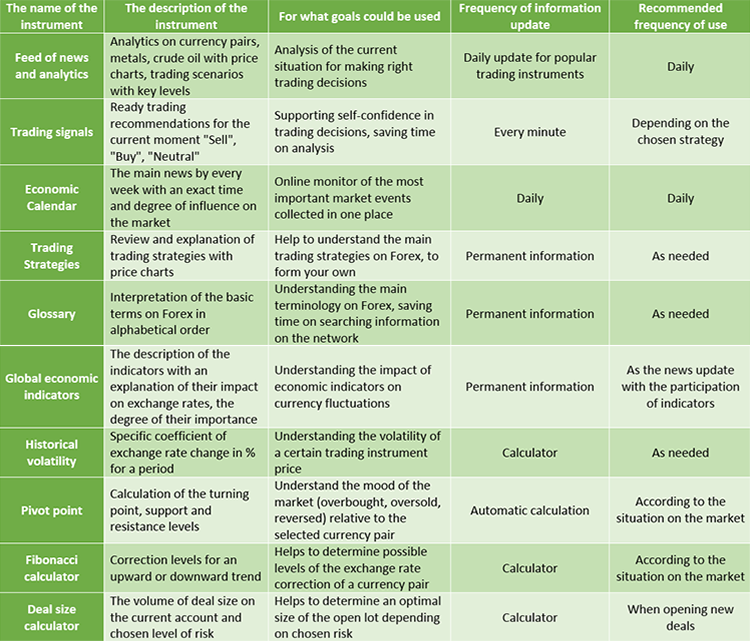

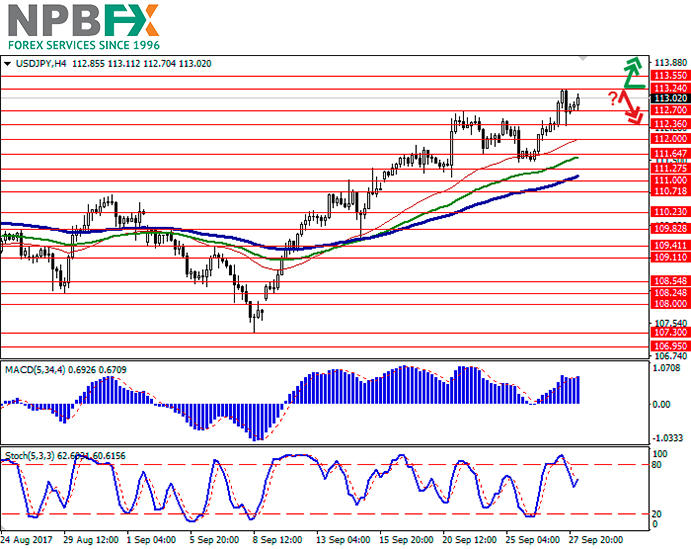

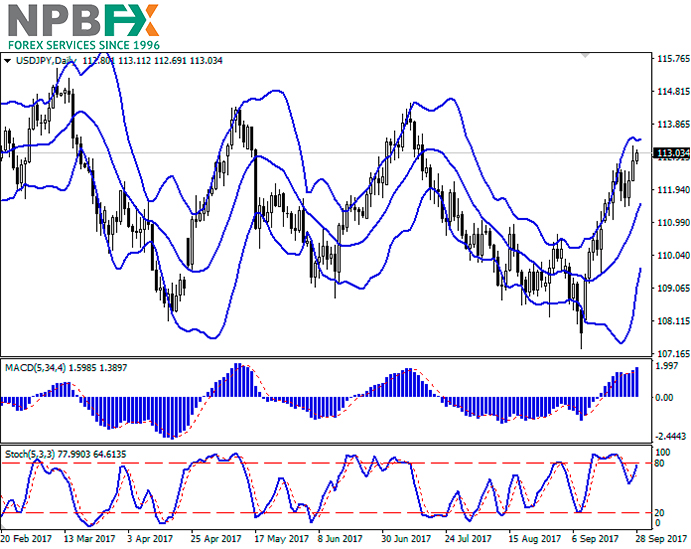

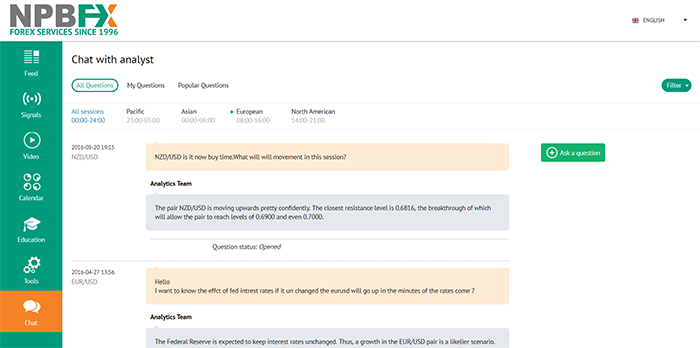

In order to get help with orders involving currency pairs and commodities, you can use free analytical reviews with trading recommendations on popular instruments on the NPBFX online portal.

Start your acquaintance with trading and get profit with a reliable NPBFX broker today.