$1000 and the newest iPhone 11 Pro are awarded to a trader with 20 years of experience! Introducing an interview with the winner of the Battle of Traders in June

For sure, not everyone remembers the Forex market of 1999. Moreover, many Gen Z traders were not yet born. In those times, bars were drawn on paper, and trading was conducted only through the phone. Moreover, it was not one-click mobile trading which we take for granted nowadays. Back then, a transaction could only be opened by calling the broker through a landline, most often a rotary phone. Andrey Petrovich Panchenko, the winner of the June’s Battle of Traders, became a successful trader and mastered the basics of technical and fundamental analysis at the very nonce, 20 years ago. However, life has brought certain changes and he had to change his main field of activity. Recently, Andrey Petrovich has been programming expert advisers, uses modern technical indicators to predict the market, and he won the Battle by executing only 18 transactions on the DAX30 and NASDAQ100 indices! These particular indices, in his opinion, are perfectly predictable in the current market and allow earning according to the conventional trading rules. What is the point of such a classic strategy, what should stop loss protect against, why does a trader need flexibility and Buddhahood? The winner himself will answer these and other questions. Read an interesting interview and follow in the footsteps of the winners!

- Andrey Petrovich, please tell us how did you know about the Battle of Traders and why did you decide to take part in it?

- I knew about the Battle from one of the traders’ web forums. At that, I have known your company for a long time, 3-4 years. Actually sometimes I do programming, creating expert advisers. I am looking for a more convenient and profitable way to trade. Due to this I decided to try to participate in the Battle to test an adviser. Moreover, it was quarantine then.

- June was the third competition month in which you participated. Before that, you did not manage to enter the top ten of the Battle of Traders. What helped you to move on, and not to give up?

- On the first two stages, I also did a lot. However, when I looked, for example, at the others a week after the start of the Battle, then my hair almost stood on end. My adviser was slowly functioning, and other guys had already over 60, over 70 thousand dollars! I decided that with such an adviser I would not be able to win. A little bit later, I closed everything and tried to pull out the trade myself. It didn't work out. I work on shift system, so I had no time to monitor and control the situation for hours. Forex is not a game, it is a real work.

- What were your first words and emotions when you found out that your results were #1 and that you were the one who won the Battle in June? Did you share this news with someone?

- I was really worried, because I did not have enough time to make my trades without intermission. I saw that competitors are trying so hard to outrun me. Of course, I was nervous, at work I was monitoring from the phone my competitors’ results. I thought that if I won, I would have to open a bottle of champagne!

I didn't have that, you know, wow feeling! I felt I deserved that. Everything. Surely, I wanted to rejoice, but deep inside I felt that it was well-earned victory. I try to keep a certain balance – both in joy and in sorrow. When I told my friends about the victory, many of them did not believe. I will experience the real joy when there is profit on the real trading account.

- Andrey Petrovich, how long did it take you to register as a participant of the Battle of Traders? How do you evaluate the conditions of the Battle at NPBFX?

- There were no problems. Everything was fine and transparent. I passed verification quickly, without issues, everything was fine.

- Your trading result can be considered as one of the best in the history of the Battle. In June, the initial deposit of $ 5000 on your account has increased by 63 times (up to $ 310 888)! According to the rules of the Battle, NPBFX awards you not only $ 1000, but also a super prize – the latest iPhone 11 Pro! Was it your strategy – to win an iPhone or was it an unexpected surprise?

- The situation was as follows: I was monitoring the last competitor, what he opens, the statistics. He overtook me a lot. I realized what he was doing, but he ignored the system – I mean the principles of classical trading. That was a mistake. He was going on trading, when, in fact, everything was already heading for downfall.

All competitors who tried to get ahead of me, were taking random actions – they read, learned what to sell or buy, and started trading. These are their problems. I don’t do it at random – I analyze the situation – and make a transaction. That’s it.

- Could you share with us – what is the principle of your trading strategy?

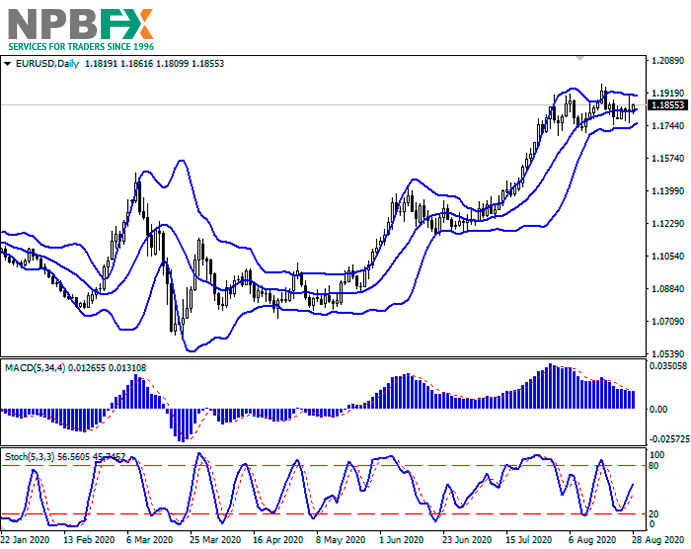

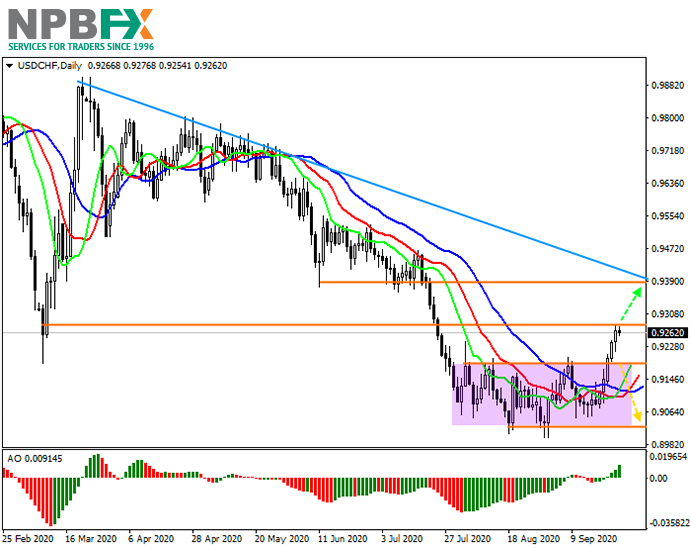

- The point is that this is classic trading. Conventional trading, in which you need to understand where is the resistance level, where is the support level. You need to understand where the level for manual adjustments. You need to watch where it breaks, and where it does not break, and control the indicators, for example, Stochastic. I did not use any complex elements, everything was done manually. I was watching where the processes were active and where I needed to wait. I opened a transaction and was holding a position – for 15 minutes, an hour. This allows to see where the tool will go.

In addition, it is important to choose the correct trading volume and, no matter how unstable are circumstances of a trading process, just keep this position. However when it goes against, it is necessary to use stop loss. Stop loss is just perfect. It protects against wrong and unexpected losses. I have no difficulties with the losses. If to take into account the fact that you and I – all traders – underwent training, and understand this system correctly, these ordinary rules are relevant.

- Your trading portfolio includes only 2 instruments, including only indices DAX30 and NASDAQ100. In total, in June you closed 18 transactions, 16 of which were based on DAX30. Why did you choose indices?

- It turns out that it was in that particular market situation I was the most qualified in DAX30. Frankly speaking, I liked the German index. Tomorrow I may change my opinion. In any case, I will analyze other ones as well, and, if it is clear to me, I will trade. DAX30 is more relevant to me and my systems today.

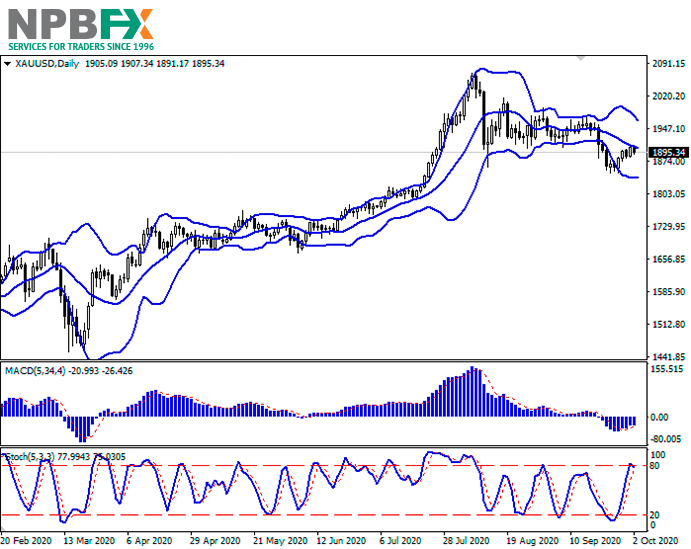

I started to be interested in the indexes relatively recently; at first, I was not completely successful, the specification was somehow different. I understand that currency is currency and indices are indices. Then my past training, technical analysis came back to my memory. I noticed that it became a little risky to use classic trading on currency pairs. Previously, it worked, but now everything is mixed up; however, classic trading was still suitable for trading on indices.

- The most profitable trade brought you over $162,000 in profit. Its trading volume was 50 lots. Could you tell me, did you use indicators, technical or fundamental analyzes to manage your trading?

- Yes, yes and yes! At that moment there was a very clear entrance, I fully understood where it all would go. At the moment it is not clear – either there or here?! Therefore, now the evaluation of the situation is based more on current trends. Bulls and bears have fought and are waiting for help. I mean, for now you just have to wait. However at that moment I had an opportunity, I had enough time – it was my day off. I saw a clear tendency: I opened a trade and started, step by step, making money. After that, I saw a channel that would reach a certain level. So this is the way I was monitoring, controlling and constantly moving the stop loss.

- During the Battle, did you open positions through the desktop version of MT4 NPBFX or through a smartphone (tablet)?

- I used my computer. I wouldn't do that with my phone, I somehow can't set up the indicators. But in PC version of MT4 – that was exactly what I was doing.

- What can you say about NPBFX trading conditions? On working on indices, in particular.

- There are no complaints about the indices, everything is fine and well-done. Everything works clearly, that is, I haven’t find any surprises from the company there. This is how I got addicted to the indices, and from March to the present day I haven’t faced any issues. All the information I need, it is all reflected. I have not noticed requotes and other problems with the broker. I have only a positive attitude towards your company.

- How often during the competition did you refer to monitoring the accounts of all participants? How useful was the monitoring?

- Of course it’s useful. This is a competitive field, a person understands its own strategy, processes and strengthens. This is an opportunity to test oneself and earn what one deserves.

At least for myself, it was useful for me to see what others are doing. That’s a competitive spirit! If there was no monitoring, I would have stopped. But I saw – there were competitors, so I continued. Anyway I have to control the situation.

- The coronavirus pandemic has been affecting the global economy for several months. Have there been any changes in the Forex market during this time, in your opinion?

- Indeed. But there is one hitch. I can share with you my analysis of the market: in such a situation there should be a great interest of investors, who are ready to pay for technologies – pharmaceuticals, all areas that promote the creation of some projects and technologies. IT, nanotechnologies, all corporations that deal specifically with technologies. These are the sectors where investors prefer to put their money. And I clearly understand that such tendency is focused on purchases. Due to this reason, the indices reflect the economic indicators of enterprises, so one just need to focus on them at the moment.

- $1000 has already been credited to your real trading account with NPBFX. Are you planning to follow the same trading strategy on it as on a demo account in the Battle?

- I do not know for now, here it is necessary to be rather careful. There was competition in the Battle, so there was already a big risk. This is the first time in my life when I have succeeded and won. Therefore, it is necessary to somehow save the deposit. I have to work and earn. And the Battle was just a competition. On real account I am not competing with anyone, only with myself. These are completely different things.

- Andrey Petrovich, tell us a little about your professional path: what brought you to Forex – was it accidental or a conscious choice? How long have you been trading Forex?

- I have been at Forex since 1999, i.e. for 21 years. It was interesting to me, I was attracted by the opportunity to earn. I have been trained. Then there were little monitoring and graphs. We drew bars on plain paper and bowed like war commanders over these graphs. I was very good at technical analysis, just instantly, then there were no indicators, experts, neurosystems. We thought it will take a long time to develop all these instruments ... I was training then when trading was performed on phones.

When the Internet era started, we gained wide access – all these indicators, experts started to be developed, the modern systems started to launch. I went back to classic trading. I succeed in “manual” work – resistance, support, triangles, technical figures, Stochastic. There were times when I really made money. However at a certain moment, my life circumstances changed, and I could not devote my time to this any more. Although I am constantly engaged in Forex: I develop programs, make advisers, indicator settings, communicate on the forum. For now I have a dream – to create the so-called “Grails”. Trading Forex is much more then investing 50 dollars, it’s much more, you need to do everything in order, be ready, have your own workplace, time, develop discipline. And do just that.

- What personal traits should a trader have in order to become a professional and achieve financial success?

- First of all, a trader needs flexibility. Not just intelligence, but flexibility. Ability to cope with emotional impulses: joy or fear. One needs to be reserved, developing some kind of Buddha-attitude. That’s it. Just reduce emotions, they shouldn’t be there at all. In general, as I said before, you should not discard the classic trading. A trader should train all the time, open demo accounts. Just try it.

- What do you do besides trading, what is your profession?

- At the moment I work in production, the production of ventilation systems. But I plan to switch to trading. Maybe I’ll leave my current job. I have my experience and my knowledge. I understand that I need to do this. It’s not a game, it’s not about having fun, passion – just pure work.

- Please tell me, what country are you from, what is the name of the city where you live? How old are you, are you a family man, what are your hobbies?

- I am 52 years old, from Kiev, Ukraine. I used to have hobbies, I was fond of many things. At the moment I have a family and grandchildren. I love to travel, doing some hand craft. There are interesting projects that I want to implement. However, it is necessary to engage in trading, and then devote free time to the implementation of projects.

- Andrey Petrovich, would you advise your friends and acquaintances to join the Battle if Traders? Why?

- Of course, definitely. There are people who want to earn money – I can recommend it them. If they want, I can show them and explain all the nuances of effective trading.

I can recommend online training, seminars. If they like it, I recommend the Battle of Traders. Here you can test yourself and win.

- What would you like to wish NPBFX and the participants of the next Battle of Traders?

- I wish you all the best. You guys are great, you enable people to do what they like, what they want! You give them the opportunity to believe in themselves, in their strength. Here I have only positive experience.

Of course, I wish you great success and prosperity! And I wish the participants of the Battle the same! It doesn't matter, whatever the policy is in the country or global situation with the coronavirus, I hope everything will be fine. Because if you have money, everything will be fine! Good luck!

- Andrey Petrovich, thank you for participating in the Battle and for the interview. We wish you new victories and achievements in the financial markets! And let the NPBFX real account trade be as successful as it was on your contest account in June!