Re: NPBFX - making money with us since 1996!

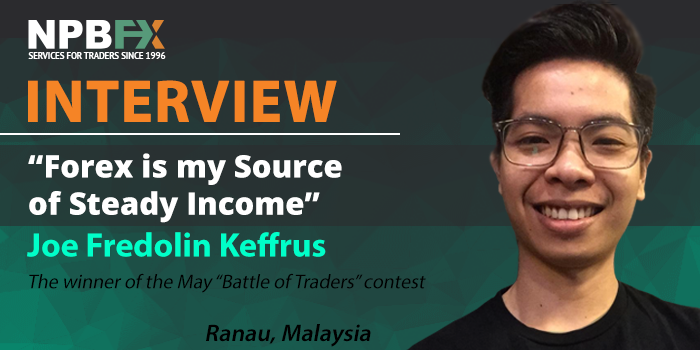

Riding the Elliott Wave right to the 1st place of the contest! The interview with the winner of the May “Battle of traders”

Malaysia is a Southeast Asian country occupying parts of the Malay Peninsula and the island of Borneo with a population of 31 million people. Joe Fredolin Keffrus citizen of this country was awarded the victory in the May Battle of Traders contest and a prize of $ 1000 to the trading account! In his interview, the winner of the trader’s battle shared that he had succeeded due to the Elliott Wave strategy and the never-give-up ability. Why did Joe have a hard time learning Forex trading, whether trading in financial markets is popular in Malaysia, and how does the winner evaluate the conditions of the contest itself? Read the questions and answers session in the interview.

- Joe, it was May you participated in the monthly Battle of Traders contest for the first time. Please tell us how did you learn about the contest and why did you decide to take part in it?

- I saw a banner in the “Promotions” section of my Personal Office and decided to try.

- Did you set a goal to take first place?

- I was planning to get into the top five winners and was very happy when I learned about my victory!

- Your trading result for May was $ 47,677. You managed to increase the initial deposit of $ 5,000 almost by 10 times! Please tell us the nature of your trading system?

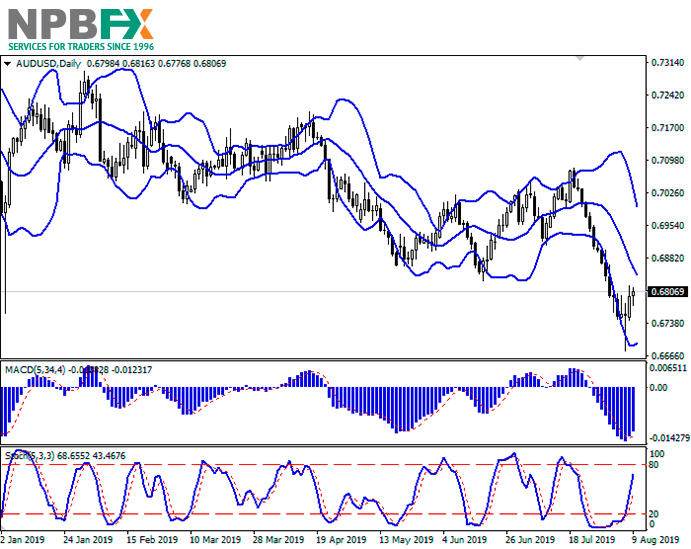

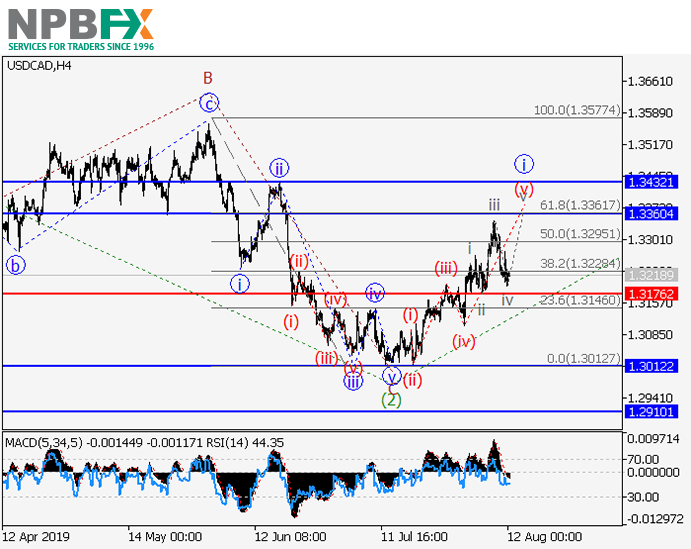

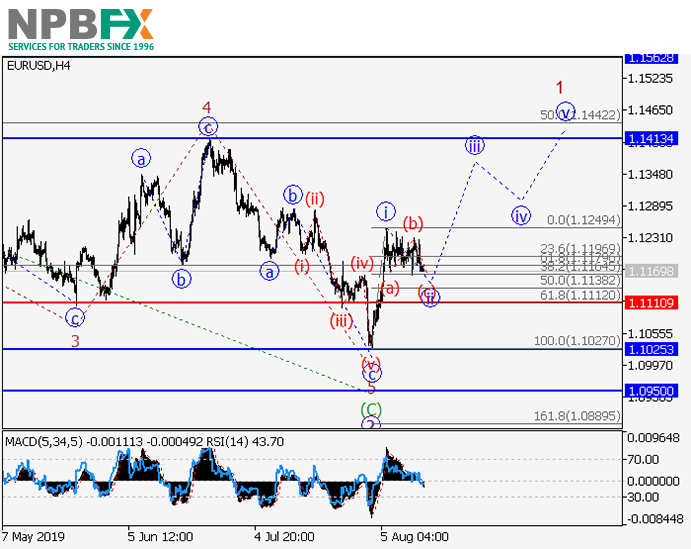

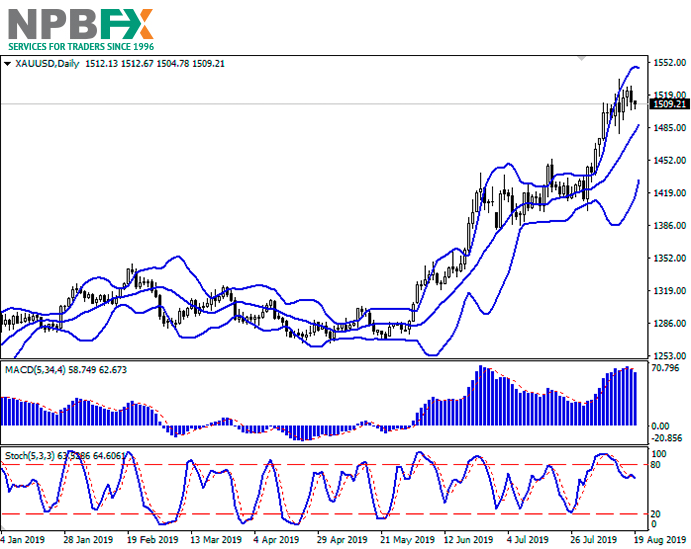

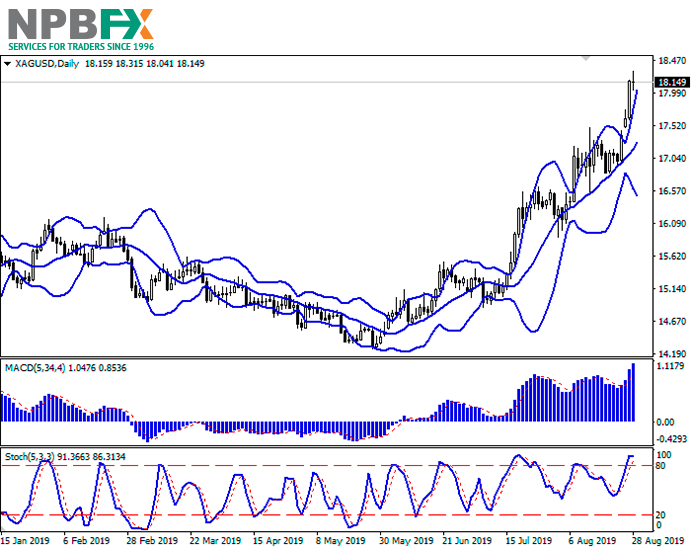

- I trade “manually”. Elliot Wave strategy helps me a lot in making trading decisions. Most often I hold the position open for 2-3 days before I close.

- You had a fairly wide trading portfolio during the contest: more than 10 currency pairs, as well as gold. What is the reason for choosing such trading instruments?

- I prefer not to be focused on one instrument, I always choose the instruments with the best fopportunities. On the contest account, I traded in currency pairs and precious metals. I am less aware of cryptocurrencies, that’s why I didn’t use them in trading.

- NPBFX has already credited $ 1,000 to your real trading account. Are you planning to trade using the same strategy as you did on the contest demo account or change it?

- Yeah, I’m going to use the same strategy.

- In May, nearly 2000 traders took part in the contest. Did you watch rivals through monitoring? Did you compare your results with the achievements of other traders?

- Yes, I always checked the latest results and tried to improve my own.

- What are your personal traits (character features) that helped you achieve success in the contest?

- Constant striving for the best, the ability to fight to the bitter end and never give up.

- Joe, what do you think about the NPBFX “Battle of Traders” contest conditions in general?

- An excellent contest for any trader, practice, and the opportunity to feel the drive throughout the contest.

- Joe, please share, how long have you been trading Forex? Why did you decide to start trading? Was it easy to learn how to trade?

- I’ve been trading at Forex a little over a year. I decided to try on the advice of a friend who had already been a successful trader by that time. It was not easy to learn: there are many aspects to consider, such as emotions, psychology and trading itself.

- Do you feel like Forex is currently a hobby for you or do you take trading as a source of steady income?

- For me, Forex is a source of steady income.

- It would be interesting to learn more about you. Please tell, what country and city you are from? How old are you, what is your profession, are you a family man, what are your hobbies besides trading?

- I am 21 years old, I am from the city of Ranau, Sabah, Malaysia. I’m currently working in a small private company. I spend my spare time with family and playing online games.

- Do your relatives know about your Forex trading? Have you already told your relatives about your victory in the contest?

- Some of the family members do not really support me, because they consider Forex a risky business. But those of them who more deeply understand what it is, support me.

- In your opinion, how many people in Malaysia are aware of trading in financial markets, at Forex? Do you have friends engaged in trading?

- I believe there are few people in Malaysia aware of the online trading earning potential due to a lack of basic information and understanding of financial markets.

- Joe, would you recommend to your friends to participate in the “Battle of Traders” contest? Why?

- I would! This is an excellent training platform for beginner traders.

- What would you wish NPBFX and the participants of the following “Battle of Traders” contests?

- I would like to thank NPBFX for the great contest and wish all future participants to never give up and win!

- Joe, thank you for participating in the contest and for the interview! We wish you new victories and achievements in the financial markets with the NPBFX broker!