Topic: Grid Trading with EA Studio Experts (Averaging Down)

Introduction

Hello Traders,

I was invited to a team-building event organised by Petko Aleksandrov from https://algotradingspace.com/. We discussed a variety of topics related to algorithmic trading.

Petko and his team trade a lot of strategies, including third-party robots, strategies created by EA Studio, and automatically generated strategies from the Top 10 Robots App.

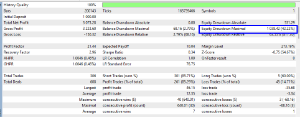

From the stats he already has, it appeared that the fixed-lot strategies created with EA Studio are suited best for Prop-firms challenges and also for small accounts ($200 - $1000). It was also clear that the best results come from strategies which are manually examined, monitored and updated by experienced traders.

The automatically generated and validated strategies from the Top 10 App does not show a steady performance in general. It appeared that they are useful only after additional validation and examination in EA Studio. It was good that we charted ideas for improvement of the workflow, but this is an additional topic.

It was noted that he has a moderate success form third-party scalping robots.

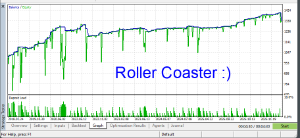

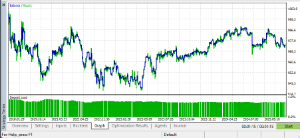

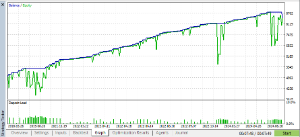

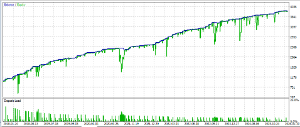

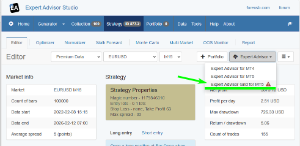

However, the most interesting for me was that Petko has more success with robots with the so-called grid compensation of the losing trades with a predefined risk.

He trades multiple accounts with one "Grid" robot per account. Despite the risk of account blow-off, he is in total profit.

I examined the way Petko and his team work and here are my notes:

- multiple accounts with one robot instead of a large account with multiple robots. (diversification)

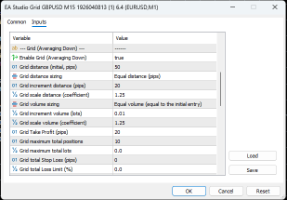

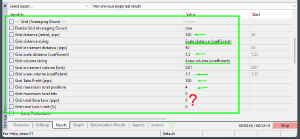

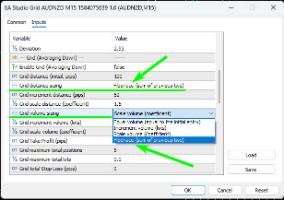

- limited number of additional entries to a losing position with a small scaling coefficient of the entry volume. (controlled Martingale)

- manually testing the experts in MetaTrader to find the most suitable currency pair for each robot and the exact parameters.

- periodic profit withdrawal

It all looks exceptionally well from the outside. However, I had my observations:

- Petko does not pay for the third-party robots. He partners with the robot developers and sells their products. As a rule, the so-called "vendor" robots are expensive: $500 - $1000+. They also have a limited number of activations. I'm not sure what the profit would be if we include the price of the robots themselves.

- He mostly trades on brokers with whom he has an affiliate partnership or ones that sponsor his videos. This is a disadvantage.

...

I was thinking a lot about how to add more value for you and how to make it possible to have more successful trading.

I'll examine my ideas in the next post.