Topic: EA Studio vs Every Tick Based on Real Ticks: how to avoid mismatches?

Hello all,

I personally went trough many tests where Open Price Mode backtest is positive on Ea Studio and MT5 BUT, as soon as I backtest in "Every Tick based on Real Tick" the result is very bad.

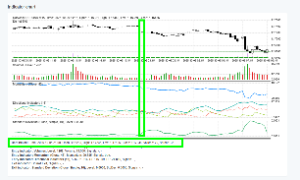

Here's an example from GBPCHF M30 in 2025, with fixed SL= 50 (no TP), on same prop firm data:

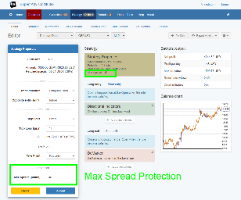

After putting the request on the wishlist to have a "Open price mode trading" input, I was wondering in the meantime if and eventually how do you mantain the same backtest result among "Open Price Mode" and "Every tick based on real ticks" mode, with the same EA downloaded from EAStudio.

Many thanks