Re: Daily Market Forecast By Capitalcore

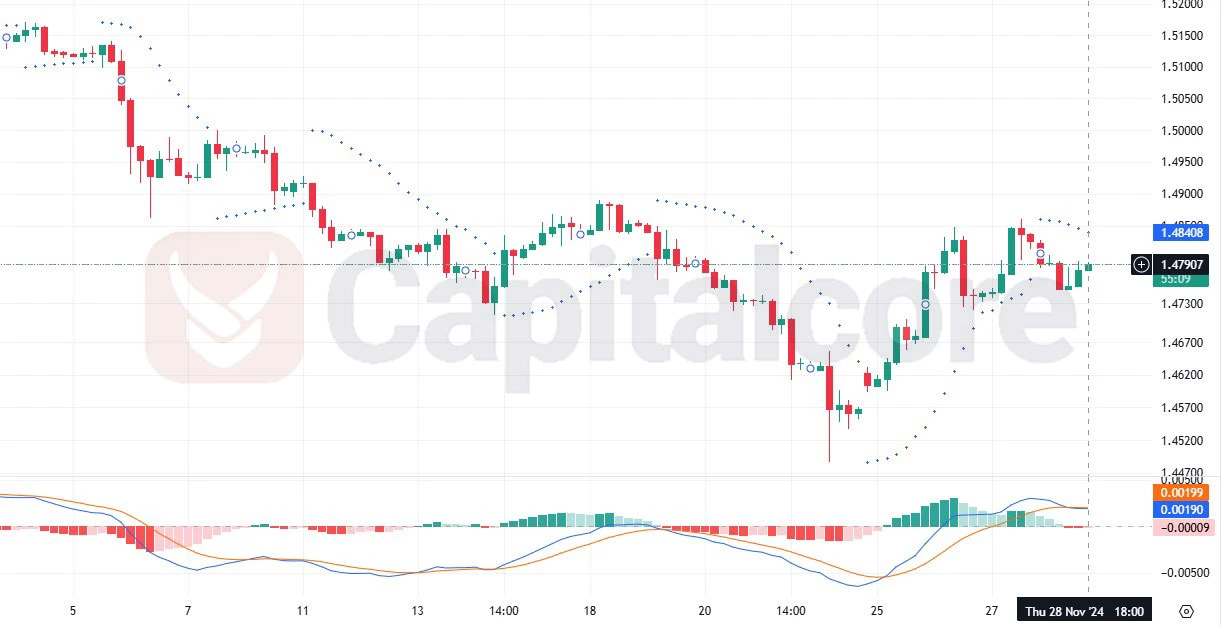

EUR/GBP H4 Technical Outlook and Fundamental Forecast

The EUR/GBP currency pair, often nicknamed "Chunnel," showcases the dynamic economic relationship between the Eurozone and the United Kingdom, both key players in the European market. For today’s EURGBP news analysis, traders are eyeing critical economic data releases, starting with Germany's Wholesale Price Index (WPI) and France's Consumer Price Index (CPI) for the Euro. The WPI, as a leading indicator of consumer inflation, could provide early insights into pricing pressures in Germany, while France's CPI is expected to gauge consumer spending power and inflationary trends, impacting the Euro's appeal to investors. Simultaneously, the UK is releasing multiple economic indicators, including Gross Domestic Product (GDP), the Visible Trade Balance, and the Gross Value Added (GVA) figures. Strong GDP or trade balance results would underscore the UK's economic resilience, potentially supporting the Pound, while weak data might shift market sentiment toward the Euro. With both economies facing inflationary concerns, EUR/GBP’s fundamental signals are crucial in determining whether the Euro or Pound may gain an edge in the pair’s trading environment today, especially amid heightened inflation worries and economic performance considerations across Europe.

Chart Notes:

• Chart time-zone is UTC (+02:00)

• Candles’ time-frame is 4h.

In the EUR/GBP H4 chart, the candlestick pattern reveals recent “Chunnel” price volatility with significant resistance levels around 0.8340 and support near 0.8280. The Moving Average Convergence Divergence (MACD) indicator displays a bearish crossover, indicating a potential EUR/GBP bearish trend, while the Relative Strength Index (RSI) hovers around 47, suggesting neutral market sentiment with a slight bearish tendency. Traders should observe the pair’s reaction to today’s economic data, which could confirm or invalidate the current trend based on EUR and GBP strength in light of upcoming inflation and growth metrics.

• DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.

Capitalcore