Re: Daily Analysis By FXGlory

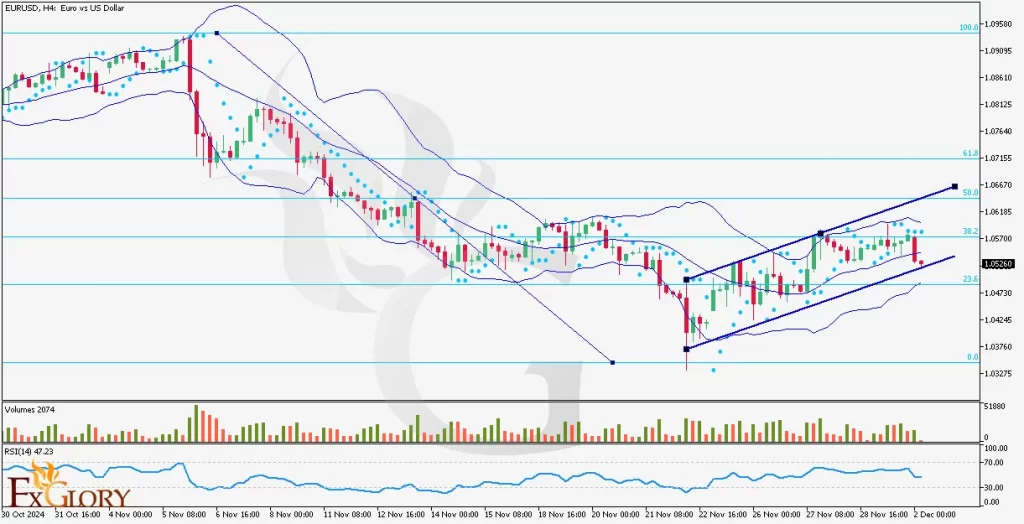

EURUSD H4 Technical and Fundamental Analysis for 11.22.2024

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/USD news analysis today remains highly sensitive to macroeconomic developments and monetary policies. Today’s fundamental signals focus on key Eurozone PMI data for both manufacturing and services sectors. The Flash PMI, which is a leading indicator of economic health, is expected to signal whether the Eurozone economy remains in contraction territory or shows signs of recovery. Meanwhile, for the US, the release of PMI and University of Michigan sentiment data could provide insights into the strength of the American economy. Additionally, comments from Federal Reserve officials may hint at future monetary policy direction, further influencing USD movements. As inflationary pressures persist in both regions, traders remain cautious about potential volatility in the EUR/USD forecast today.

Price Action:

The EUR/USD H4 candle chart exhibits a clear bearish structure, characterized by lower highs and lower lows. The pair has recently broken below key support levels, indicating sustained selling pressure. The recent candles show a rejection near resistance, with bearish momentum driving the pair toward new lows. EURUSD’s Price action suggests that sellers are in control, and the trend remains to the downside unless buyers reclaim significant levels.

Key Technical Indicators:

Stochastic RSI: The Stochastic RSI is currently at 18.78, deep in the oversold zone. This indicator further reinforces the possibility of a minor pullback, although the overall bearish sentiment remains intact.

Parabolic SAR: The Parabolic SAR dots are consistently above the price, signaling a strong bearish trend. This indicates sustained downward momentum, with no signs of reversal yet.

RSI (Relative Strength Index): The RSI is at 31.82, approaching oversold territory. While this suggests bearish dominance, it also hints at a possible short-term correction or consolidation before continuing downward.

Support and Resistance:

Support Levels: 1.0465 (recent low) serves as the immediate support level, while 1.0425 is the next key level, acting as a strong psychological and historical support zone.

Resistance Levels: 1.0520 is the nearest resistance, which was previously a support level now turned resistance. Further above, 1.0585 marks a critical level to watch, as it represents the recent swing high and could act as a significant barrier for bullish attempts.

Conclusion and Consideration:

The EUR/USD outlook on its H4 chart is firmly entrenched in a bearish trend, as confirmed by price action and the pair’s technical outlook with indications from the Parabolic SAR, RSI, and Stochastic RSI. While oversold conditions on the RSI and Stochastic RSI suggest the potential for a short-term correction, the overall trend remains bearish. Traders should closely monitor upcoming economic data from both the Eurozone and the US, as these releases could influence short-term volatility and momentum. Risk management is crucial, with stop losses placed below support levels for buyers and above resistance levels for sellers.

Disclaimer: The analysis provided for EUR/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURUSD. Market conditions can change quickly, so staying informed with the latest data is essential.

FXGlory

11.22.2024