Re: FxNews.me — Technical Analysis

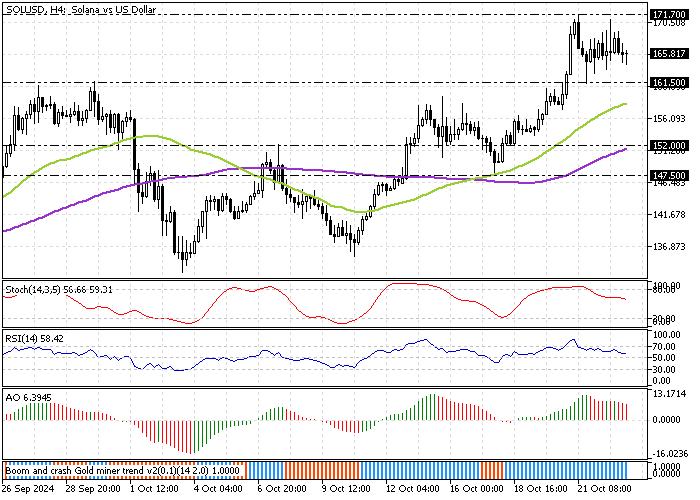

Will Solana Bounce Back Above $171.7? Key Levels to Watch

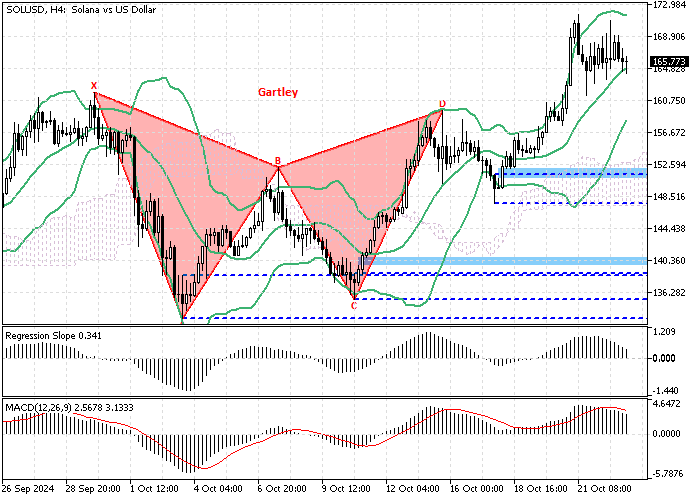

FxNews.me—Solana consolidates below the $171.7 high as expected because the Stochastic and RSI 14 signaled overbought at the time. As of this writing, SOL/USD trades at approximately $165.6, testing the median line of the Bollinger Bands.

The primary trend should be considered bullish because the price is above the 50- and 100-period simple moving averages. However, the Awesome Oscillator histogram is red, signaling that the downtick momentum from $171.7 could extend to the lower support levels.

Forecast

From a technical perspective, the trend outlook remains bullish as long as Solana trades above $161.5. However, for the uptrend to resume, the Bulls must close and stabilize the price above $171.7.

Conversely, a dip below the $161.5 should invalidate the bullish outlook. In this scenario, a new bearish wave will likely form, and the target could be the 100-period SMA at $152.0.