Re: HFMarkets (hfm.com): Market analysis services.

Date: 11th June 2024.

Market News – Inflation reports dominates!

Trading Leveraged Products is risky

Economic Indicators & Central Banks:

* The selloff in Treasuries continued ahead of the FOMC decision tomorrow, though losses were moderate. Disappointment that the continued strength in the labor market will push back any easing until at least September at the earliest continued to weigh.

* Chinese stocks dropped after traders returned from a long weekend, weighed down by weak travel spending and renewed concerns over the property sector, raising doubts about the sustainability of China’s economic recovery.

* Developer Dexin China Holdings gets liquidation order from a Hong Kong court adding to a growing number of legal victories for creditors involving overdue debt.

* Geopolitical risks also affected shares of electric vehicle makers as traders awaited the European Commission’s decision on provisional duties expected this week.

* Australian business confidence turned negative in May, and conditions slipped to below-average levels, indicating that elevated interest rates and a worsening consumer outlook are weighing on the corporate sector.

* Markets are also closely monitoring potential fallout from political upheavals in Europe.

Asian & European Open:

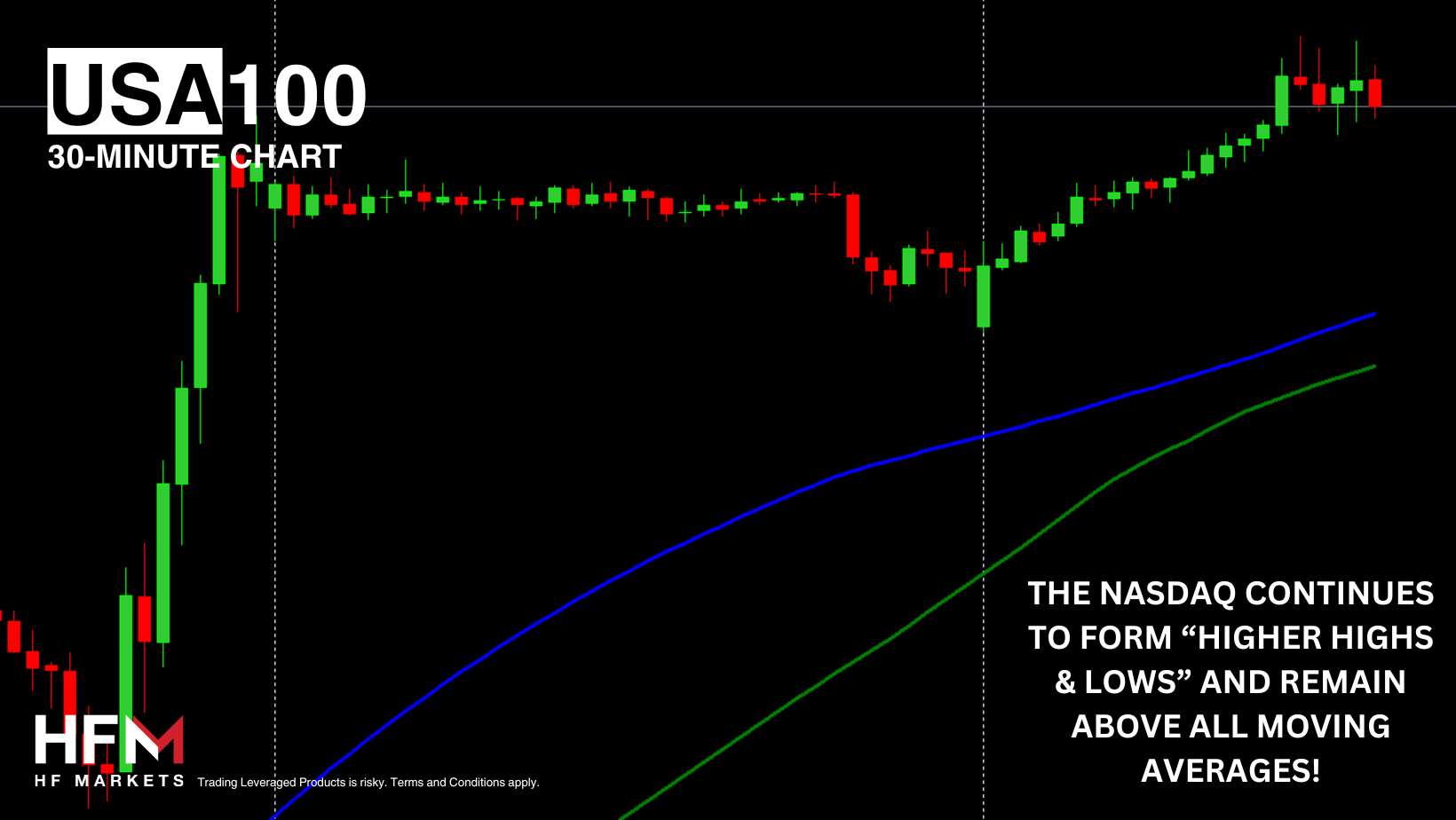

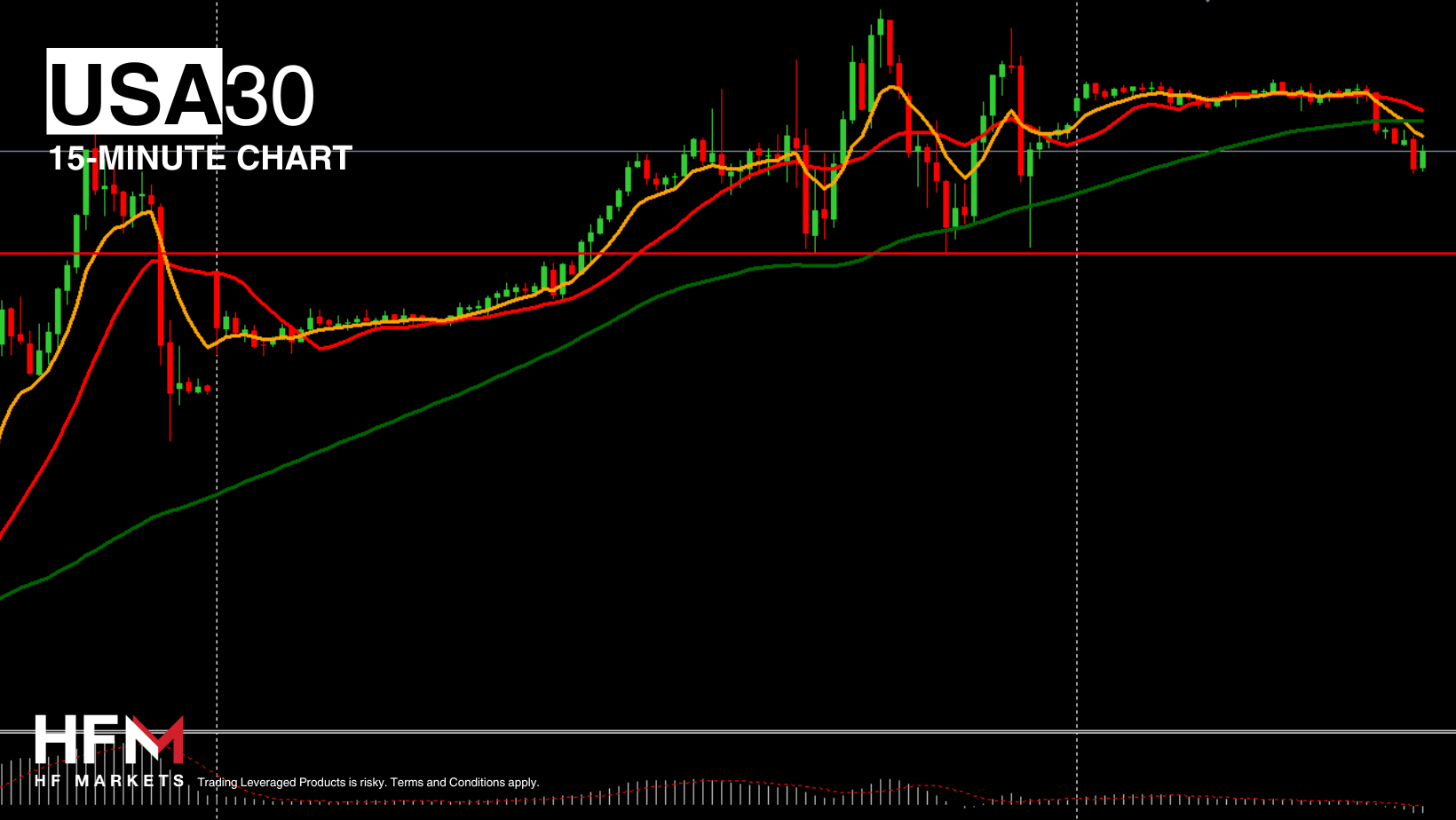

* All three major indexes closed higher on Monday, with the S&P500 and Nasdaq both hitting new records. The Dow ended the day up about 0.2%, following a modest finish to a winning week.

The CSI 300 Index of mainland shares fell up to 1.4% after reopening from the Dragon Boat Festival holiday, while Hong Kong-listed Chinese shares were among Asia’s biggest decliners, dropping as much as 2%.

* Apple Inc. sank despite unveiling new artificial intelligence features. The company’s suppliers also dropped after Apple’s latest AI platform was seen as disappointing.

* Billionaire Elon Musk stated he would ban Apple devices from his companies if OpenAI’s software is integrated at the operating system level, calling it a security risk.

Financial Markets Performance:

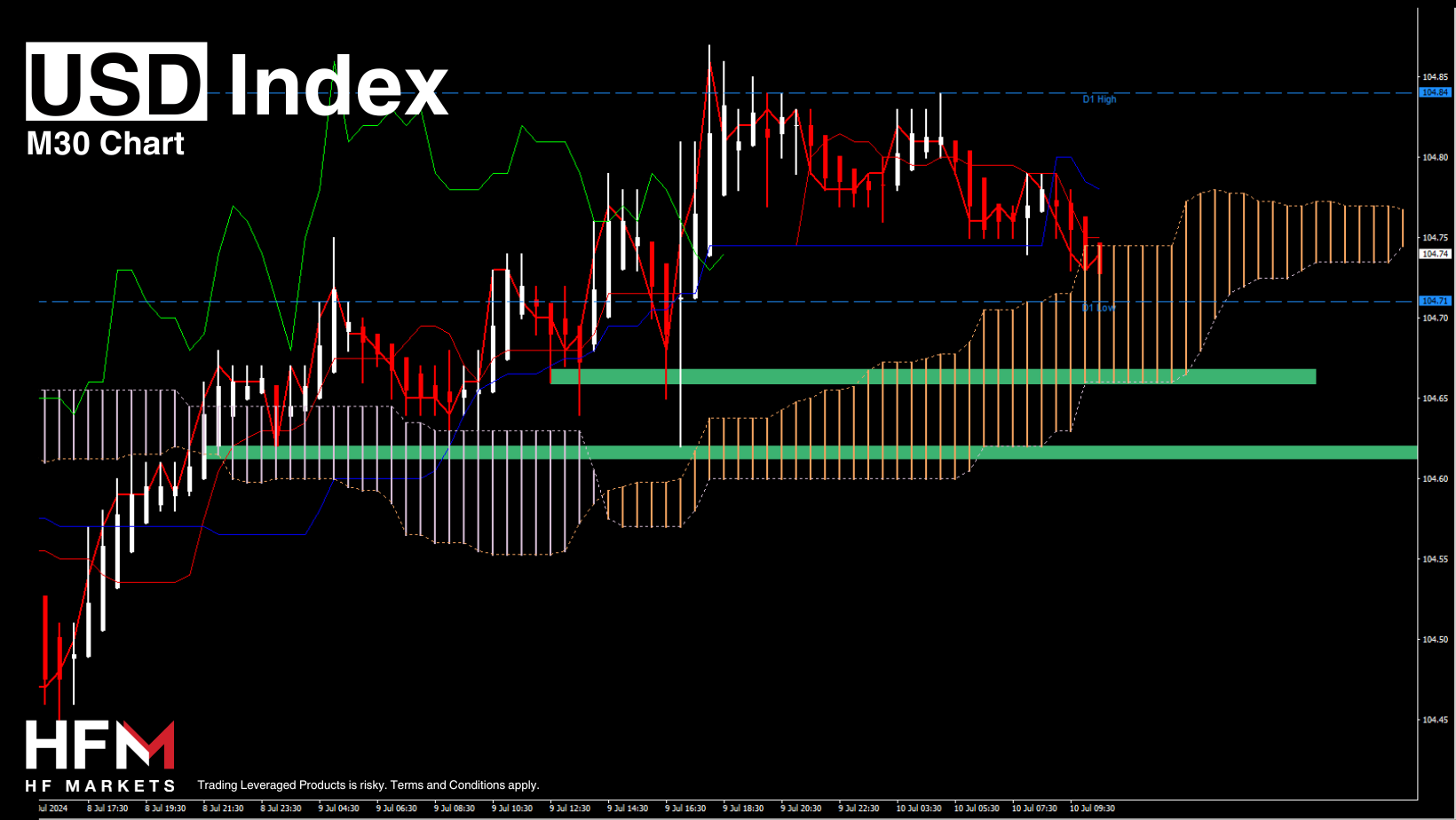

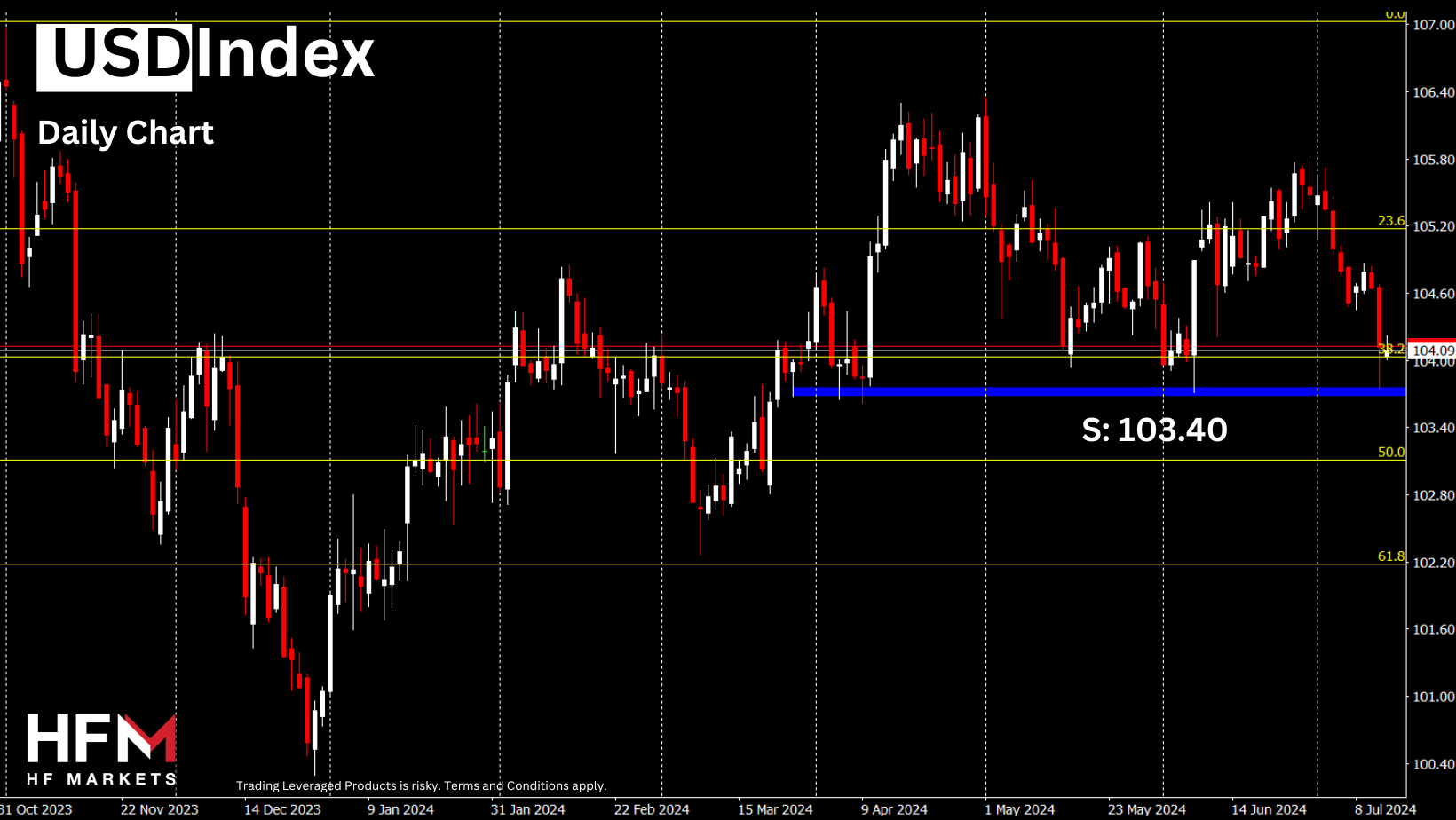

* The USDIndex has caught a bid with the push back to rate cut expectations. It closed at 105.150, back with a 105 handle for the first time since May 14.

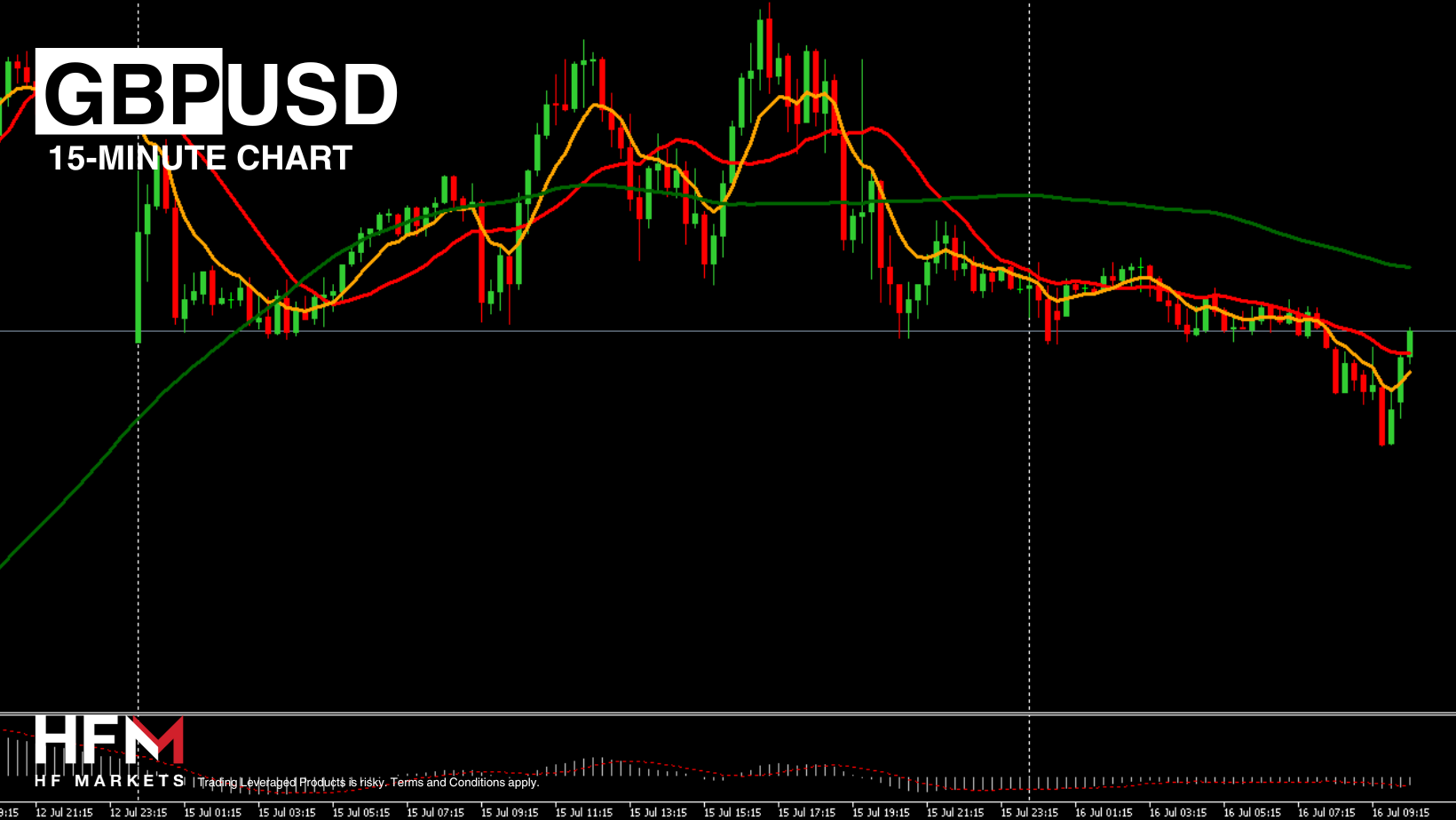

* The EURUSD stalled at 1.0770, while GBPUSD declined slightly today after the tight labor data.

* USOIL held the biggest jump since March ahead of an OPEC report that will provide a snapshot on the market outlook.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.