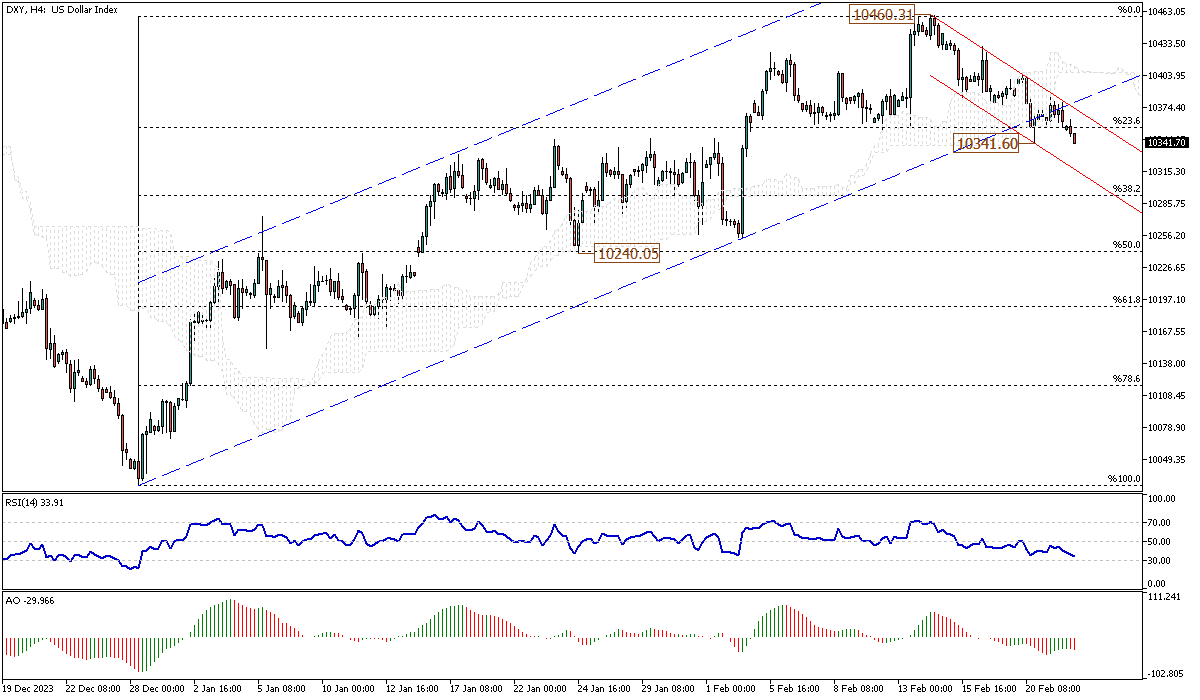

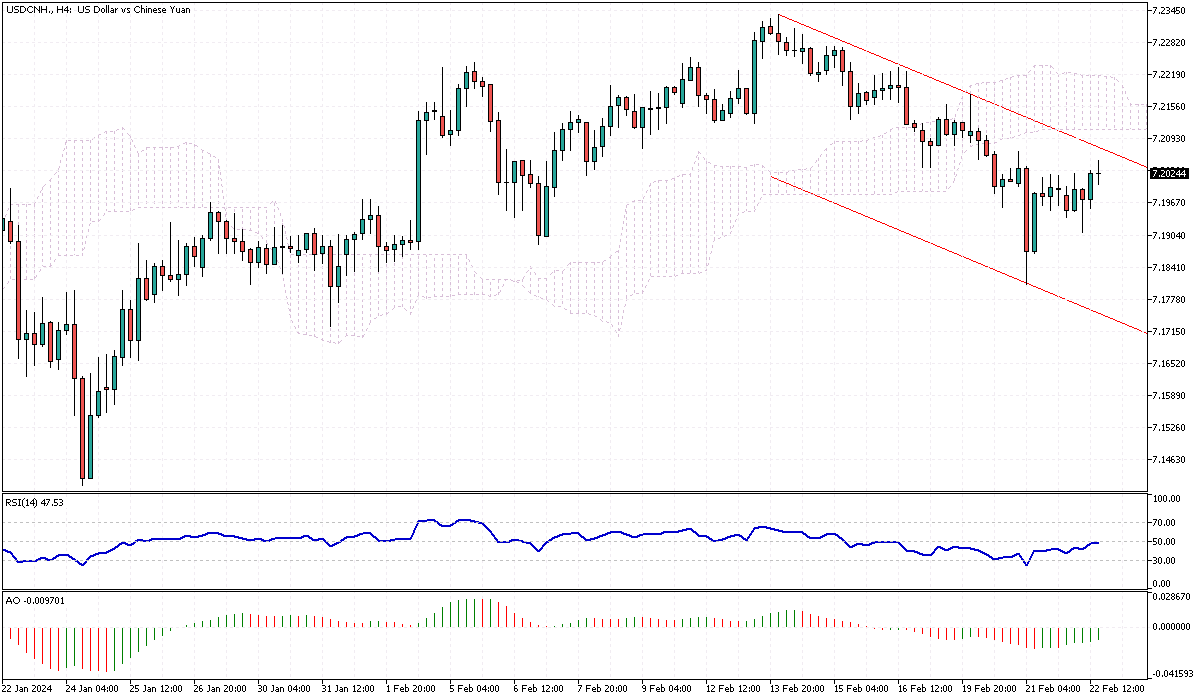

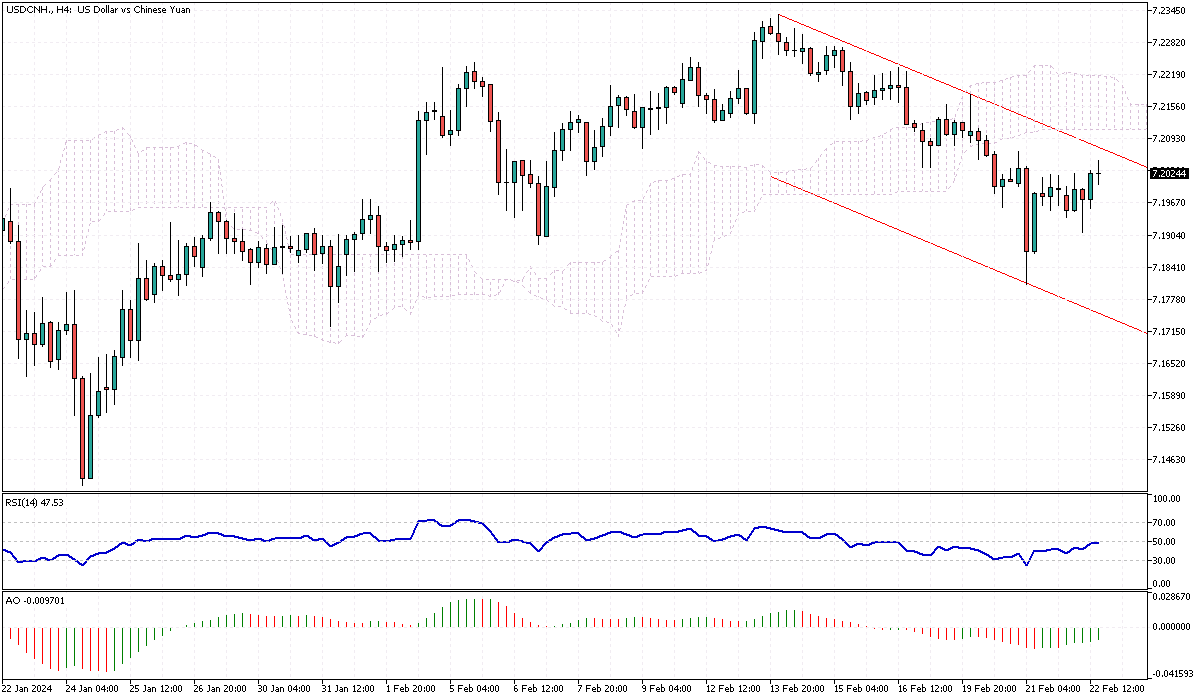

Offshore Yuan's Rise Amid Weakening Dollar

Solid ECN – The offshore yuan has seen a notable appreciation, reaching its highest level in three weeks, climbing toward 7.20 against the dollar. This rise is primarily attributed to the dollar's decline amid increasing uncertainties regarding future interest rate decisions in the United States. Additionally, the Chinese currency is riding a wave of positive sentiment as investors show renewed interest in Chinese markets.

This is evidenced by the significant upswing in mainland stocks, which have soared their highest points in two months. This surge in investor confidence and currency value reflects a broader trend of optimism in Chinese financial assets.

China's Aggressive Monetary Easing

In a move that surprised many, the People's Bank of China (PBOC) significantly reduced its five-year loan prime rate by 25 basis points, bringing it down to 3.95%. This decision exceeded the expectations of a modest 15 basis points cut and marked the most substantial reduction since this rate's inception in 2019. The aggressive cut underscores China's intensified efforts to stimulate economic growth amidst various domestic and global challenges.

However, the PBOC opted to maintain the one-year loan prime rate at 3.45%, indicating a nuanced approach to monetary policy. These measures are part of a broader strategy to invigorate the Chinese economy, reflecting a balanced mix of short-term stability and long-term growth initiatives.

Unleashing Capital for Growth

Earlier in the month, the PBOC took another significant step by reducing the reserve requirements for banks by 50 basis points. This strategic decision has released approximately 1 trillion yuan in long-term capital, aiming to lubricate the economy's gears by enhancing liquidity and encouraging lending.

This substantial capital is anticipated to bolster economic activities, support small and medium-sized enterprises, and stimulate consumer spending. By easing the reserve requirements, the PBOC is providing banks with a greater capacity to finance business projects and consumer needs, thereby fueling the overall growth trajectory of the Chinese economy amidst evolving global financial landscapes.