Re: Market Update by Solidecn.com

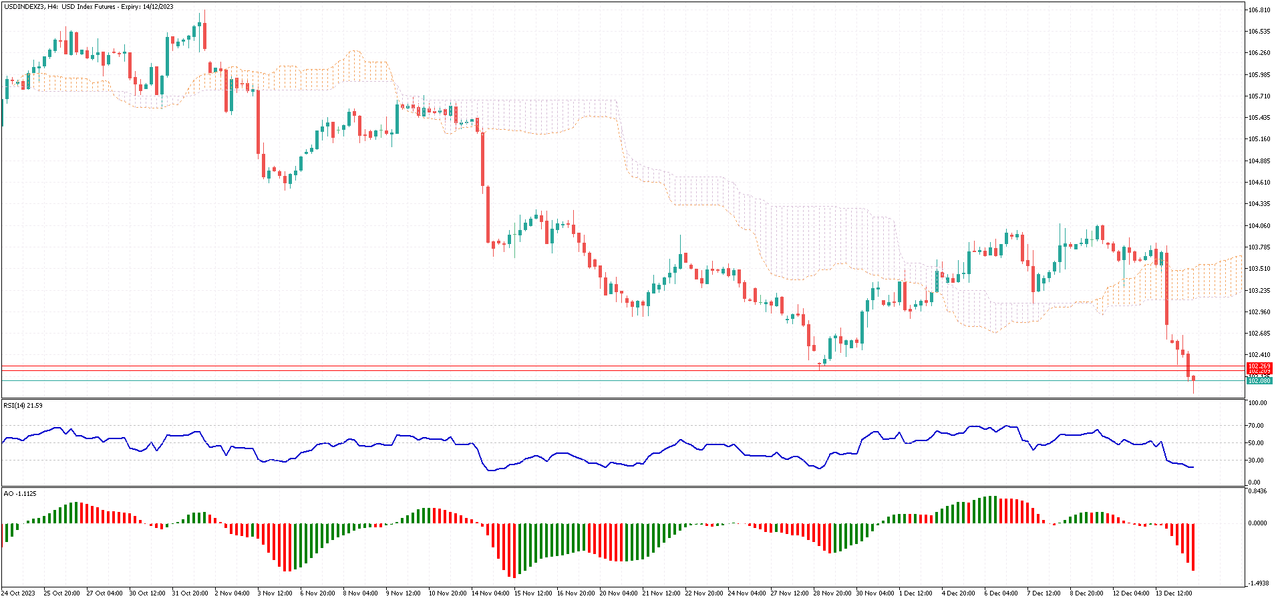

Dollar Plummets to Four-Month Low

On Thursday, the dollar index fell below 102.4, hitting its lowest level in four months since early August. This drop came as investors digested the latest decisions on monetary policy and new economic data from the US. For the third time in a row, the Federal Reserve kept interest rates unchanged. They also signaled a more rapid reduction in rates for 2024, estimating 75 basis points in cuts, more than what was projected in September.

During the press conference, Fed Chair Powell maintained a dovish stance, hinting at possible reductions in borrowing costs due to a faster-than-expected drop in inflation. On the other hand, the European Central Bank (ECB) and the Bank of England decided to keep their rates steady. They committed to maintaining higher rates to tackle inflation. Despite robust US retail sales and a fall in weekly jobless claims, these developments didn't significantly alter investors' outlook.