Re: Forex Fundamental Analysis & Forecast by RoboForex

EURUSD: things are complicated. Overview for 19.01.2023

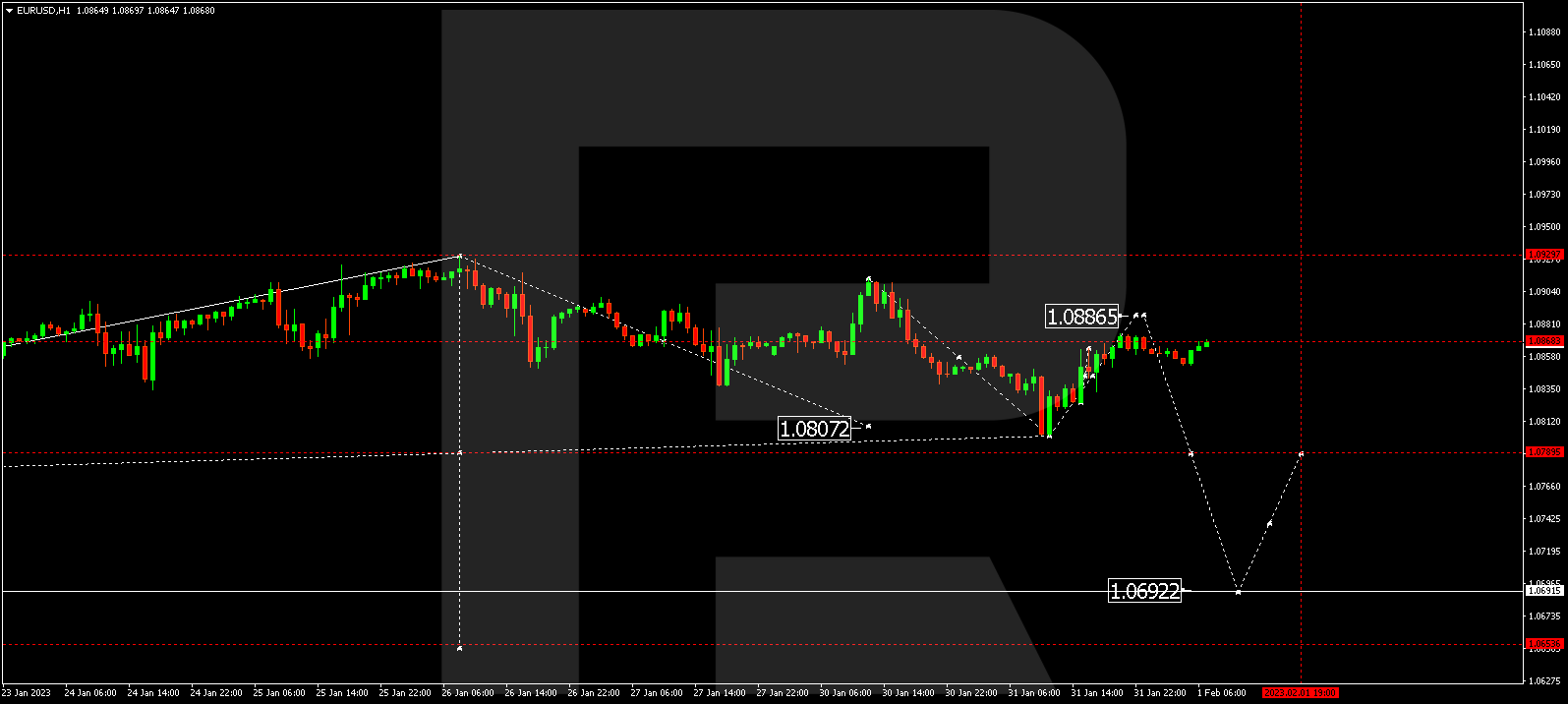

EURUSD keeps fluctuating at big amplitude. The current quote is 1.0800.

The yield of treasury bonds in the US dropped quite a bit yesterday, pulling the USD down. Investors are nervous that recession in the US economy might grow, especially after statistics gave such signals.

So, the news is as follows. Retail sales in the US in December dropped by 1.1% m/m, while the forecast was 0.8%, and the preceding decline amounted ti 1.0%. Retail sales except cars lost 1.1% after falling by 0.6% in November. Looks like the rush season before Christmas failed to stimulate consumers to spend. And this fact is definitely worth thinking about.

The PPI in December dropped by 0.5% m/m, while the forecast was 0.1%, and in November it grew by 0.2% m/m. The base indicator grew a bit. This signals that inflation still has momentum. Other publications concerning the price situation are also likely to show the same.

Industrial production volume in December lost 0.7% m/m. This is also a worse result than forecast (-0.1% m/m) and worse than in November. The production powers load index also dropped to 78.8% from 79.4%.

Forecasts for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.