Re: HFMarkets (hfm.com): Market analysis services.

Date : 20th September 2022.

Market Update – September 20.

Trading Leveraged Products is risky

*USDIndex – steadied at 109 – 109.30, as Treasuries were weaker on the day and closed near their lows as the market awaits an all-but-done 75 bp rate boost. The 2-year US Treasury yield , which is extremely sensitive to policy expectations, rose as high as 3.970% overnight for the first time since November 2007. The 10-year yield reached a high of 3.518%, a level not seen since April 2011.

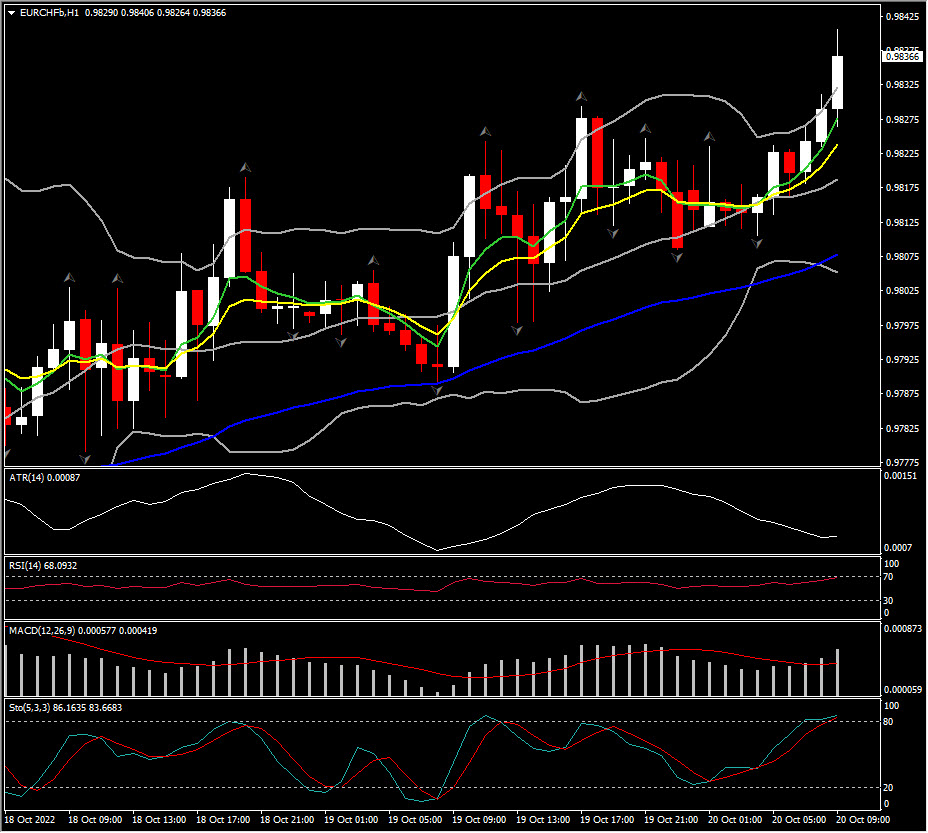

*EUR – back to parity (1.0030) after it dropped as low as $0.9864 on Sept. 6 for the first time in two decades.

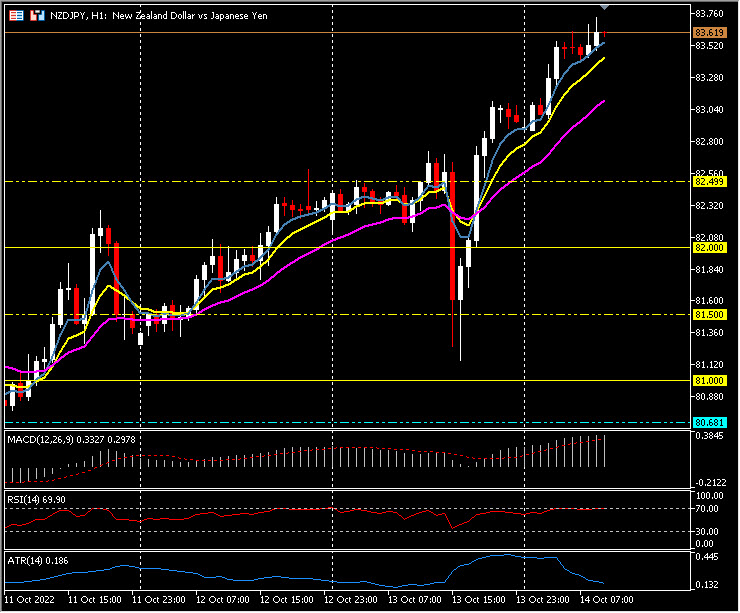

*JPY – at 143.40, in a week following consolidation. The BoJ decides policy on Thursday, and is widely expected to keep its ultra-easy stimulus settings unchanged — including pinning the 10-year yield near zero — to support a fragile economic recovery.

*GBP – at 1.1445, finding some ground after the 37-year low. Consensus expectations predict a 50 bp move from the BoE, although a 75 bp move is likely to be discussed.

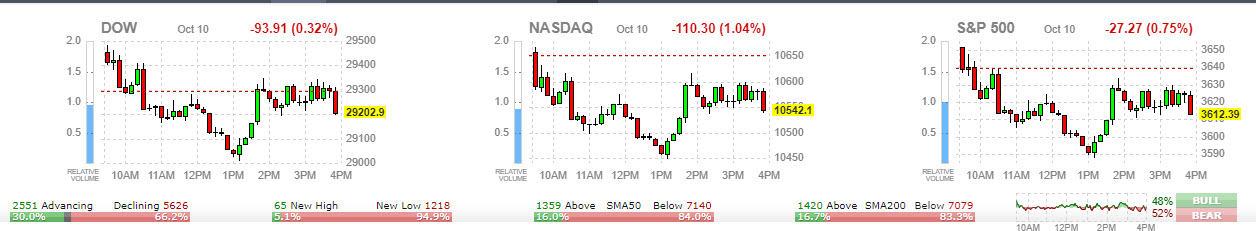

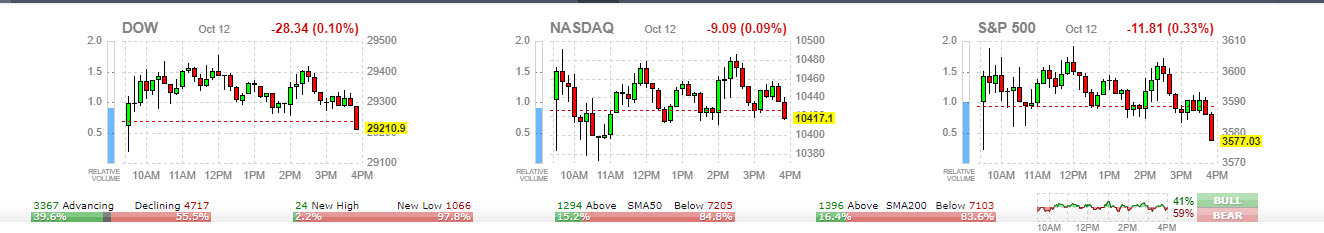

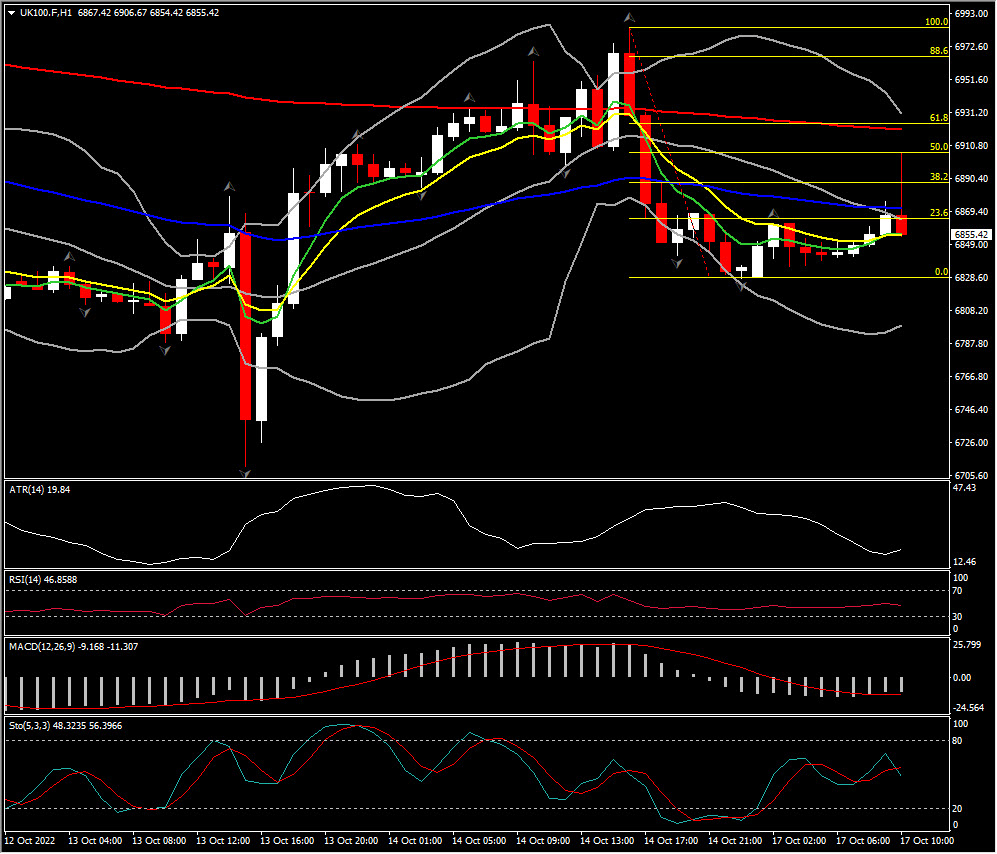

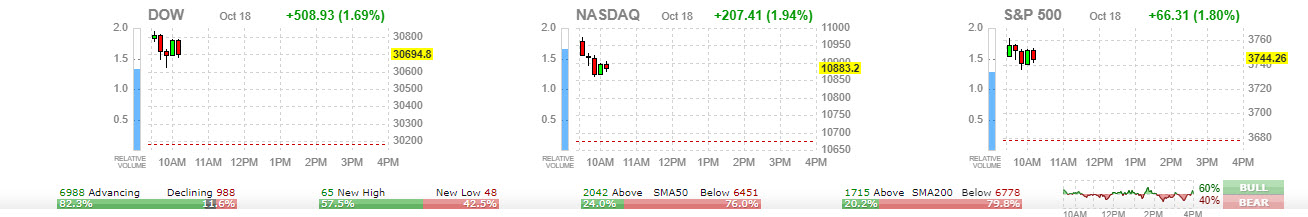

*Stocks: A late-day rally left the US100 up 0.76% at 11,535, while the US30 and US500 rose 0.64% and 0.69%, respectively, to 31,019 and 3899. Nikkei was up 0.45% at the close, the ASX managed a 1.29% gain, while CSI and Hang Seng are currently up 0.2% and 1.1% respectively. GER40 and UK100 futures are up 0.3% and 0.6% respectively.

*Apple rallied by 2.51% yesterday. The company announced yesterday that prices of apps and in-app purchases on its App Store will increase in several countries including Japan, Malaysia and all territories that use the euro currency, from next month. Also in a statement to Bloomberg, Apple has acknowledged the iPhone 14 Pro’s camera shaking issue and has revealed that it will release a software update to fix this. This update should be out by next week.

*USOil – at $85 area after dipping to $82. US crude oil stocks are estimated to have risen last week by around 2 million barrels in the week to Sept. 16, a preliminary Reuters poll showed on Monday. European gas prices meanwhile continue to decline with Dutch TTF at EUR 170 per megawatt hour – the lowest since July 25. European governments are intensifying efforts to ease the reliance on Russian imports and there are also efforts underway to reform the energy market as governments move to reduce energy consumption in preparation for the winter. European inventories are almost 86% full, but if Russia doesn’t resume gas deliveries via Nordstream 1 it will still be a struggle to avoid power cuts.

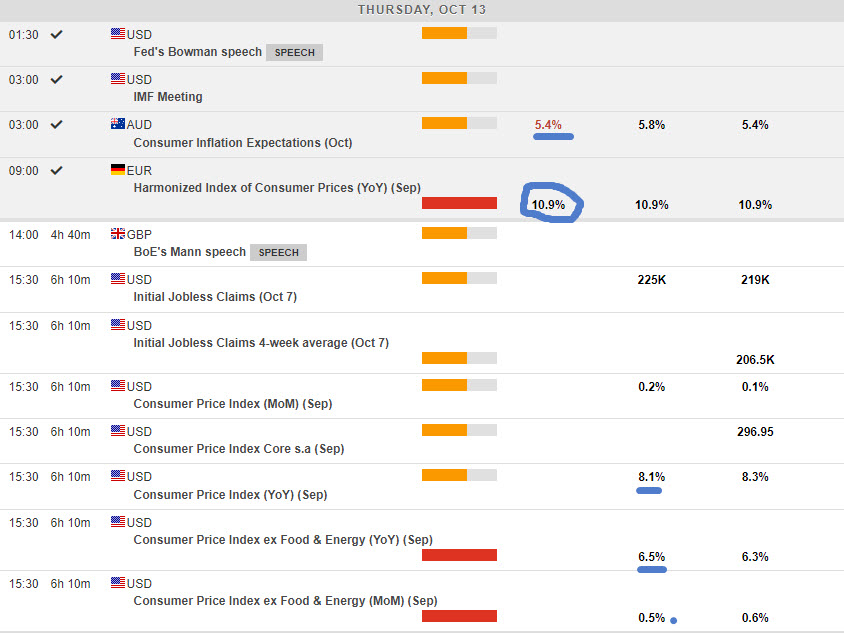

Overnight & Today - US Building Permits & housing Starts, Canadian Inflation and the highlight is the ECB Lagarde speech, BoC Deputy Beaudry speech and RBA Assist Gov Bullock Speech.

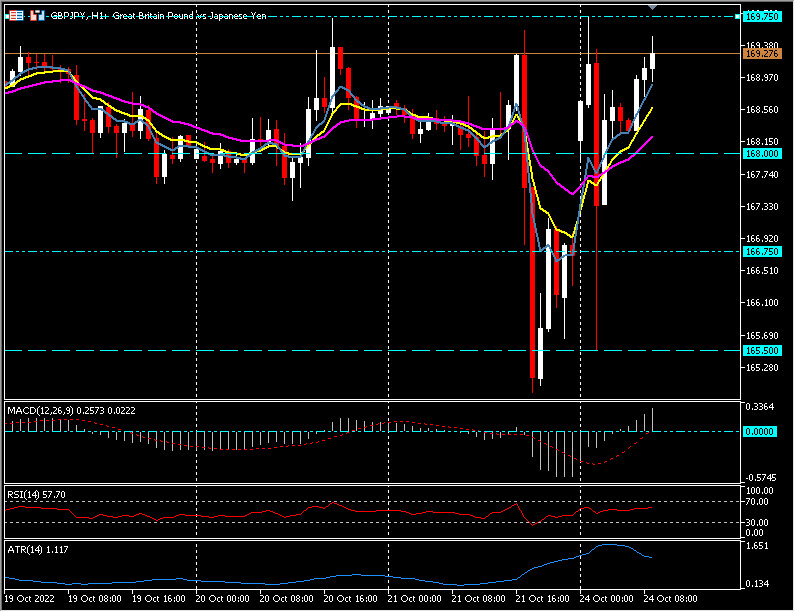

Biggest FX Mover @ (06:30 GMT) GBPJPY (+0.42%) rallies to 164.35 (200-hour SMA). MAs aligning higher, MACD histogram & signal line turned positive and rising. RSI 69, H1 ATR 0.225, Daily ATR 1.557.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.