Re: Technical Analysis by FXOpen

ETHUSD and LTCUSD Technical Analysis – 20th JAN, 2022

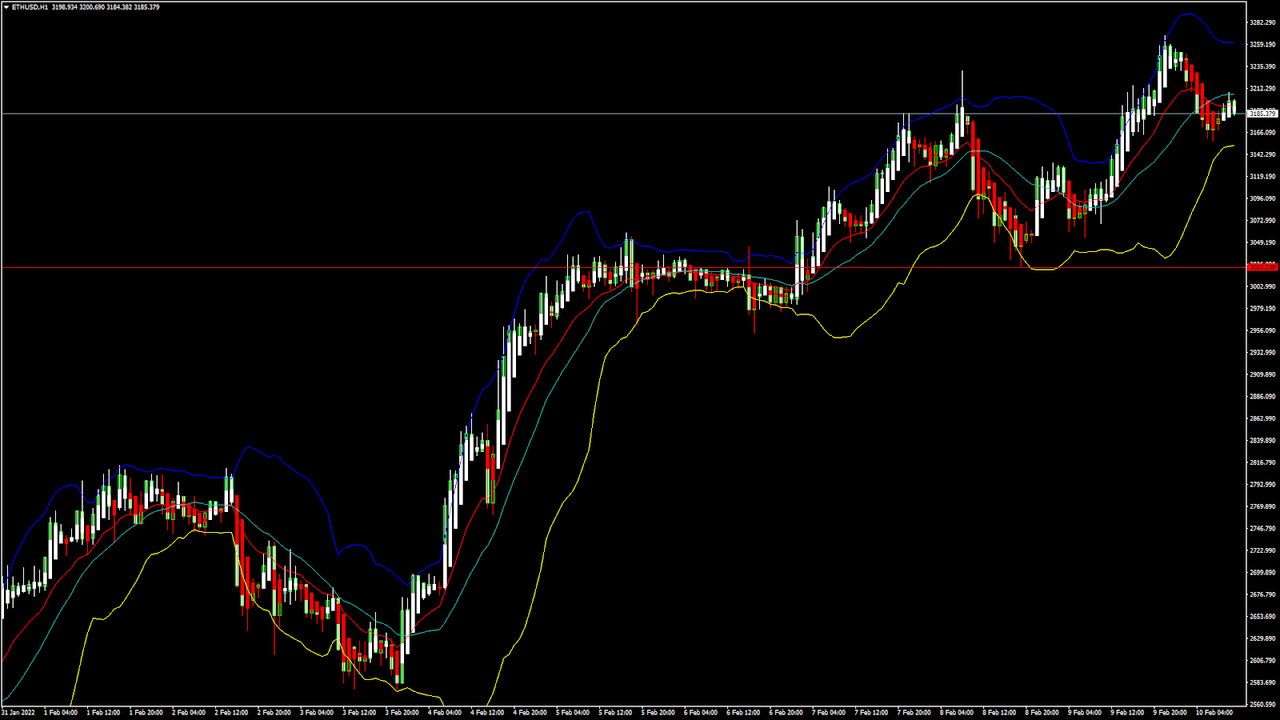

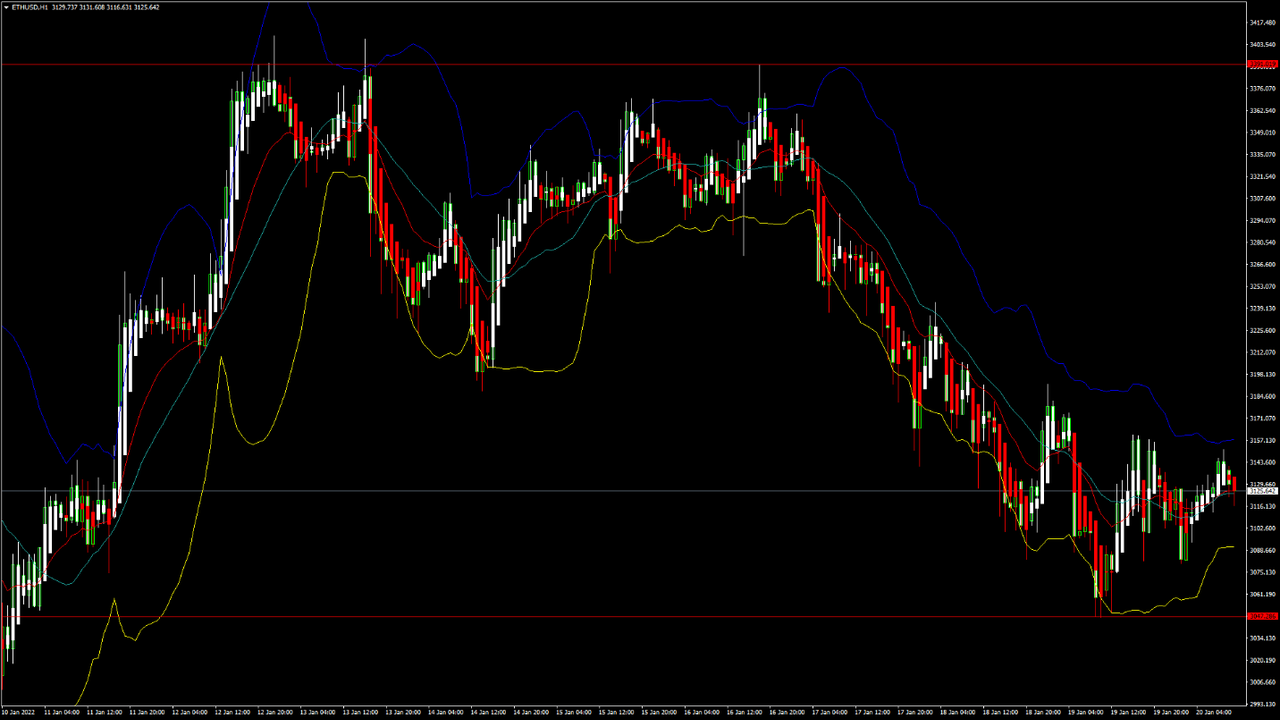

ETHUSD: Double Bottom Pattern Above $3,000

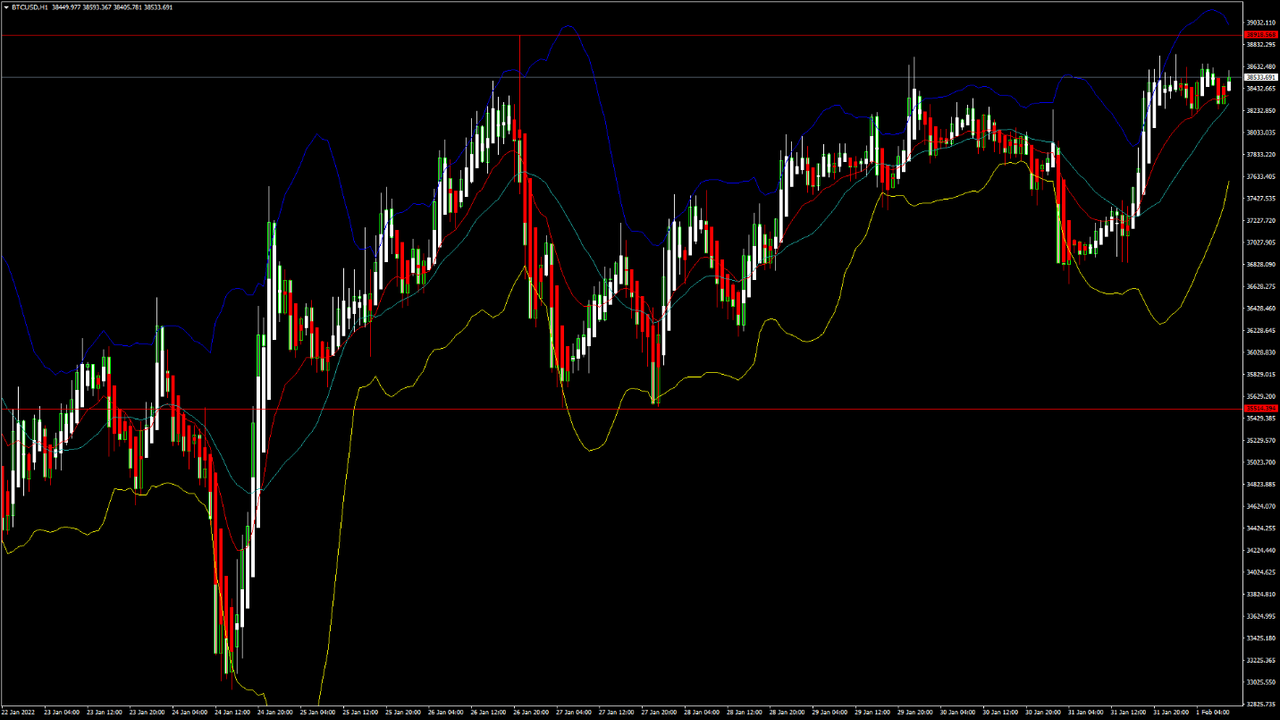

Ethereum was unable to sustain its bullish momentum this week, and after touching a high of $3,409 on 12th January, started declining against the US dollar.

ETHUSD touched an intraday low of $3,080 in the Asian trading session today, after which we can see some consolidation in its prices above the $3,000 handle.

We can clearly see a double-bottom pattern above the $3,000 handle which is a bullish reversal pattern and signifies the end of a downtrend and a shift towards an uptrend.

ETH is now trading just below its pivot levels of $3,131 and is moving in a consolidation channel. The price of ETHUSD is now testing its classic resistance levels of $3,138 and Fibonacci resistance level of $3,146, after which the path towards $3,300 will get cleared.

The relative strength index is at 49, indicating a NEUTRAL market and a move towards the consolidation phase after the decline.

We have detected an MA 20 crossover pattern above the $3,124 level which signifies a bullish trend reversal in the short-term.

Some of the technical indicators are giving a BUY signal.

ETH is now trading below the 100 hourly and 200 hourly simple moving averages.

Ethereum consolidation is seen above the $3,000 mark

Short-term range appears to be NEUTRAL

Ultimate oscillator is indicating a NEUTRAL market

Average true range is indicating LESSER market volatility

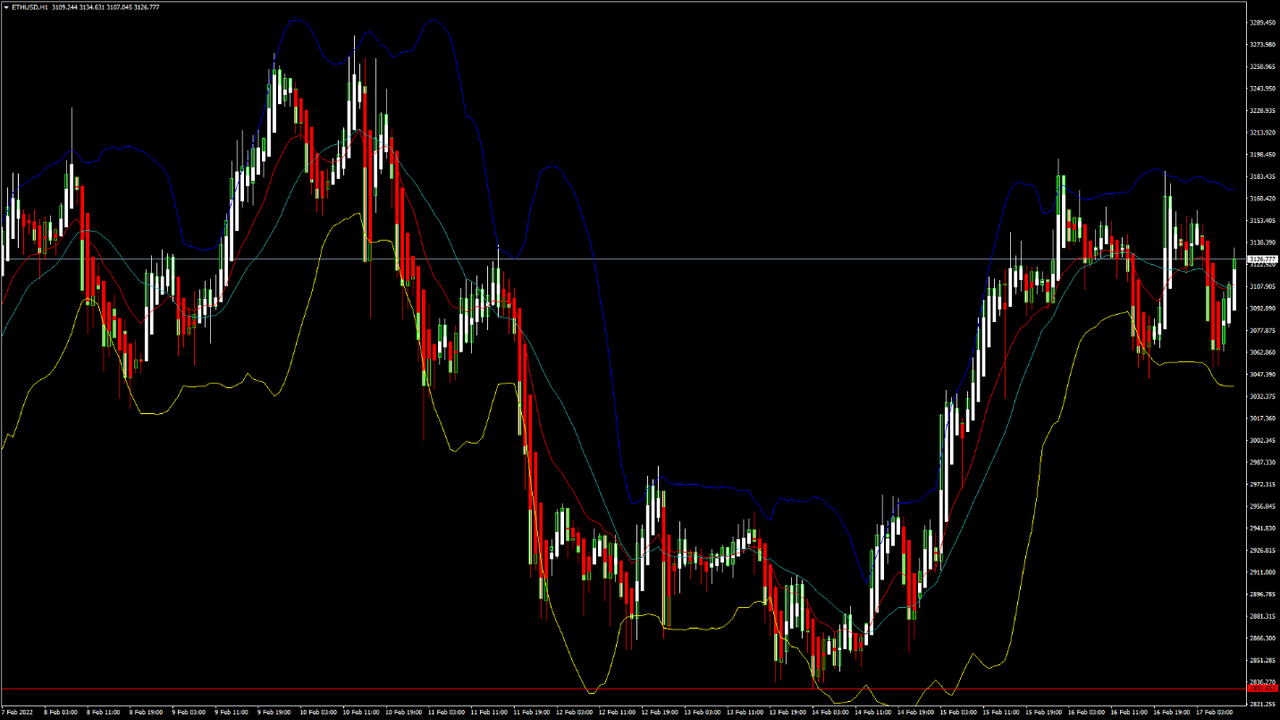

Ether Consolidation Channel Seen Above $3,000

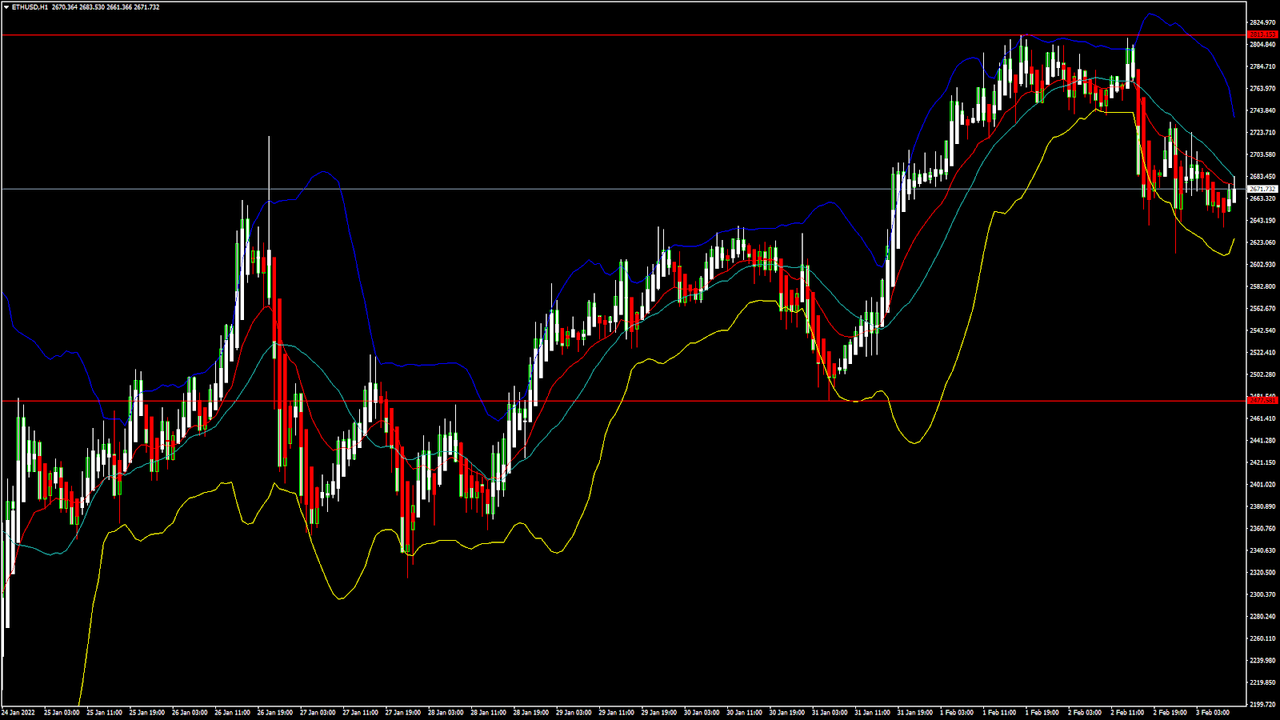

ETHUSD continues to move into a consolidation channel above the $3l000 handle in the European trading session today.

Most of investors are not entering the markets and are waiting for a bullish momentum.

The commodity channel index is indicating a NEUTRAL market, and the overall sentiment is also neutral at these levels.

We are also due for a major upwards correction in the ETHUSD which could manifest in the form of a rally taking its prices close to the $4,000 handle.

We can see a mildly bullish channel in progression today which is expected to push the prices of ETHUSD towards the $3,300 level.

ETH has gained 1.47% with a price change of 45.44$ in the past 24hrs, and has a trading volume of 11.474 billion USD.

We can see a decrease of 16.90% in the total trading volume in the last 24 hrs., which appears to be normal.

The Week Ahead

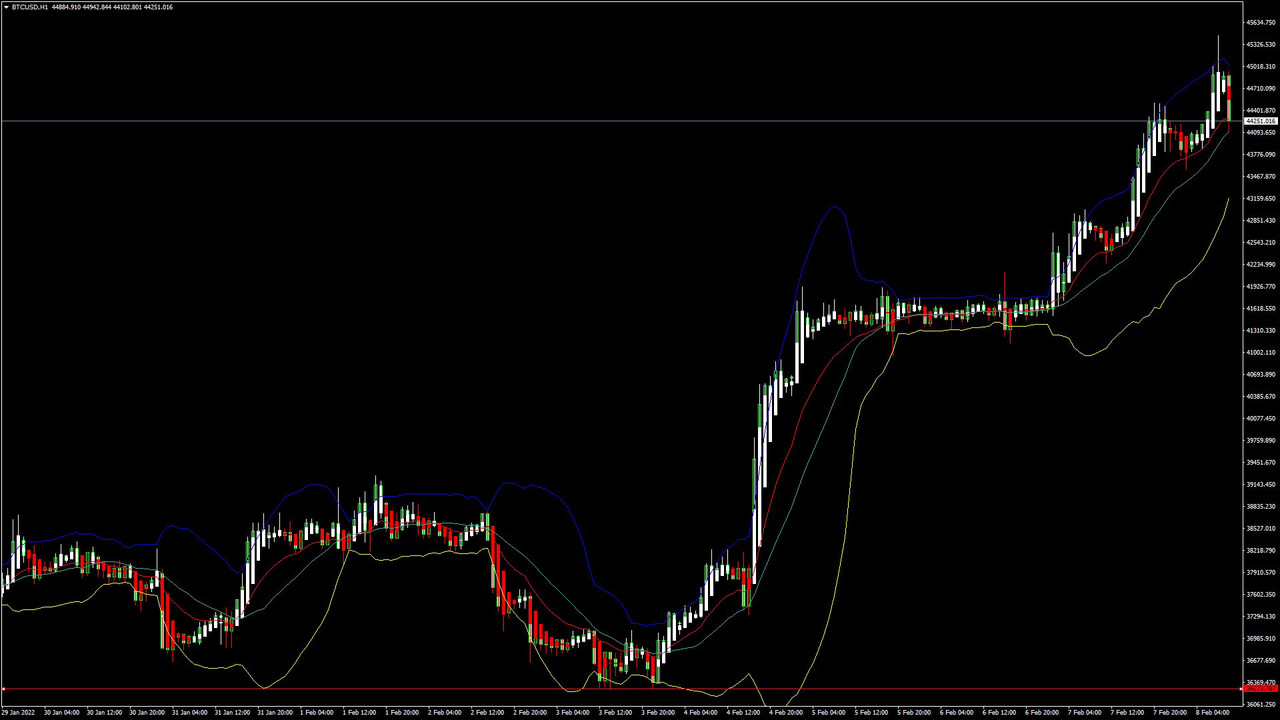

Ethereum is now approaching its important support level of $3,000 which will decide whether we will see a bullish reversal in the markets.

If the price of ETHUSD continues to remain above the $3,000 handle, as we can see today, it will signify a bullish reversal with an upside target of $3,300 to $3,500 in the next week.

The immediate short-term outlook for Ether has turned NEUTRAL, the medium-term outlook is MILDLY BULLISH, and the long-term outlook for Ether is BULLISH with a RALLY formation towards $4,000.

MACD has indicated a bullish crossover which is also giving a BUY signal at the current market levels.

This week, we can expect to see $3,300 to $3,400, and in the next week Ether is expected to trade at levels above $3,500.

Technical Indicators:

Williams percent range: at -37.39 indicating a BUY

Stoch (9,6): at 71.39 indicating a BUY

Moving averages convergence divergence (12,26): at 1.75 indicating a BUY

StochRSI (14): at 58.95 indicating a BUY