Re: Technical Analysis by FXOpen

BTCUSD and XRPUSD Technical Analysis – 30th NOV, 2021

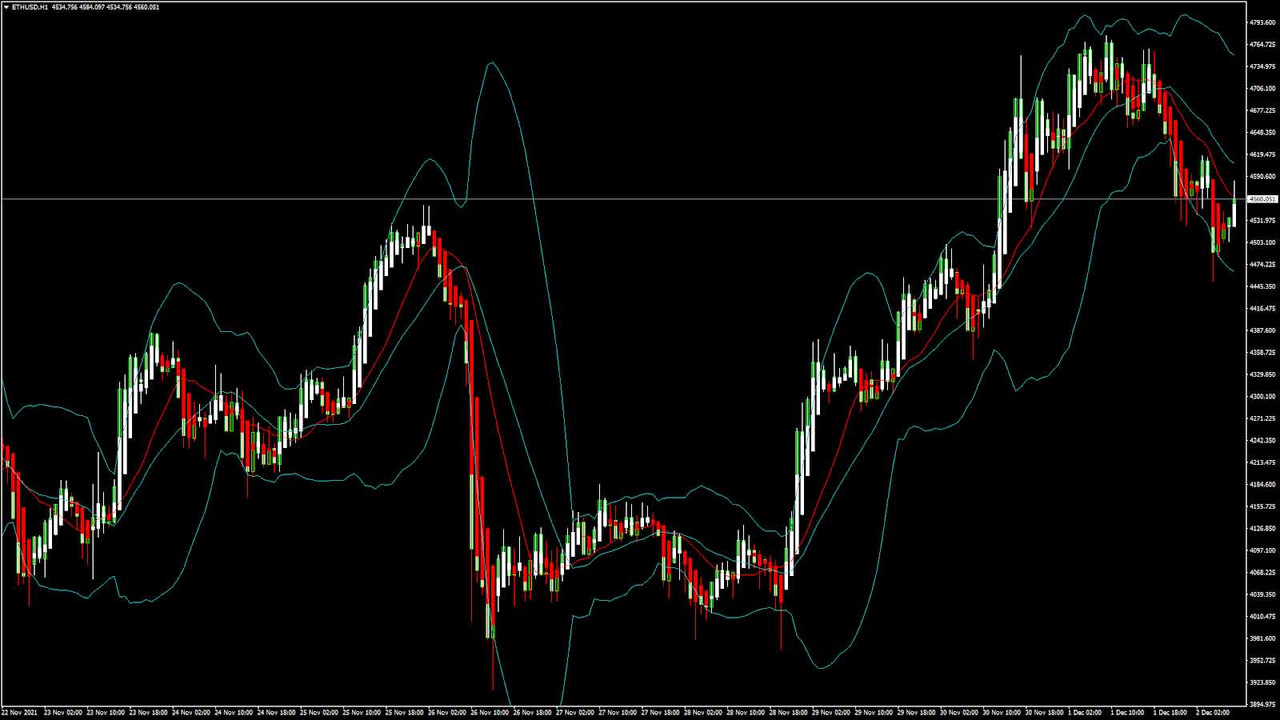

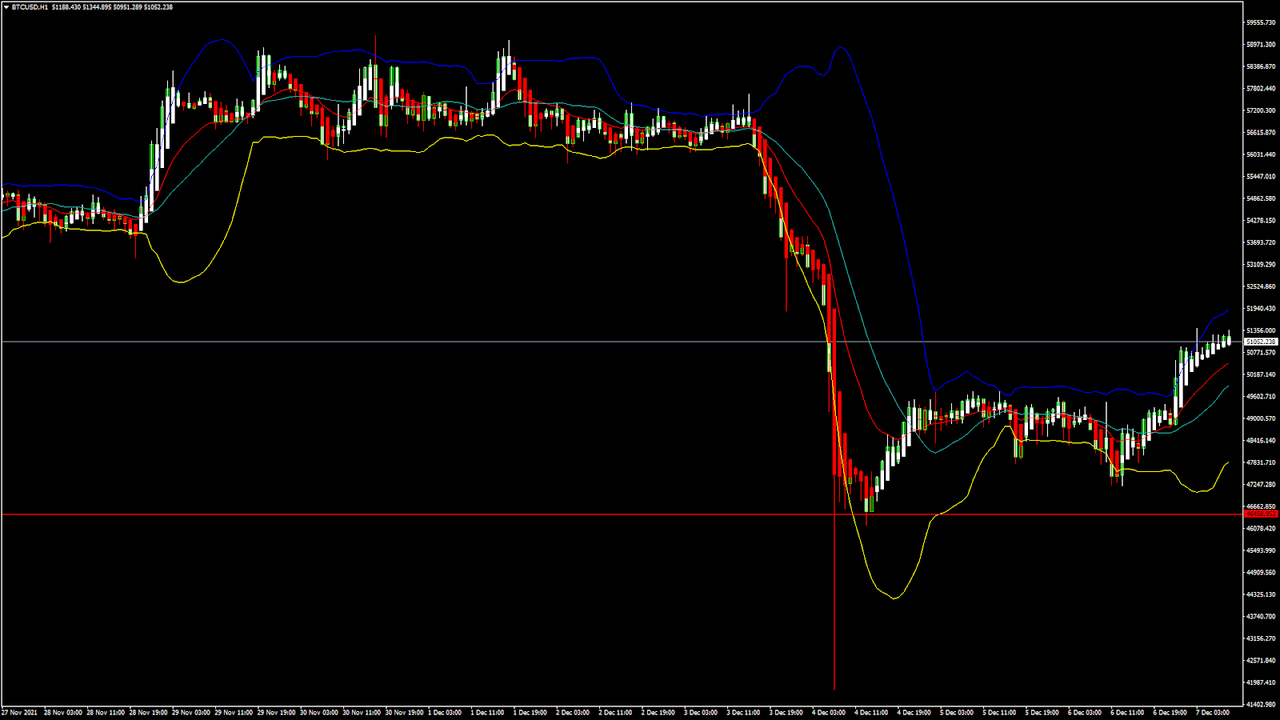

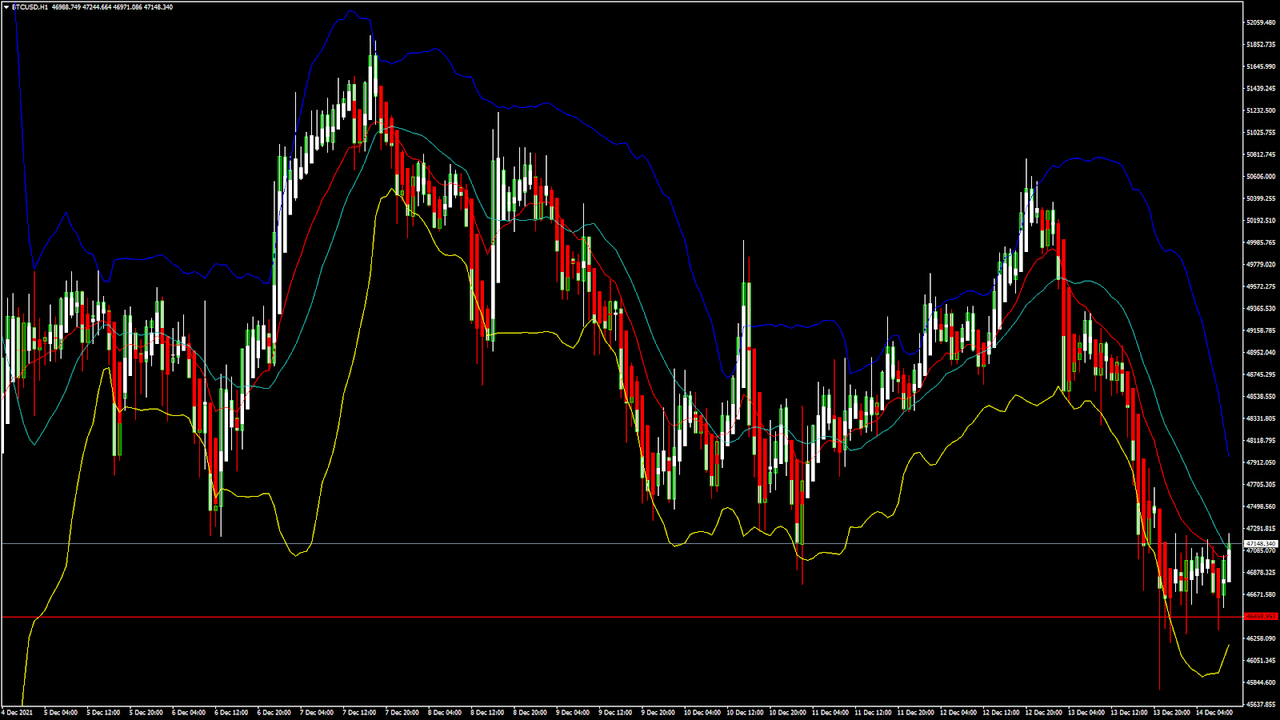

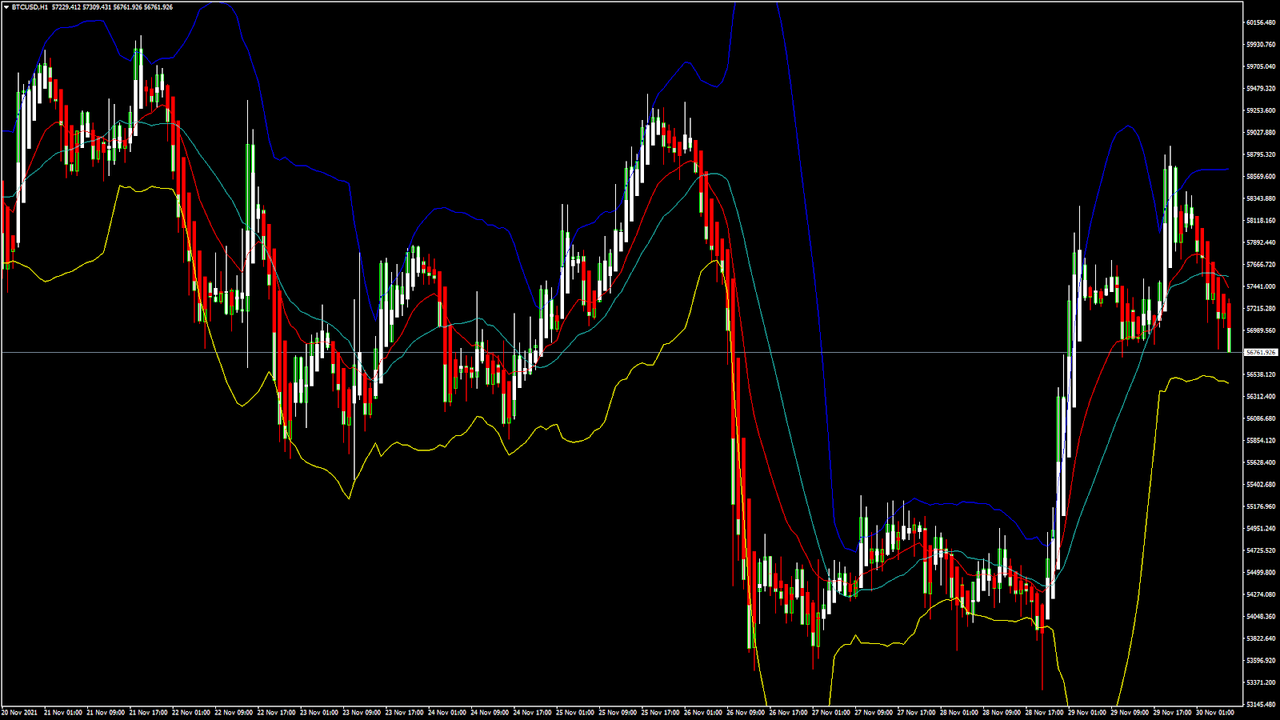

BTCUSD: Double Bottom Pattern Above $53,000

Bitcoin suffered heavy losses at the end of last week when it touched a low of $53,700 and remained in the bearish trend.

At the start of this week, bitcoin had a major bullish correction after it recovered from its last-week losses and gained more than 6%, touching the $57,000 handle.

This week, bitcoin is moving in continuation of a mild bullish trend and giving mixed signals. At present, BTCUSD is trading above the $56,000 handle in the European trading session.

We can clearly see a double bottom pattern above the $53,000 handle, which is a bullish reversal pattern signifying the end of the downtrend and a shift towards an uptrend.

Yesterday, we saw BTCUSD touching an intraday high of $57,635 after which the prices started to decline and, today, touched an intraday low of $56,795.

The immediate short-term outlook for bitcoin has turned NEUTRAL and we will have to wait till the clear market signals are visible.

Williams percent range is overbought which signifies that more selling is expected today in the US trading session, pushing the prices of BTCUSD below the $56,000 handle.

Bitcoin is now moving above its 100 hourly simple and exponential moving averages.

The average true range is indicating less market volatility which means that markets are due to enter into a consolidation phase soon.

Bitcoin trend reversal is seen above $53,000

Stoch is indicating OVERBOUGHT levels

The price is now trading just below its pivot level of $57,213

All the moving averages are giving a NEUTRAL signal at current market level of $56,820

Bitcoin’s Mild Bullish Trend Towards $58,000

BTCUSD is now trading above its important support level of $56,500 and needs to remain above this level for the bullish trend to continue today.

Some of the major technical indicators are giving a STRONG SELL signal, which means that the prices can also get a downward correction before reaching the level of $60,000.

The price of BTCUSD is trading below its classic resistance level of $57,363 and Fibonacci resistance level of $57,478 in the European trading session.

In the last 24hrs BTCUSD has gone DOWN by -1.19% with a price change of -682$ and has a 24hr trading volume of USD 31.536 billion. We can see an increase of 7.64% in the trading volume as compared to yesterday.

The Week Ahead

We can see that bitcoin has recovered from its losses and is on its way towards the $58,000 handle this week.

The medium to long term outlook remains BULLISH for bitcoin with the target of $65,000. At present, the markets are giving a SELL signal so it would be better to wait before entering the long positions in bitcoin.

The relative strength index of 46 is indicating a NEUTRAL market and fresh buying is expected in the market at any time.

It is also possible for bitcoin to remain in a sub-consolidation phase below the $57,000 handle this week and start its bullish move next week.

Technical Indicators:

Stoch (9,6): at 97.13 indicating an OVERBOUGHT level

Average directional change (14-day): at 30.35 indicating a SELL

Rate of price change: at -0.288 indicating a SELL

Ultimate oscillator: at 39.55 indicating a SELL