Re: NPBFX - making money with us since 1996!

GBP/USD: GBP tries to resume growth 05.10.2020

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on GBP/USD for a better understanding of the current market situation and more efficient trading.

Current trend

GBP is showing flat dynamics of trading today, maintaining a weak "bullish" advantage, preserved from last week. GBP buying activity is noticeably weakening amid new statements by Boris Johnson, who reiterated that the UK will be able to do without a trade agreement with the EU after the Brexit transition period ends at the end of the year. However, the Prime Minister stressed that he would like a different outcome of the situation, but so far the parties are faced with insurmountable contradictions.

The US macroeconomic statistics released on Friday had an ambiguous impact on the market dynamics. In September, Non-Farm Payrolls showed growth only by 661K new jobs, while last month was marked by an increase of 1.489M. Experts expected the growth by 850K. At the same time, the Unemployment Rate in the USA in September has steadily decreased from 8.4% to 7.9% against the forecast of 8.2%.

Support and resistance

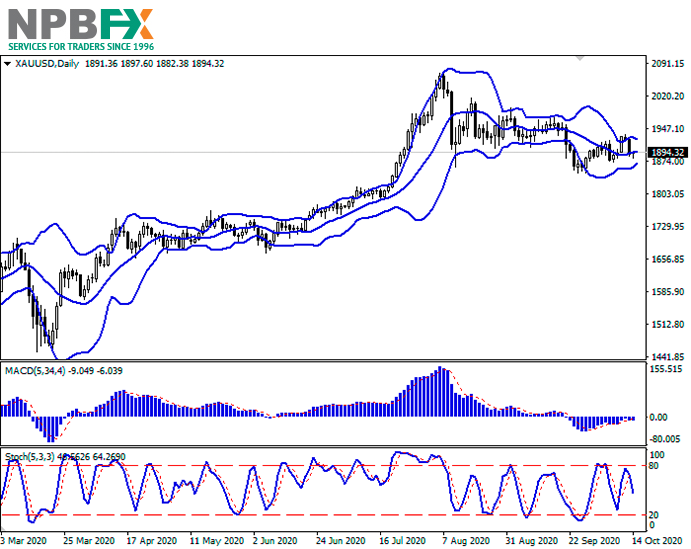

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is almost constant, remaining rather spacious for the current level of activity in the market. MACD indicator is growing preserving a weak buy signal (located above the signal line). Stochastic, having approached the level of "80", reversed into a downward plane, signaling the risks of a corrective decline in the ultra-short term.

To open new trading positions, it is necessary to wait for the signals from technical indicators to be clarified.

Resistance levels: 1.3000, 1.3100, 1.3200, 1.3300.

Support levels: 1.2900, 1.2850, 1.2800, 1.2761.

Trading tips

To open new short positions, one can rely on the breakdown of 1.2900. Take-profit – 1.2800–1.2761. Stop-loss – 1.2970. Implementation time: 2-3 days.

The breakout of 1.3000 may serve as a signal to new purchases with the target at 1.3100. Stop-loss – 1.2940.

Use more opportunities of the NPBFX analytical portal: glossary

Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on GBP/USD and trade efficiently with NPBFX.