Topic: Daily Fundamental ForexTime ( FXTM )

Daily Fundamental ForexTime ( FXTM )

US stocks: More bumps ahead?

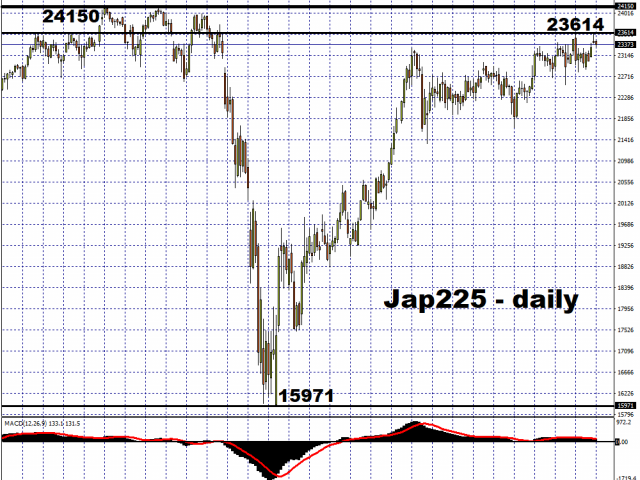

Asians stocks are putting in a mixed shift after Wall Street was unable to sustain its mid-week rebound. Investors are also mulling the prospects of another round of US fiscal stimulus arriving before the November elections, which have now grown slim, after Senate Democrats shot down the Republican’s downsized proposal. The MSCI All Country World Index (ACWI), which measures the performance of global equities, is set for two straight weeks of losses, with such an instance only last seen in March.

The heightened volatility in the markets of late is evidenced by the Volatility Index (VIX) rising above its 100- and 200-day moving averages, though the index has now moderated from its peak a week ago and now reads slightly below the psychologically-important 30 level.

Investors apparently remain trepidatious about preserving the same break-neck speeds in adding to stocks’ advances, considering the still-lofty valuations. Yet the desire to push US stocks even higher is still attempting to gain critical mass, with benchmark futures edging higher at the time of writing, while FXTM trader's overall sentiment is long on the US SPX 500 (Mini).

Watch out for witching day

Looking ahead, there could be even more volatility in store, with quadruple witching day for US markets set to happen in a week from now. On September 18, Futures and Options on Indices and Stocks are set to meet their quarterly expiration, which can trigger heightened volatility and a surge in trade volumes.

In the week before the June quadruple witching day, the S&P 500 tumbled by as much as 7.7 percent and the VIX breached above the 40 mark. Since the June 19th quadruple witching event, the VIX then moderated through end-August, even flirting with its long-term average of 20, while the S&P 500 added another 12 percent through the end of August.

Perhaps the volatility so far this month is just another bump in the road for US stocks, as investors pursue new record highs, emboldened by the tremendous support from global central banks.

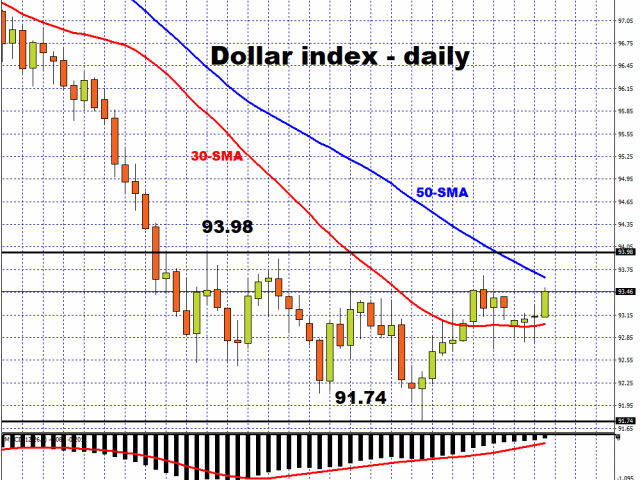

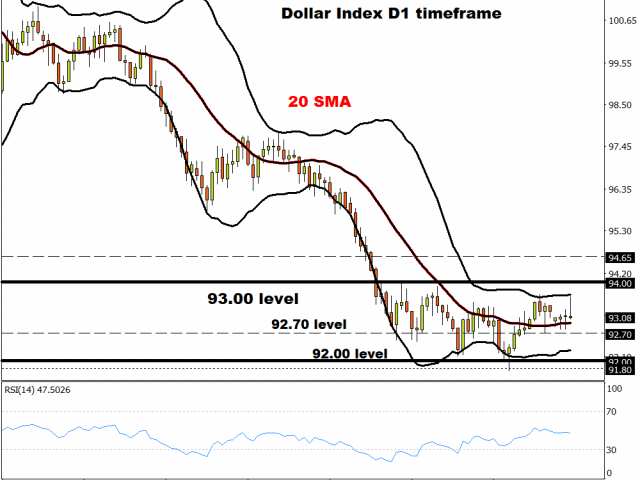

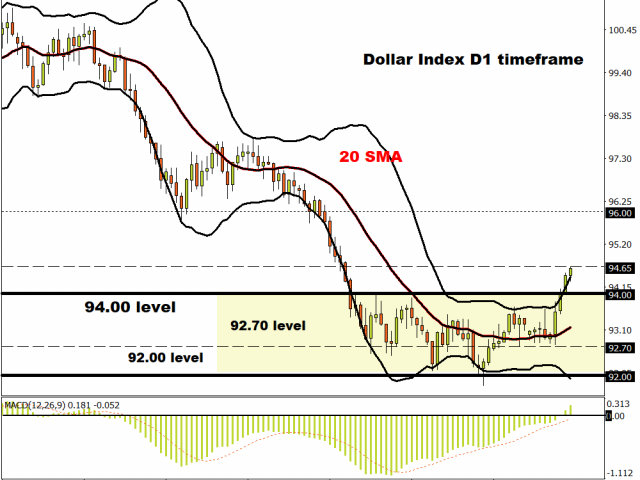

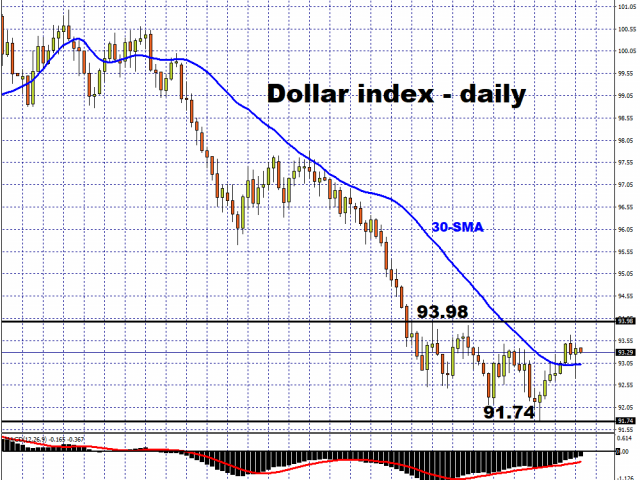

Beleaguered Pound helps Dollar index stay afloat

The Dollar index (DXY) has managed to clamber back on top of the 93.0 psychological level and keep its head above the 30-day simple moving average, as EURUSD’s break above 1.19 proved fleeting. Still, the Euro’s resilience remains a drag on the DXY, having set aside the notion of immediate central bank intervention in the bloc’s currency for the time being.

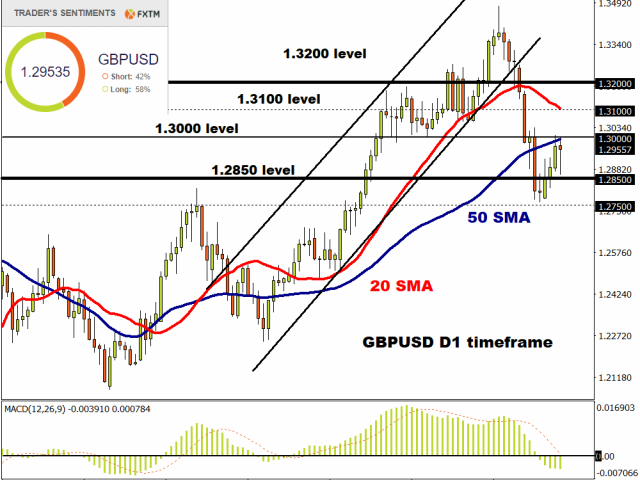

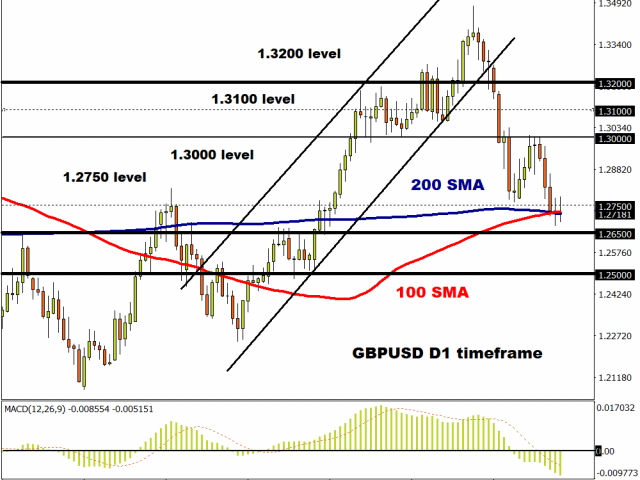

The DXY’s fortunes are also aided by the weaker Pound, which accounts for 11.9 percent of the DXY. With bigger cracks showing up in UK-EU talks, it raises the threat of a no-deal Brexit on December 31. Having concluded eight rounds of negotiations, with another round set to take place in Brussels next week, the Brexit drama could return with a vengeance and haunt the British Pound. The uncertainty is expected to keep GBPUSD in the sub-1.30 region over the coming weeks, barring a miraculous breakthrough in negotiations or a sudden bout of weakness in the US Dollar.

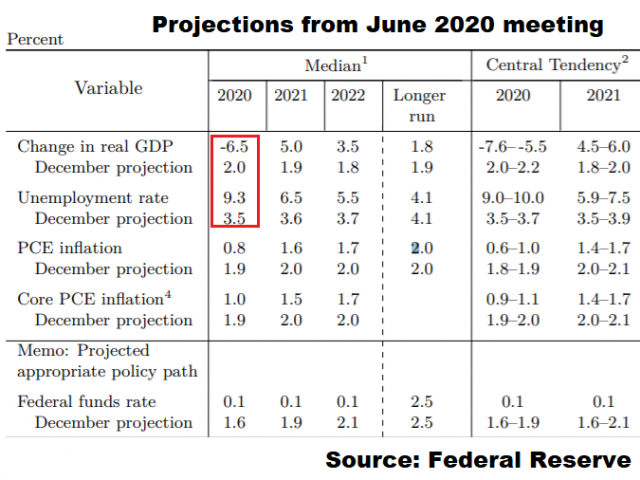

The US inflation outlook remains a key driver of the US Dollar, with the August CPI data in focus today. Although the spectre of faster US inflation, as tolerated by the Fed, threatens to erode the Dollar’s allure, markets remain sceptical over the source of such upward price pressures, especially considering the uneven recovery in the US jobs market as seen in Thursday’s disappointing weekly US jobless claims data. Without the promise of incoming fiscal support over the near-term, coupled with the rising political uncertainty surrounding the November elections, such concerns may in turn bolster support for the Greenback.

Still not trading with a leading broker? Register with FXTM