+14 800% profit! Interview about the way to the incredible success of the winner of the March Battle of Traders contest

If Forex had something similar to the Guinness World Records, then the winner of the March Battle of Traders contest would definitely take an outstanding place. Within just one month he was able to increase his deposit of $5000 to $741,129! This highest record of the contest was set by Mikhail Dmitrievich Sozykin from Perm. He got involved in trading six years ago. Constantly developing his professional skills, the trader has come to the conclusion that to be successful you need not only have a proven trading strategy, but above all have to trade consciously and without emotions. He does not use fundamental analysis, fully trusting the technical one. And Mikhail Dmitrievich can relax and unwind by pursuing his creative hobbies - playing guitar, designing and creating metalware.

What is the essence of his extraordinarily successful trading strategy, what is his “cool” attitude towards mobile trading, how does he assess the market prospects during the coronavirus pandemic and why does he recommend the Battle of Traders to his friends? We asked the winner these and some other interesting questions. Detailed answers are presented in the interview. We hope that you will find the information in the article useful and set your trading records already in April!

- Mikhail Dmitrievich, please tell us how you found out about the Battle of Traders contest and why you decided to take part in it.

- It was by chance. I registered in your company, wanted to participate in the contest. But somehow I didn't go to the site again. After a while, my manager called me and told me more about the contest. That call made me interested. In addition, I needed money for real trading. So I went to your site quickly, read the terms of the contest. Everything was interesting, everything was simple and clear: no restrictions on trading, nothing. And that's it, here we go!

- In March you participated in the contest for the first time and you finished in the first place straightaway! What were your first words and emotions when you found out about your victory in the Battle?

- It’s not my first victory in trading contests. The first victories caused a storm of emotions. In the Battle of Traders, when I found myself in the first place, I was calm. There were some inner emotions, of course, I was glad, but I didn`t show it up. I noticed when I rejoiced I got problems with trading. So now I try to be balanced: I try not to be happy and not to be upset.

- Who have you shared the news of the victory with so far?

- Yeah, my wife knows what I am doing, she's actively involved. I've written to a few friends on VKontakte (Russian social media).

- Mikhail Dmitrievich, how long did it take you to register for the Battle of Traders contest?

- It all happened very quickly. Immediately after the call of the manager I filled in all the necessary data for registration for the contest and sent them. Plus, I wrote to the support service to be able to open the first trade in the contest more quickly. It took literally 15-20 minutes to do everything and to get access to the contest account.

- How do you evaluate the terms of the contest in NPBFX?

- The conditions of the contest are very simple: there are no leverage restrictions, no restrictions on the opening volume. The conditions are simple and give you a good opportunity to get promoted and take first place quickly. But there's also an equally great opportunity to drain everything.

- How much time per day did you usually spend on trading in the contest?

- I haven't been spending on the charts all day. I've been monitoring the trades from time to time and then left. I tried to take my mind off the market in order not to do anything wrong.

I hold positions for a long time and don't close out right away. A trade can be opened for two days, three days, a week. Usually, I wait for the target. I know where the position could go and where I have to close out. It should be mentioned that after accumulating a certain amount I “added” myself to other positions as the market was moving. I looked where else I could “stock up on” in order to increase profit on the deposit.

- In March you showed the most incredible trading result in the entire history of our competition: the initial deposit of $5000 increased 148 times (up to $741,129)! According to the contest rules, NPBFX company awards you not only $1000, but also a super prize - the latest iPhone 11 Pro! Did you set yourself the goal to get the iPhone or was it a pleasant surprise?

- This is a pleasant surprise indeed! I didn't think I could increase my $5,000 to $250,000. When I felt that the market offered such an opportunity, and when I saw the guys who took first places (they had $400,000 there), I thought, why not. Then I started to force and to increase the volumes in order to earn more.

- Please tell us more about your trading strategy, which led you to success. What is the essence of it?

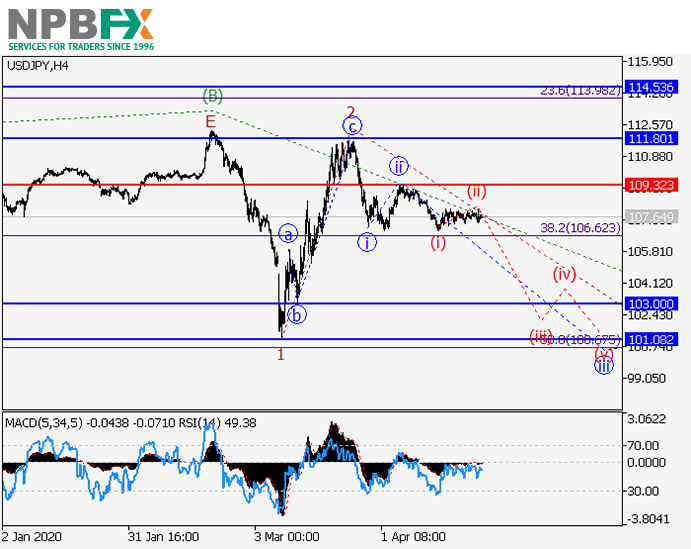

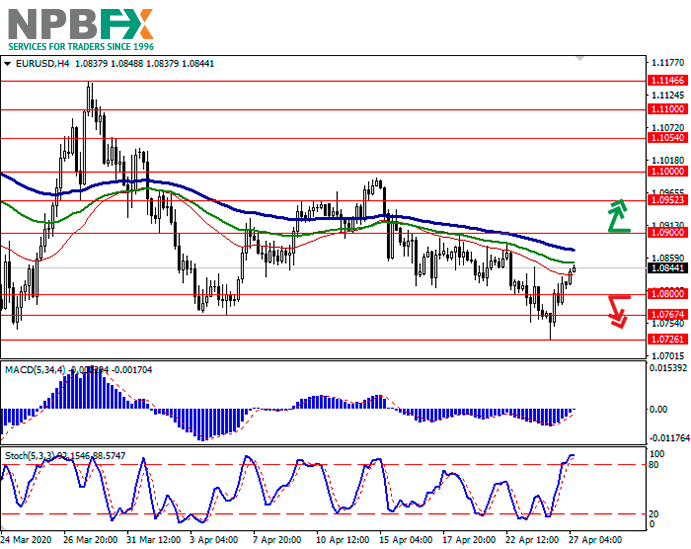

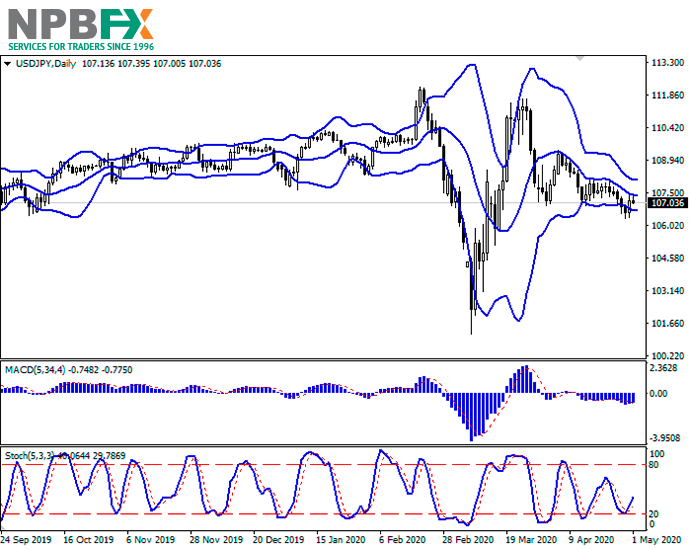

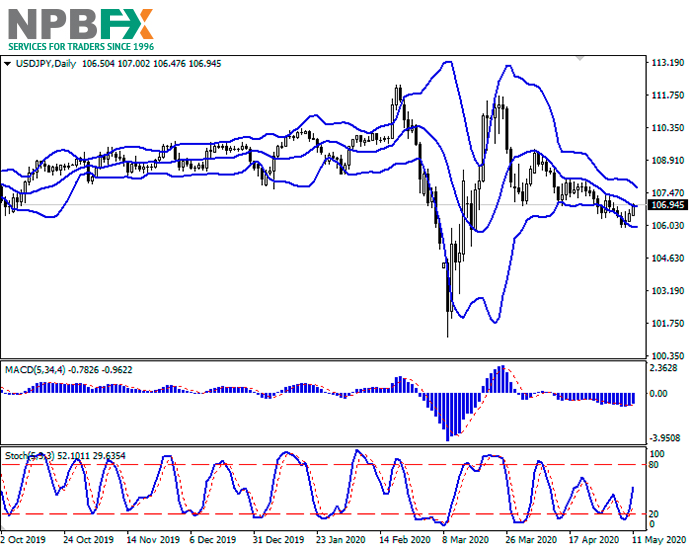

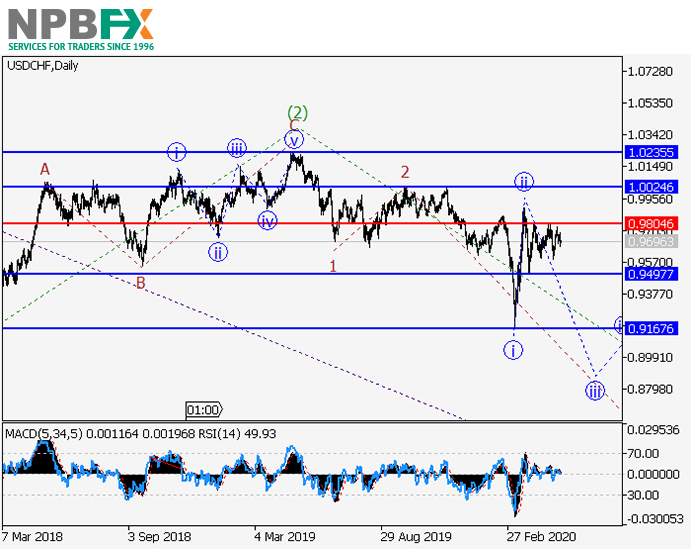

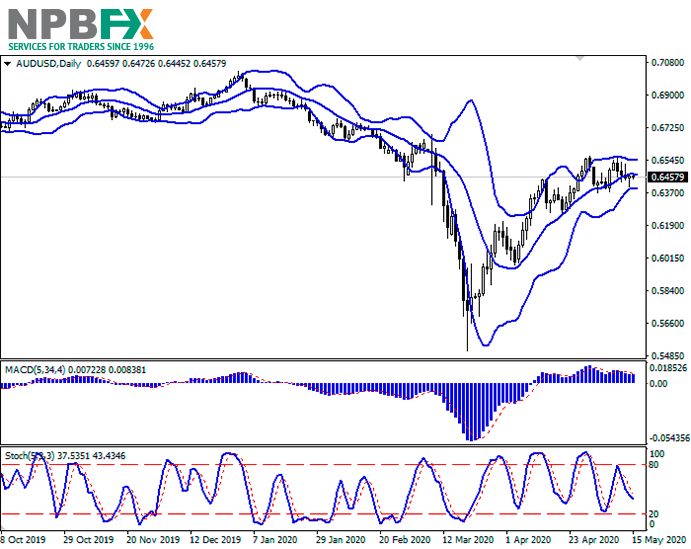

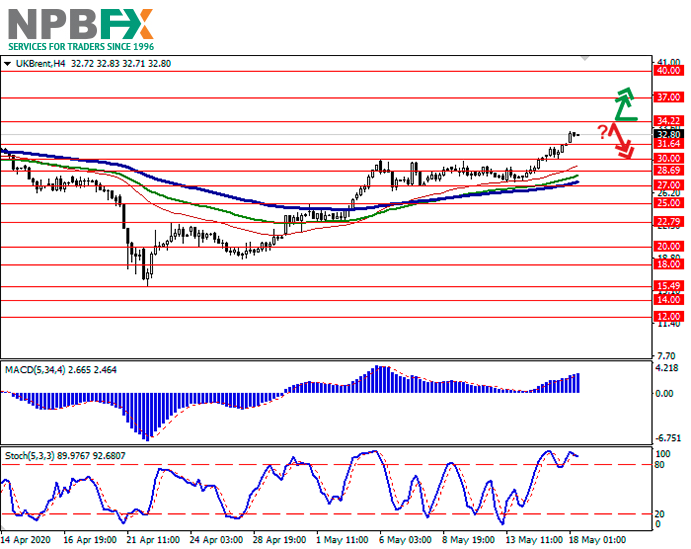

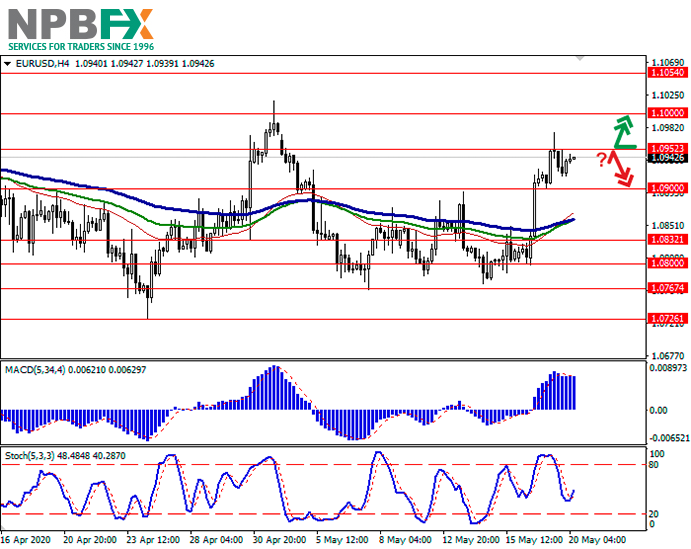

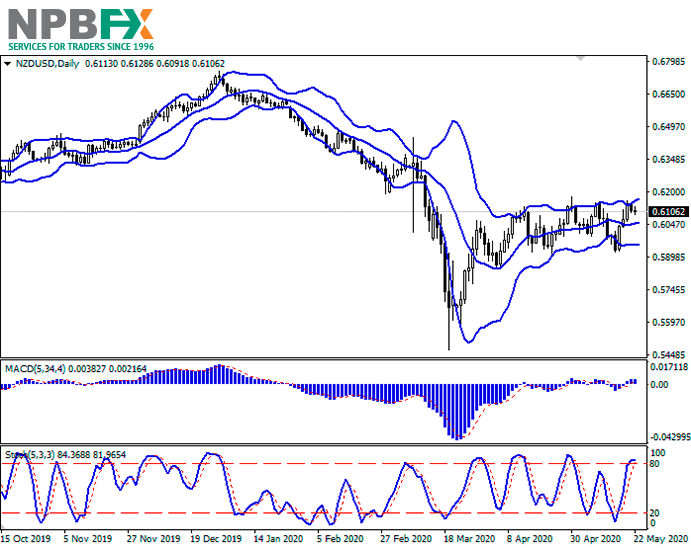

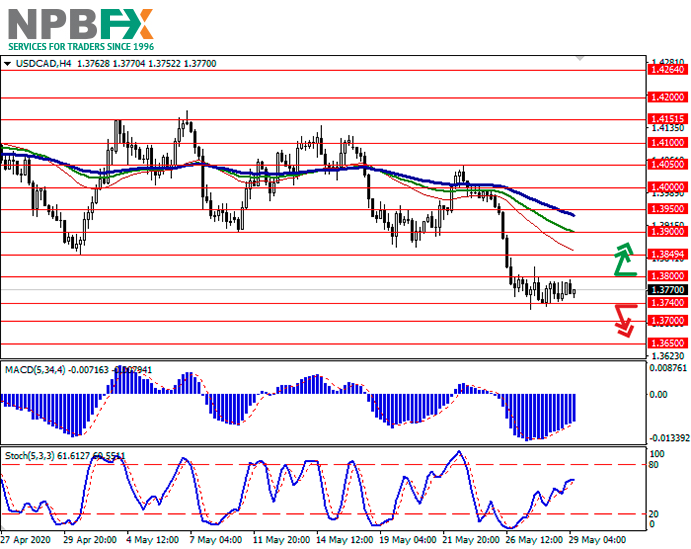

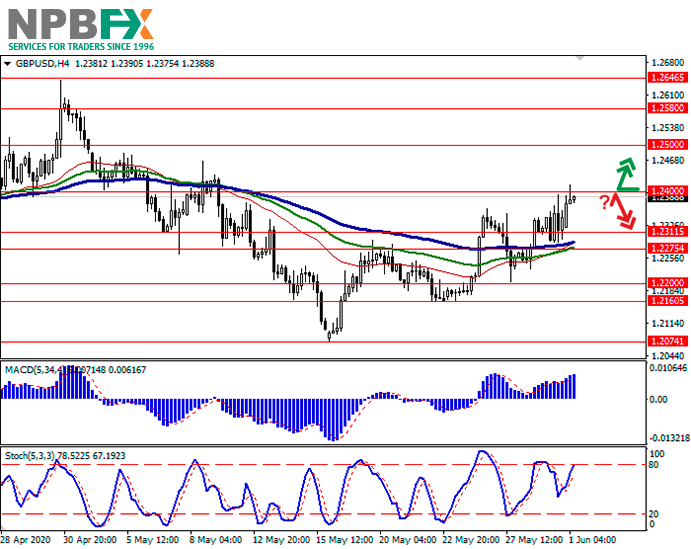

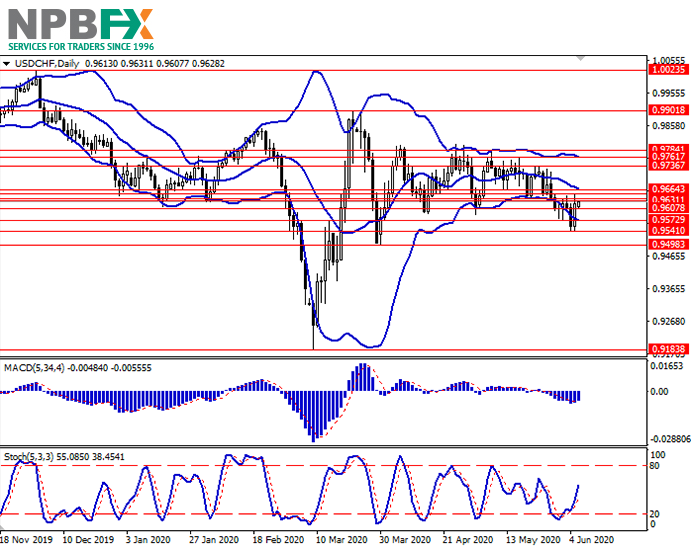

- Basically, the system is simple. Let's call it “mirror levels” of support-resistance. Many probably know what a mirror level is. It is when the price reaches the peak, then breaks it and declines. Sometimes it works out, sometimes it doesn't, so fifty-fifty. This time I was just lucky. Plus, I use the indicators for sure. Indicators are a map of a minefield; it's stupid not to use them. For example, I look at MACD as a secondary, more like a filter for my signals.

- During the contest you made 47 transactions. You have quite an interesting trading portfolio. The usual "majors" are rarely found in it. You used currency pairs that were not so popular on Forex. For example, franc-yen (CHFJPY), pound-Australian dollar (GBPAUD), Canadian dollar-franc (CADCHF) and others. Why did you give preference to these instruments?

- I was assessing the current situation. Where there was a high probability of making a profit as a rule I went in there. But the main ones were gold, dollar-yen and pound-yen. These are three trading instruments, which gave more profit. At first I thought that euro-yen and franc-yen would go, but they slowed down. I just closed them out to free up the capital. Then I saw a good situation on euro-dollar - I earned on it. Then Canadian dollar-franc also showed that it was going to rise - I earned on it. The deals on these pairs were with good profit.

- The trading volume on the trades of your account are also impressive: 20, 40 and even 100 lots on the last transaction in March. When opening a position, are you more focused on technical or fundamental analysis?

- Only technical. All you have to do is to look at the chart and it'll tell you everything. Fundamental analysis is not interesting, I hardly use it. I only look through the important news, at the interest rates, for example to be aware of them.

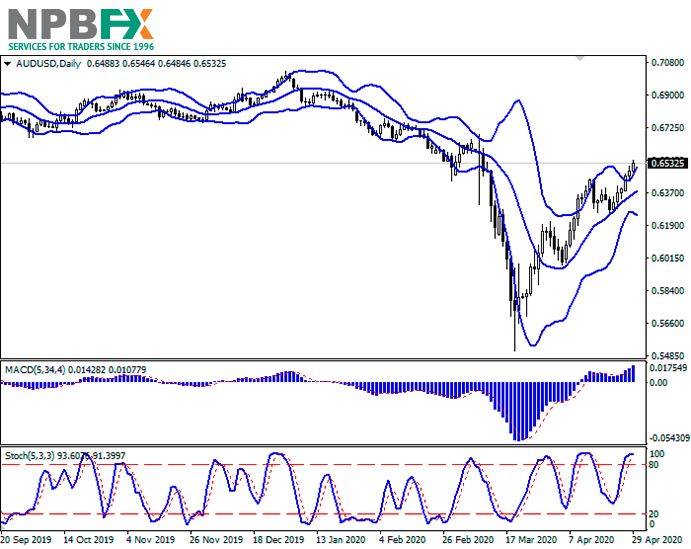

- How do you think the Forex market has changed in the last month or two during the coronavirus pandemic?

- Volatility has only increased. The rest of the movement was wave-like and remained so. The only thing is, the ranges of these waves expanded and that's it. Nothing really is changing except the volatility and direction of the movement.

- Perhaps you have some tips/recommendations for traders to trade in new conditions?

- In this case, in order not to be left without a deposit, you just need to reduce the trading volume, because the stops will increase with such volatility. I always trade from risk, and I watch how much I lose, how much I earn. As the stop increases, I will of course reduce the volume; otherwise you can quickly lose the deposit.

- Do you use your smartphone to trade on Forex or do you prefer only the desktop version?

- All I do on my phone is tracking the movement. And I do all the logging and analysis from my computer only. The phone isn't suitable for trading at all. It's silly to trade from a phone without seeing the whole picture of the chart. Only a computer. Only a wide screen, where you can see the whole chart.

- How often did you apply to the monitoring of all participants accounts during the contest? How useful was the monitoring to you?

- Yeah, sure, I always opened the accounts' monitoring. Especially when I was in the top ten, I started to study trading of other contestants, watching who was in first place and how he was trading. Monitoring is an advantage for every contestant if you want to win. I see what bar was set, I know where to go. It's “an extra crutch for a lame man”. Without monitoring it's a blind game, it's a lottery, but here everything is clear. I knew how much I needed, how much volume to beat, how much to enlarge, how much to accelerate to get away from others. It's what is needed, there's no way without it.

- 1000$ has already been credited to your real NPBFX trading account. Are you planning to trade the same way as you did on the demo account in the contest?

- Most likely not, because these are two different versions of the game, for lack of a better term. Even if trading with virtual money, it's still psychologically very hard and tense, high risks, large volumes. Secondly, I would like to make a little money with this thousand. If I trade aggressively, then I'll probably fail quickly.

- Mikhail Dmitrievich, tell us a little about your trading experiences: how long have you been trading at Forex? Why did you decide to trade?

- The conscious path to Forex began somewhere in 2014, when I realized that I had to pay money and learn how to do it. I'd learned about Forex before that. I knew you could make money here. My inner voice told me that I could succeed here. For 6 years I have been developing and improving in this business. Gradually I started to get results, but I haven't got a stable plus yet. I'm on my way to it.

- What do you consider to be your biggest achievement at Forex today?

- The main achievement is a conscious attitude towards the market. Trading not on emotions, but sobriety of mind while managing the account. When participating in the contest I faced it clearly.

- What is your job outside of trading, what kind of profession do you have?

- I have many professions, jack-of-all-trades. One of them is in education. I was a college lecturer. Welding, materials science, standardization - that's all mine. I taught for 7 years, but about a year ago I quit my job.

- Please tell us what country you're from, what city you live in? How old are you, if you are a family man, what are you into?

- Our country is Russia. I live in Perm. I am 34, married, three children.

I have a lot of hobbies. I play guitar in between times to relieve stress. I design, make metal structures to abstract my mind from the market. I do something for myself - I design, create. I'm a creative person; I make various products and structures from metal.

- Mikhail Dmitrievich, as can be seen from the monitoring, you have already become a contestant in the new April Battle of Traders contest. Would you advise your friends and acquaintances to join the Battle of the Trader contest? Why?

- Yes, I've already advised them. Now, many people have a problem with earning money. I told my friends about the contest, that there is an opportunity to earn initial capital for real trading by getting into the top ten. You can essay powers and take part in the contest without losing anything.

- What would you like to wish NPBFX and participants of the following Battle of Traders contests?

- First of all, the participants should approach it consciously and soberly in order to win. Among other things, you have to believe in success, that you can do it. Otherwise it’s impossible. I wish all participants good luck as well. It plays a big role, too. As for the company, I wish NPBFX further development, growth, more clients and prosperity!

- Thank you for participating in the contest and for your answers to the interview questions. We wish you further victories and achievements in financial market! And let trading on NPBFX real account be as successful as on your contest one!