The Brand-New iPhone 11 Pro and $1000 Granted to the Trader from Indonesia! We Present the Interview with the Winner of the November Battle of Traders

Johana Dwi Ariyanto is a trader with 13 years of experience in Forex from Indonesia. This is how to briefly present the winner of the November Battle of Traders contest. However, his success story, where the quality of trading is more important than the number of trades, deserves a detailed discussion and can be an inspiring example for someone. So, from the first day of his participation in the contest Johana set himself an ambitious goal to become the winner and get the grand prize–iPhone 11 Pro. Working 4 hours a day at his laptop, he achieved his goal and headed the table of winners with an excellent trading result +5109% profit! The winner admitted that the world of trading is interesting for him a lot, he likes to earn money on Forex and not going to stop at what he has achieved. What trading instruments does Johana include in his portfolio, why does he prefer technical analysis and how does he help the school committee? Look for the answers in the interview.

- Johana, first of all, on behalf of our company NPBFX I would like to congratulate you on a brilliant victory! What feelings and emotions do you feel about it? Tell me, please.

- I was very happy when I discovered that I had won. I immediately tried to contact NPBFX support to find out if I really won. I was even more pleased with the fact that the contest was held internationally and I beat the traders from all over the world.

- Have you already shared this news with anyone?

- At the moment when I found out that I had won the contest, I was participating in Forex trading training. So I immediately shared the joyful news with my classmates. Moreover, they initially knew about my participation and watched my progress.

- This was the first time you participated in the Battle of Traders contest. Was the victory a surprise for you or did you purposefully go to the 1st place?

- Yes, I did this with a goal in mind and was motivated to get a grand prize. When there is an extra prize, it is always a plus and greater motivation.

- Could you please tell us how you learned about the Battle of Traders contest and why did you decide to take part in it?

- I found out about the contest from Facebook, as well as from the email newsletter. I immediately began to learn the rules and decided to take part. I wanted to present a new strategy to my classmates, to show them that I was able to achieve the goal, to motivate them.

- Johana, how long did it take you to sign up for the Battle of Traders contest? How do you evaluate the terms of the contest in general?

- The sign up for the contest is very simple and the process is quite fast. The terms of the contest are also very easy and clear. Big deal is to get an extra prize.

- At the end of the contest month you have shown excellent trading results: You have increased the initial deposit of $5000 by 51 times (up to $255 476)! Could you tell us, please, what is the essence of your trading strategy?

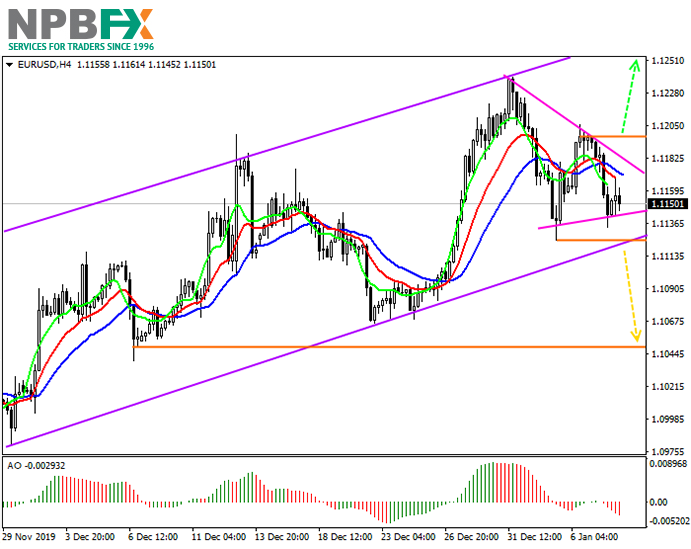

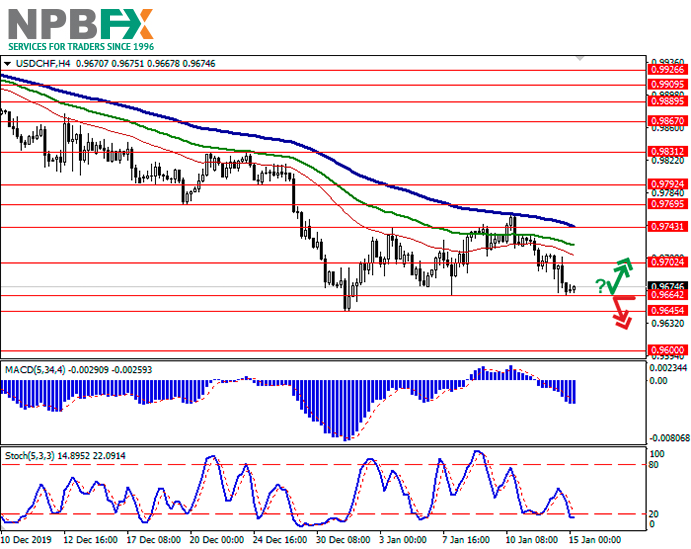

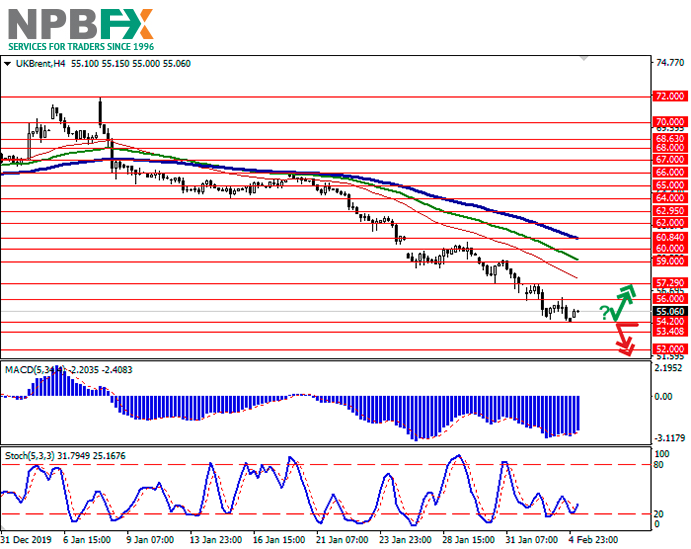

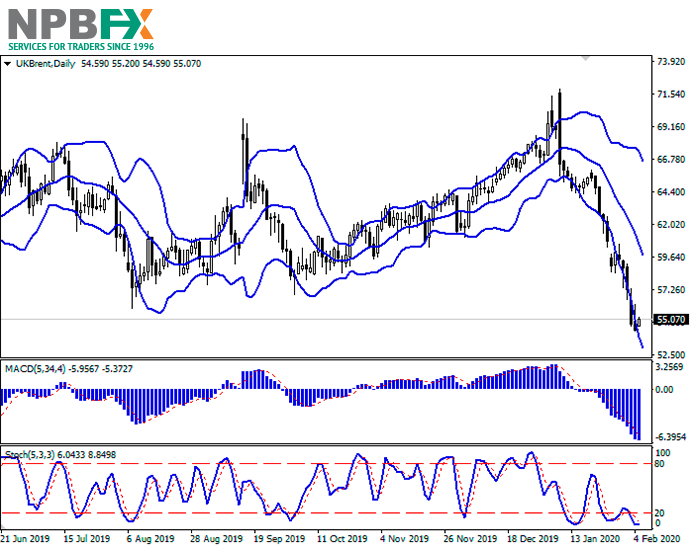

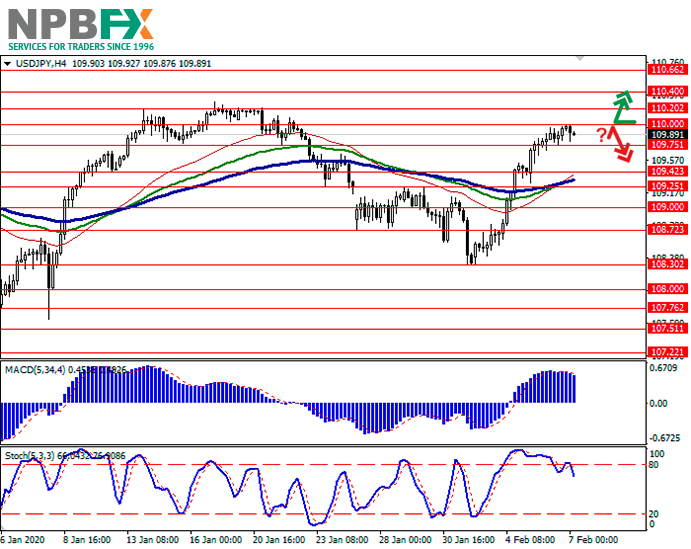

- I use supply and demand analysis strategy and look at the trend line. Then I look at the price movements using the time frame for analysis when determining the next trade.

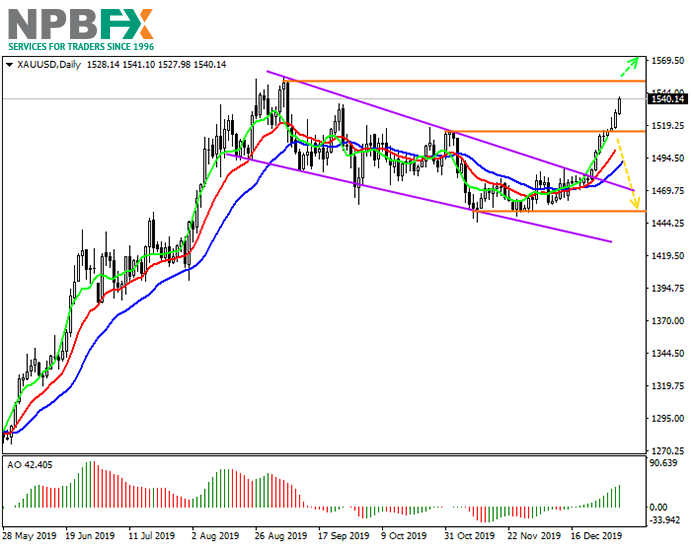

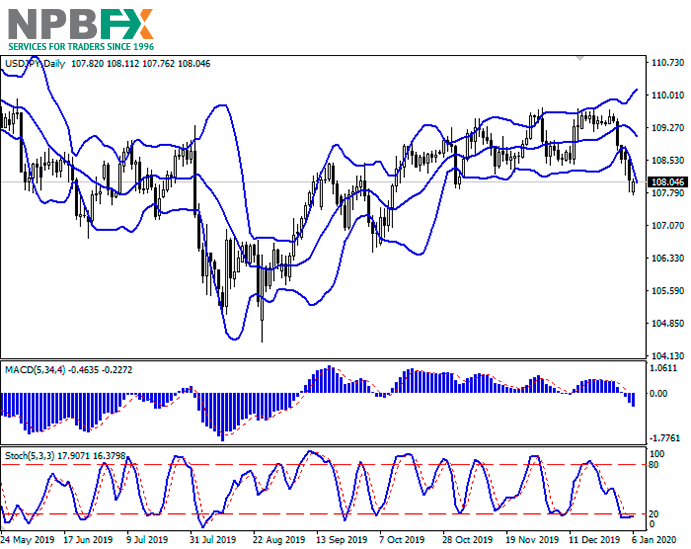

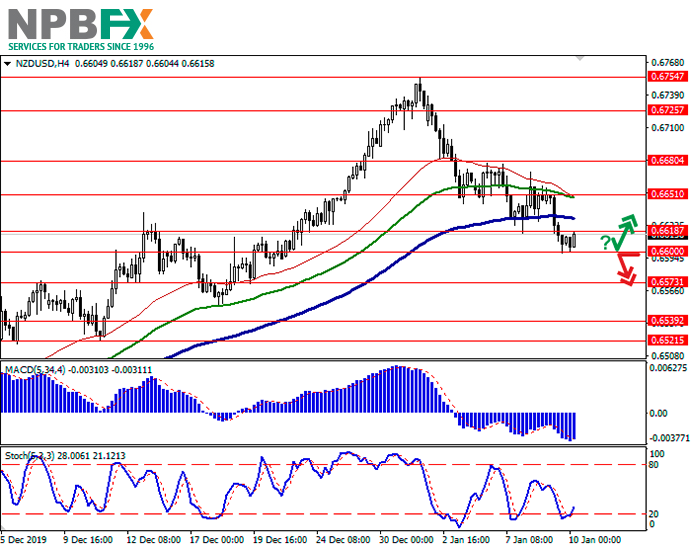

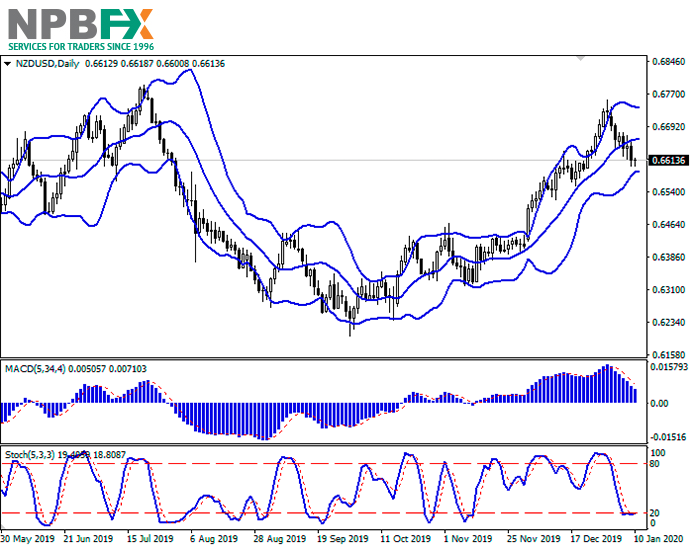

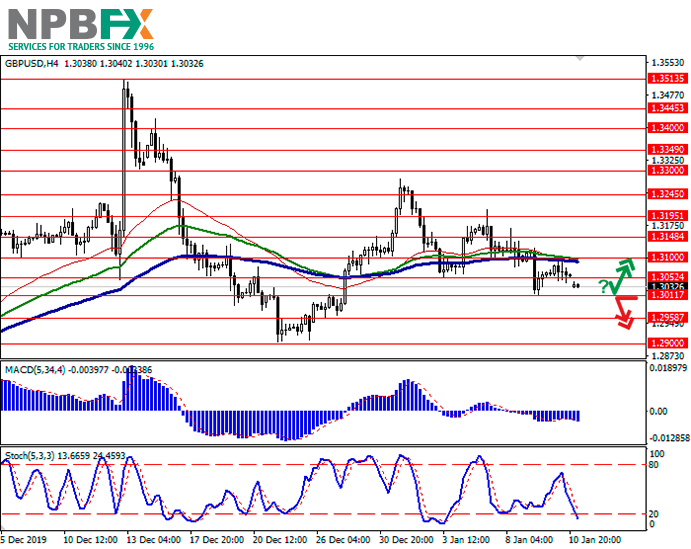

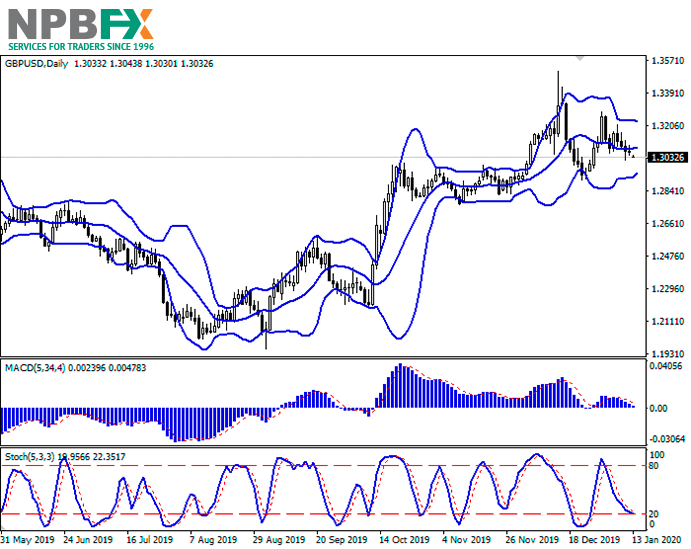

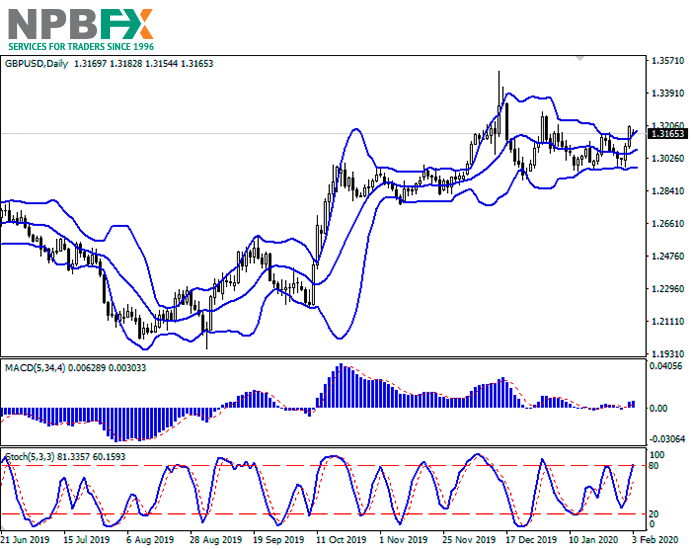

- According to your contest account statement, it is seen that you have closed 144 deals using a fairly wide trading portfolio: gold, currency pairs by pound, yen, New Zealand dollar and other currencies. Tell me, based on what principle did you form your trading portfolio?

- I prefer currency pairs and gold, because the average daily movement is quite large, especially in currency pairs with the pound sterling, and many people win on these currency pairs.

- Do you use your smartphone to trade on Forex or do you prefer the desktop version?

- In the contest I traded using my laptop, because it is easier to set an indicator.

- Johana, did you trade with an Expert Adviser/Robot or manually managed each trade? How much time per day did you usually have to spend on the contest?

- I trade manually and do not use Expert Advisors. On average, I traded 4 hours a day, sometimes in the morning or in the night, analyzing, looking at market movements.

- Do you more cater to technical or fundamental analysis when forecasting the market?

- I prefer to focus on technical analysis, because I do not trust the news that comes out.

- $1,000 has already been credited to your real NPBFX trading account. Are you planning to trade in the same way as you did on a demo account?

- It is quite possible that I will still use the same strategy, because it did not require too much time to trade.

- Johana, tell us a little about your professional path: how long have you been trading on Forex?

- I have been aware of trading since 2006 and I love making money online, in the Forex market. The world of Forex trading is quite interesting for me. It is a work with its pros and cons.

- Have you studied trading on your own or attended courses, webinars?

- I learned about the Forex market from the Internet and joined social media trading groups. I almost immediately tried to trade on real accounts by trying indicators from the group in social networks. The results were not so high. So further on I tried to work on it myself and finally developed my own strategy. At the moment Forex is my constant source of income.

- Tell me, please, what is the name of the city (village) where you live? How old are you, are you a family man, what are your hobbies besides Forex?

- I live in the village of Bolon, Central Java. I have 4 children, I’m 37 years old. In my spare time, I help my wife at home and work at the school board, I participate in improving the school’s management system. Sometimes I take project work from friends, contractors.

- Johana, in your opinion, how common is Forex trading in Indonesia?

- In my opinion, the enthusiasm and desire of Indonesians to trade on Forex market is very high. For example, I have a lot of neighbors interested in what I am doing sitting in front of my house working on my laptop.

- Would you recommend your friends to join the Battle of Traders contest? Why?

- Yes, I will start inviting my friends who took part in my training. I will monitor their progress, teach them to focus on quality, not quantity. Even on a demo account it is important to learn how to do routine work, continuously following the rules, and only then it starts to work.

- What would you like to wish NPBFX and participants of the next Battle of Traders contests?

- I would like to wish the participants of the next rounds to devote as much time as possible to improve their knowledge and analysis of the market. Do not underestimate these points even on a demo account. For NPBFX I want to wish further success, as well as to change the time of market opening, now it differs from other brokers.

- Johana, we thank you for participating in the contest and for the interview. Let trading on NPBFX real account be as successful as on your contest account!