He manually opened 705 deals via MT4 mobile terminal and won the contest! Introducing the interview about the incredible success story of a trader from Indonesia

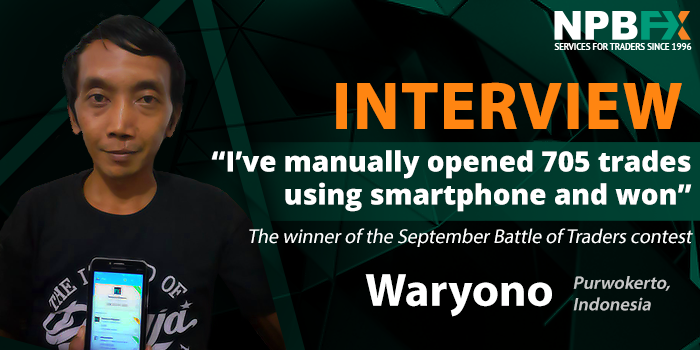

Having a desired goal and control over risks and emotions are often crucial to succeed at Forex. The success story of the today’s winner could be the scenario for a new motivational film about trading. Waryono – the winner of the September Battle of Traders contest – would definitely get the leading role. His name consists of one word, there is no surname or patronymic, which is quite unusual for Europeans. However, in Indonesia, it’s common. Waryono is 36 years old, married and has two children. Every day he sells children toys on the streets of his hometown - Purwokerto. In 2017, he decided to become a trader and, looking back, calls himself a self-taught, as all the wisdom of trade he learned by himself. For 2 years Waryono has been honing his skills on demo accounts. When signing up for the Battle, he set a clear goal to win and get the prize of $1000 and start trading on a real account. What a surprise it is to find out that the winner does not have a personal computer or a laptop. He made all transactions (705 to be exact!) manually, using the mobile terminal MT4 provided by NPBFX for Android! We congratulate the winner and invite you to get to know him better. Read about the secret of the winner’s trading strategy, where stop-loss matters, and very much more in the interview below.

- Waryono, could you tell us how you learned about the Battle of Traders contest and why did you decide to take part in it?

- I learned about NPBFX from my friends who had registered with NPBFX before and participated in the Battle of Traders as they were not ready to trade on real accounts.

- What was your initial goal? Did you expect to take the 1st place?

- Yes I did, I set myself the goal to win as I wanted to try to trade on a live account using the prize money.

- What were your first words and emotions when you learned that you had won the Battle? Did you share this news with someone?

- I was very excited and grateful. The persons I usually share the joyful news with and to whom I told about the victory were my wife and friends.

- Waryono, you have gone through all the stages of the contest: from registration to the victory and getting the prize - $1000. What can you say about the organization of the contest, its terms and conditions, monitoring?

- In my opinion, registration, terms and conditions of the contest are quite simple. Everything is organized well.

- In September, you achieved an excellent trading result by increasing your initial deposit of $5000 by 41 times (up to $208,322) in just one month! What trading strategy did you use? What is its essence?

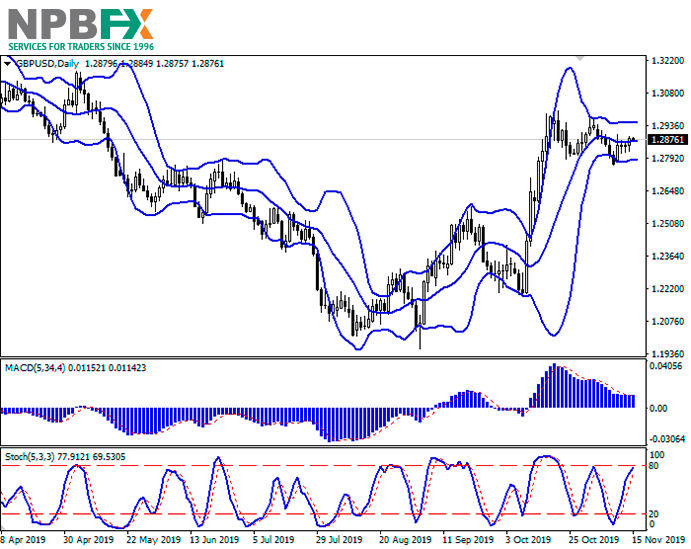

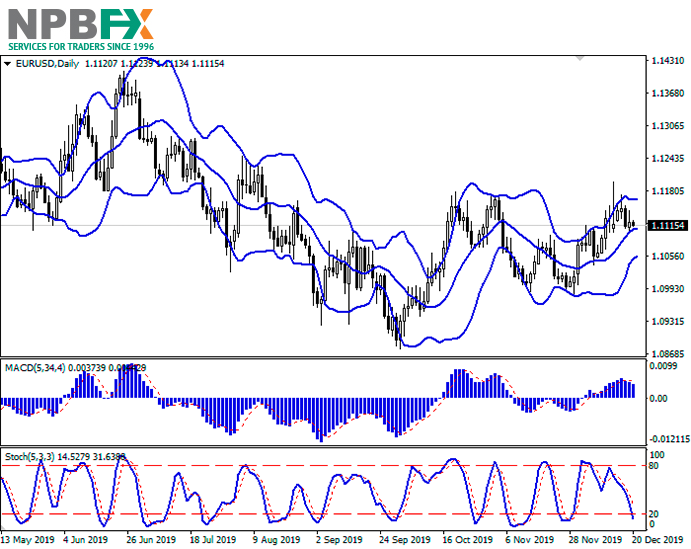

- Chiefly, I use scalping and stop-loss when it’s profitable to avoid the risk in case of a potential loss in the reverse course of the market.

- The total number of trades in your account is 705. Did you use an automated Expert Advisor or did you trade manually?

- I always open all trades manually. I never use any advisors or robots.

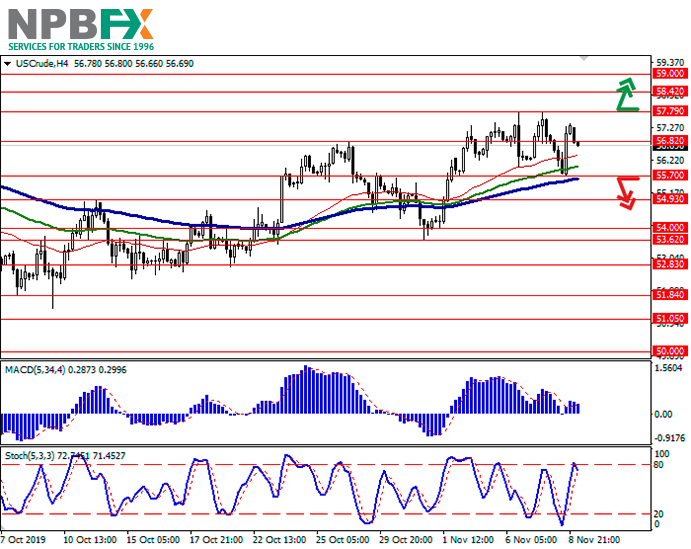

- Your trading portfolio mainly consisted of currency pairs of a major group. At the same time, a significant part of transactions in your account was in gold. Why did you choose gold for trading in NPBFX?

- Analyzing the market, I can see that the price of gold is really high, and when the price rises, I sell, and when the price of gold falls, I buy.

- Have you ever traded in cryptocurrencies (Bitcoin, etherium, etc.)?

- No, I have never traded in cryptocurrency.

- Do you have MetaTrader 4 mobile terminal installed on your smartphone or do you prefer only a desktop version for competitive trading?

- I use only the mobile terminal for Android, because I do not have a PC or a laptop.

- Waryono, did you use online monitoring during the contest? How useful was the monitoring for you?

- Sure, it was quite useful, as I was able to get to know the places of other participants, especially those below me.

- How much time per day did you usually spend on the contest?

- I can’t say for sure because I mostly trade at night.

- What traits of your character helped you to achieve success and become the winner?

- Ability to follow the timing, emotions control, risk management. When the situation is favorable for me, I always use stop-loss to avoid losses. This skill has helped me out many times.

- If one of the beginners or experienced traders wants to repeat your trading strategy on your account, what advice will you give?

- My advice to colleagues who want to try to follow my strategy is to always use stop-loss when a situation is favorable to avoid possible losses.

- 1000$ has already been credited to your NPBFX live account. Are you planning to trade using the same strategy as you did on a demo account?

- Maybe I’ll try the same strategy, but probably I’ll use another one. It depends on the market.

- Waryono, we would like to know more about you as a trader: how long have you been trading at Forex? Why did you decide to trade?

- I started trading in the middle of 2017 and from that moment I have often participated in demo contests with other brokers.

- How has your professional path been developing? How did you learn how to trade (independently from books, courses, videos)?

- I am a self-taught and studied everything myself, analyzing time frames from M1, M15, H1, D1, W1.

- What is your crowning achievement at Forex today?

- The main results at Forex today include only the results of participation in demo contests.

- Tell us a little more about yourself: where are you from, what is the name of the city (village) you live in? How old are you, are you a family man, what are your hobbies? What is your profession?

- I live in Purwokerto, I am 36 years old, married and have two children. I sell children toys on the street every day.

- Waryono, how popular Forex is in Indonesia? Are the people of your country interested in earnings in the financial markets?

- There are quite a lot of people in Indonesia who know about and are interested in the Forex market, and I believe there will be even more opportunities in 2020.

- Would you recommend your friends to join the Battle of a Trader contest? Why?

- Definitely! This is a good contest which provides good opportunities.

- What would you wish NPBFX and the participants of the next Battle of Traders contests?

- My advice to the participants of the next contests is to use stop-loss and analyze the market before making a trade, because it is important for any strategy of each trader.

- Thank you for participating in the contest and for the interview!

Aspiration to the goal and adherence to the strategy have led Waryono to the 1st place in the contest. May the new stage of professional path in trading on a live account lead the winner to the conquest of new financial peaks together with NPBFX!