Topic: 4 Types of Data Patterns

In forex the raw data is ticks (essentially Bid and Ask prices) -- there are no such things as bars. Bars are an artificial construct the MT4 software creates so you can see more data on a monitor. Bars are also referred to as OHLC data (TimeStamp,Open, High, Low, Close). If you are trading H1, then H1 bars are a condensed representation of hundreds or thousands of ticks that occurred over the past hour.

Strategies are composed of indicators -- usually some variation of moving averages. Most indicators use Bar (OHLC) data and ignore the vast majority of tick data received by MT4. This is neither good or bad -- perhaps I'll write more about this in a different post.

In this post I thought I would share some observations about the different types of data patterns received by each chart and which our strategies have to respond to. This is not something I made up -- I think most experienced traders would agree. Manual (mechanical) traders pay more attention to the data because their brain has to make the decisions. People who use EAs tend to pay less attention to the data because they assume their EAs will do the right thing.

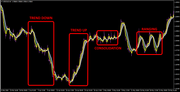

There are (at least) 4 types of price data patterns -- trend up, trend down, consolidating and ranging. Perhaps there are more -- but these 4 pretty much cover what our strategies have to deal with. Below is an image that shows an example of each (the image is from an H1 chart).

Keep in mind that strategies are very simple algebraic formulas. There is no way for a simple algebraic formula to analyze and make decisions about complex data. Turns out that most EAs exhibit much better performance when the data trends up or down, and perform poorly when the data pattern ranges or consolidates.

Here's an analogy. In the old days when people wanted to determine which way the wind was blowing they would lick their thumb, extend their arm and hold their thumb up in the air. If the wind was blowing strong in one direction (i.e. trend up or trend down), then this method worked fairly well and was accurate enough. However, in cases where there was no wind (i.e. consolidation), then it didn't work so well. Also, in cases where the wind kept changing directions (i.e. ranging), then, again, it wasn't very accurate.