Re: NPBFX - making money with us since 1996!

NZD/USD: New Zealand dollar declines 21.02.2018

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the NZD/USD for a better understanding of the current market situation and more efficient trading.

Current trend

NZD develops a downward trend against USD, updating local minima since February 13. Correctional sentiments put pressure on the instrument, as well as the widespread growth of the American currency against the background of rising US yields.

The focus of investors' attention today will be macroeconomic statistics from the US, the speech of a member of the Federal Open Market Committee Patrick Harker (16:00 GMT+2), as well as the publication of the minutes of the last meeting of the Fed.

Support and resistance

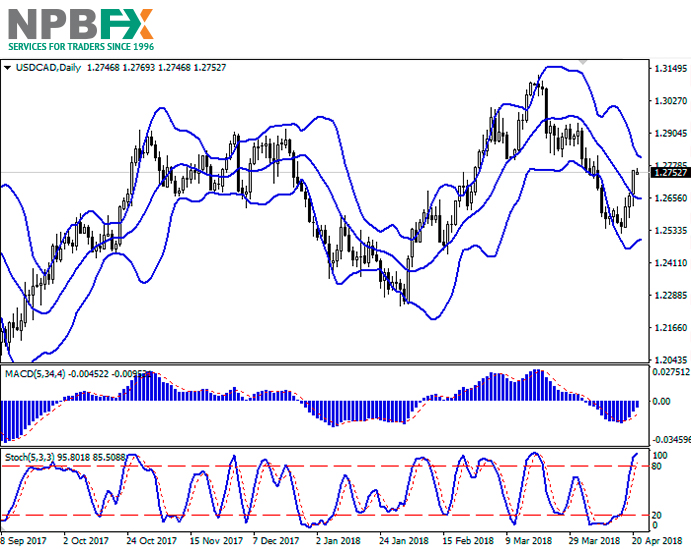

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range does not change, but still remains quite spacious, given the relatively low level of trading activity during the current week. The channel trading strategy should be followed as before.

MACD is going down preserving a moderate sell signal (histogram is located below the signal line). There is an opportunity to keep and open new short positions in the short and/or ultra-short term.

Stochastic also maintains a confident downward trend, being approximately in the center of its area. Current indicators show an adequate potential for the development of a short-term and an ultra-short-term downtrend.

Resistance levels: 0.7349, 0.7373, 0.7404, 0.7435.

Support levels: 0.7324, 0.7300, 0.7275, 0.7255.

Trading tips

To open long positions, one can rely on the rebound from the support level of 0.7324, with the subsequent breakout of the 0.7349 mark. In this case, corrective buys with the target at 0.7404 should be considered. Stop-loss should be placed no further than 0.7300. Implementation period: 2-3 days.

Confident breakdown of current support levels may indicate further sales. The breakdown of the level of 0.7300 down would provide the way for "the bears" to the levels of 0.7250-0.7230. Stop-loss – 0.7335. Implementation period: 2-3 days.

Use more opportunities of the NPBFX analytical portal: glossary

Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on NZD/USD and trade efficiently with NPBFX.