How to be confident in your trading decisions? Use technical indicators on the NPBFX portal!

Good afternoon, dear forum visitors!

Technical indicators allow traders to assess the current situation and future trends in the Forex market, helping to prognose the price fluctuations on which you can earn. Exactly the indicators form trading signals for buying, selling or waiting for the trading instruments. Market indicators are a kind of the basis for a trader's decision on selling or buying currency, as well as they are useful with other instruments, for example, CFD contracts. On the NPBFX analytical portal you can find free trading signals based on the 10 most popular technical indicators - MA10, MA20, MA50, MA100, MACD, BBands, Ichimoku, Stochastic, William`s, ZigZag, which will be discussed more detailed today.

The review of 10 main indicators on the NPBFX online portal

Traders actively use several basic graphic indicators, which give the most exact and reliable prognoses. So they are used on the NPBFX analytical portal to generate trading signals. The indicators on the analytical portal are divided into two types depending on their purpose:

1. Trend indicators show the starting point of trend and its end or reversal, trading on Forex without them is almost impossible. The most favorable time to work with these indicators is the when long price trends are observed on the market. These indicators include:

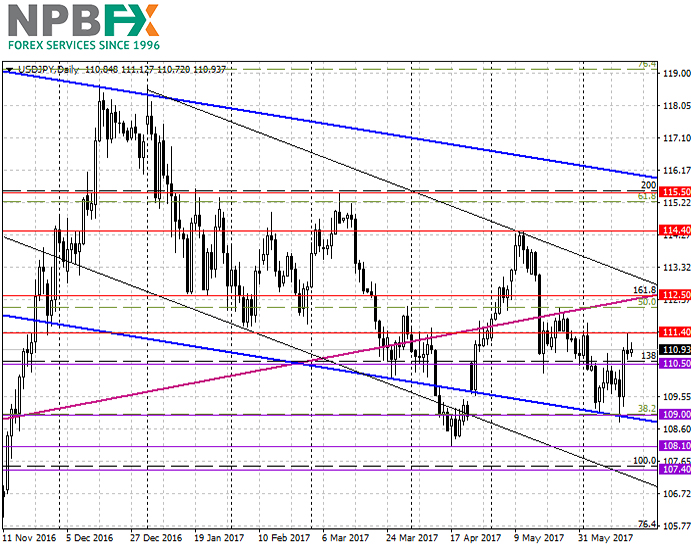

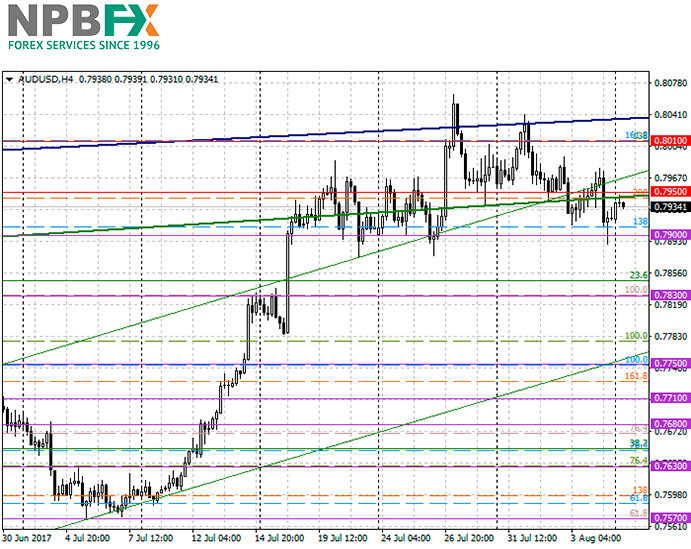

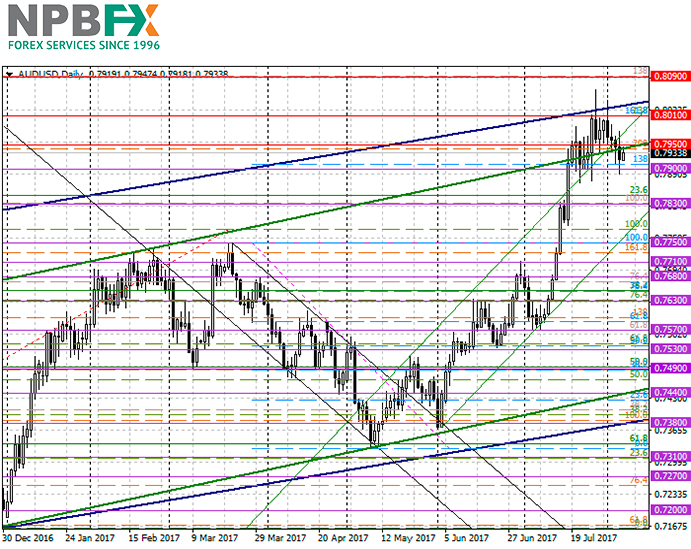

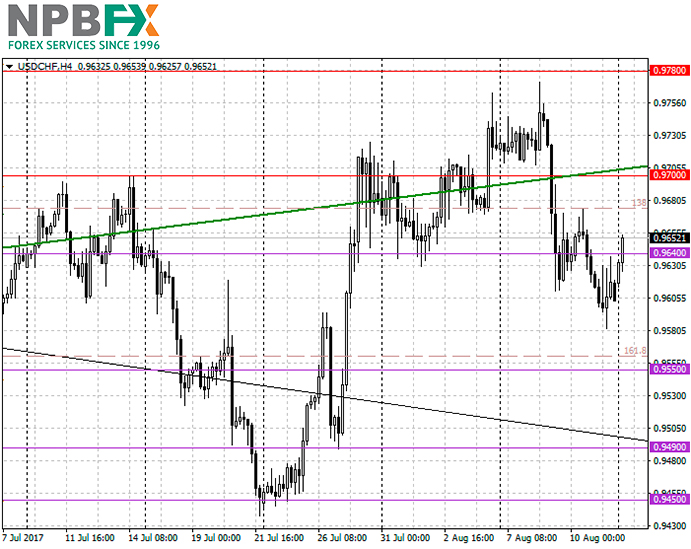

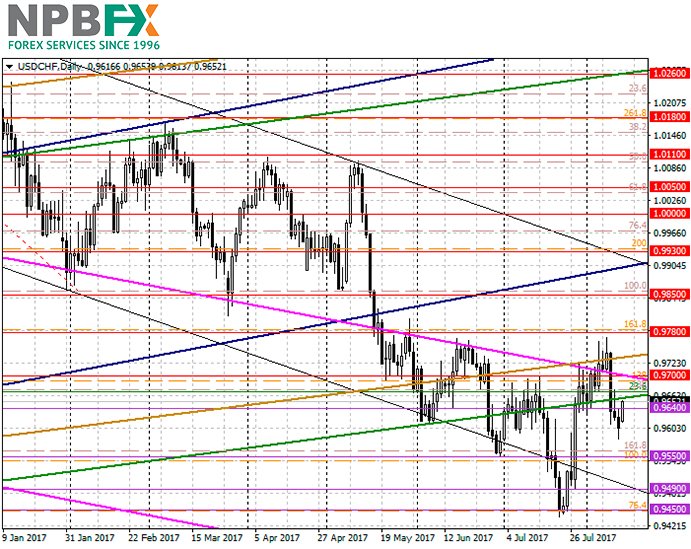

• MA10, MA20, MA50, MA100. MA indicator (the moving average) is presented on the portal for the most popular and informative periods - 10, 20, 50 or 100 days (MA10, MA20, MA50, MA100, respectively). Example: The 100-day moving average is very suitable for determining trend in the long term. And indeed, if the price has been going in one direction for 100 days, then it is not so easy to reverse the trend. MA are also the basis for many other technical indicators, such as Bollinger Bands and MACD.

• BBands - Bollinger Bands indicator reflects current changes in market volatility, confirms direction, warns about continuation or stopping of trend, consolidation periods, volatility for breakthroughs, and also points to local max. and min. The indicator shows the trading activity: in case of its increase, the bands expand and backwards, their narrowing indicates the price breakdown. Example: there are several methods working with BBands, for example, when approaching the upper level of resistance, it’s time to sell, and when you approach the lower level of support, to buy.

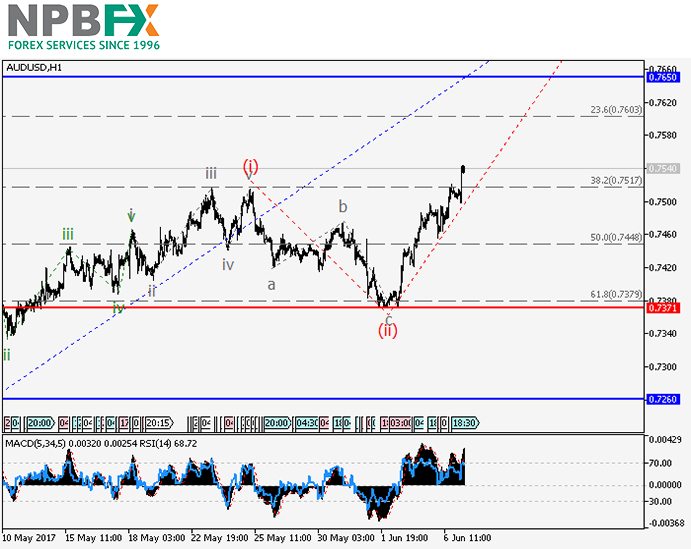

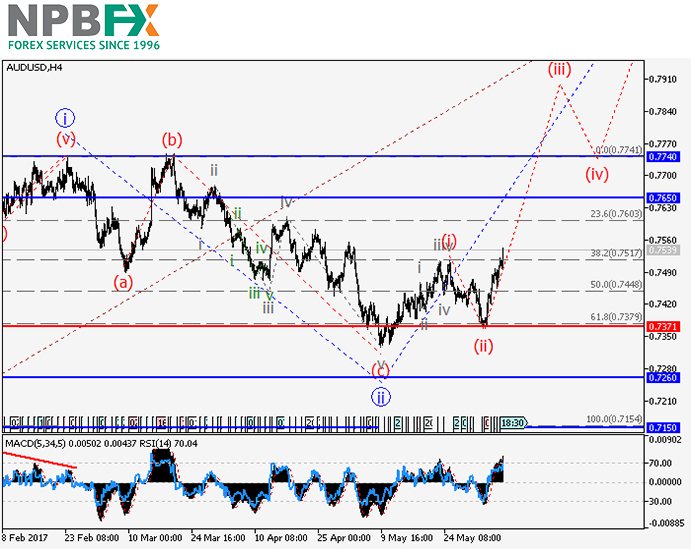

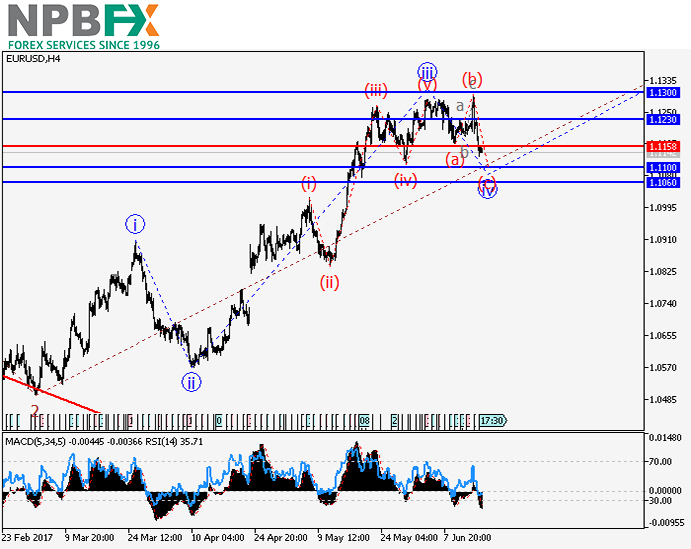

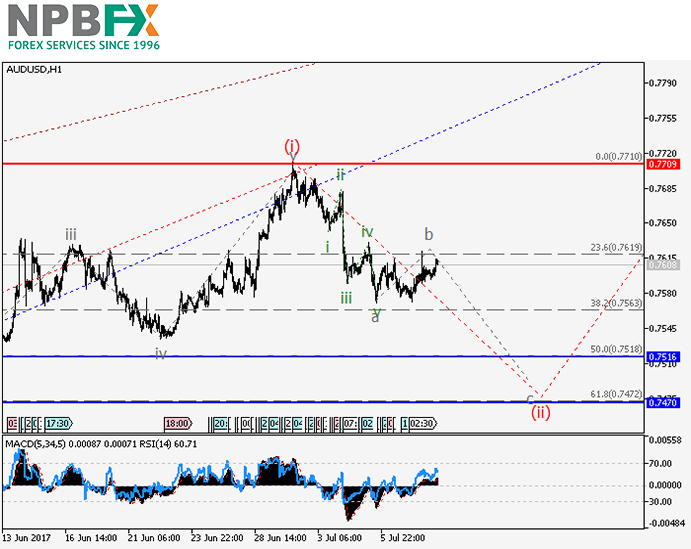

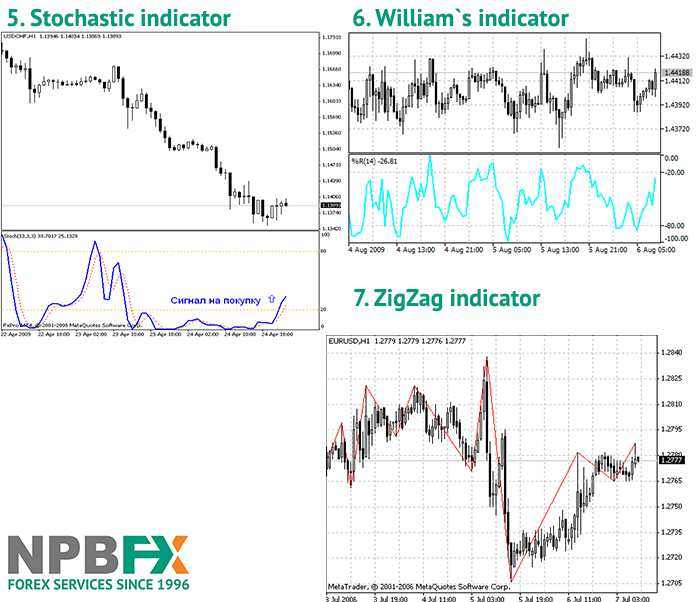

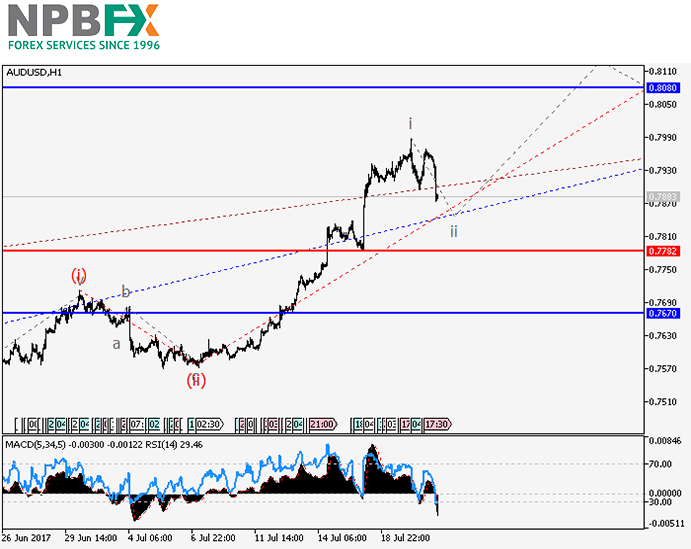

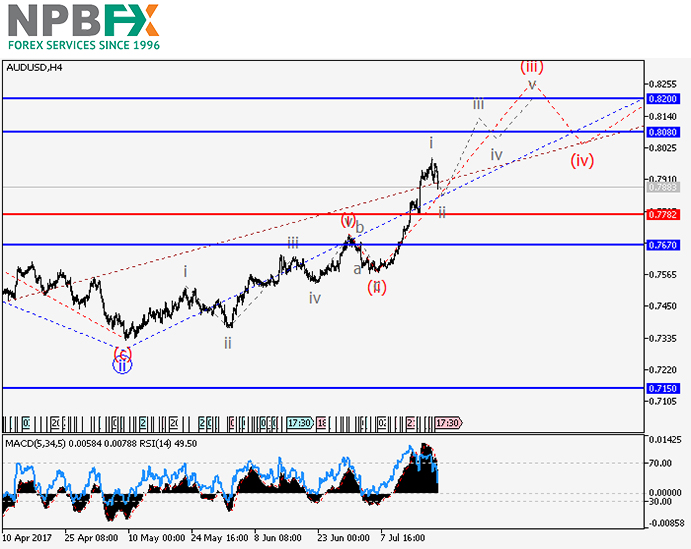

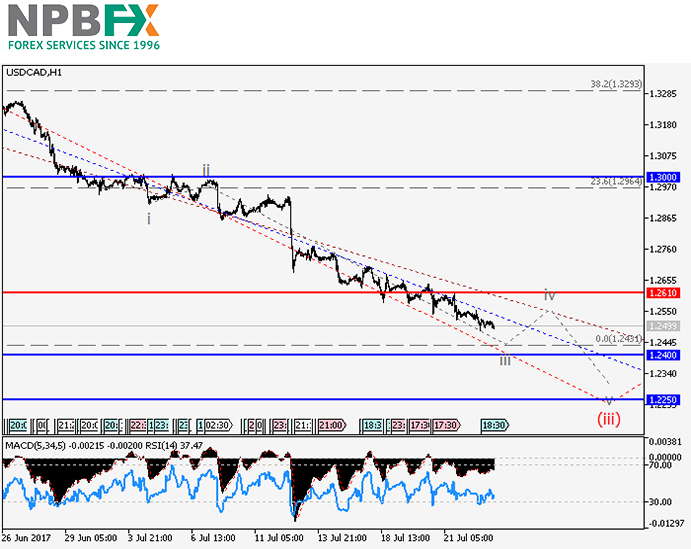

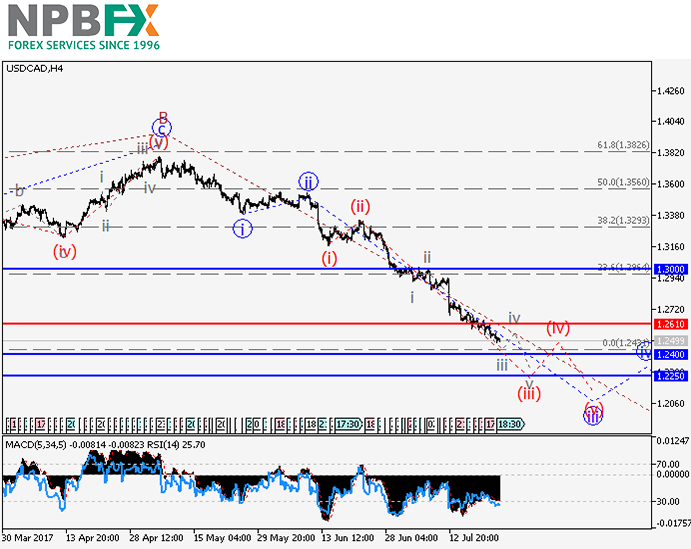

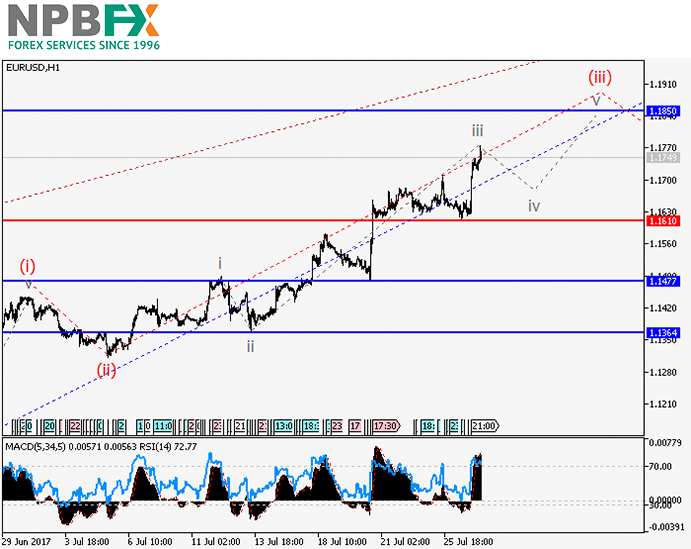

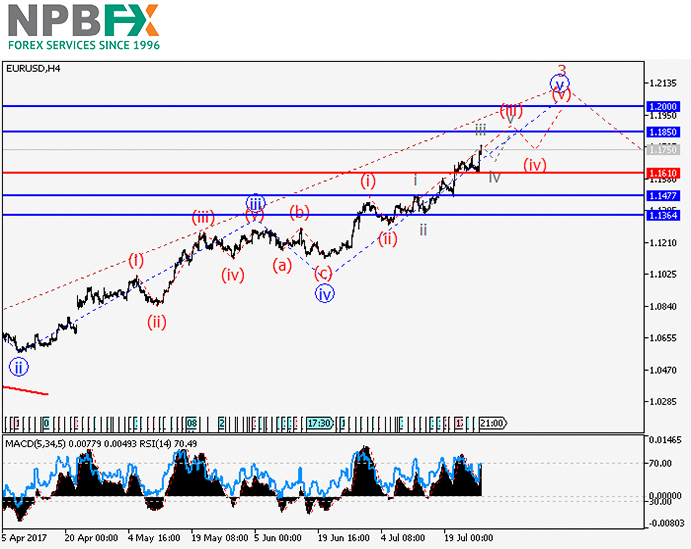

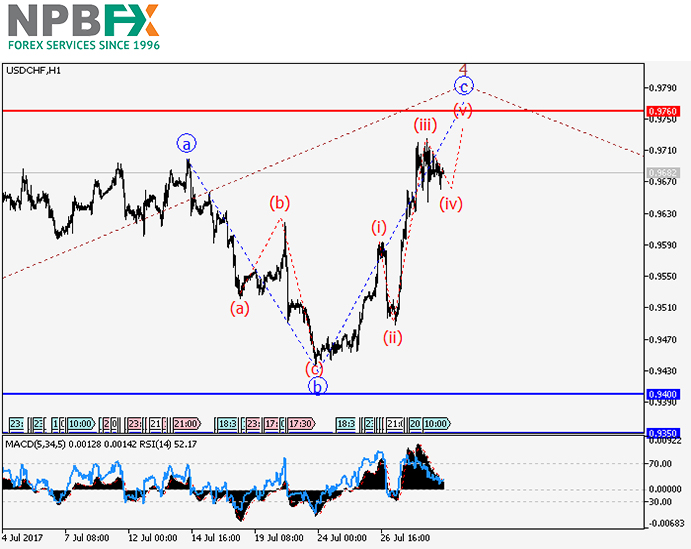

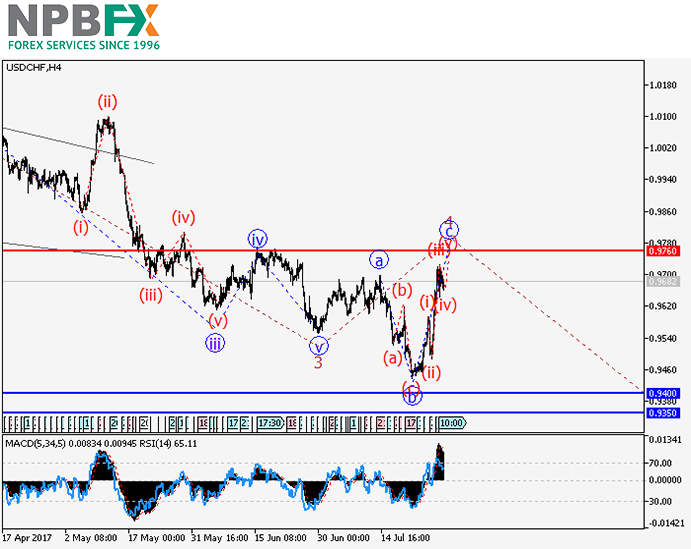

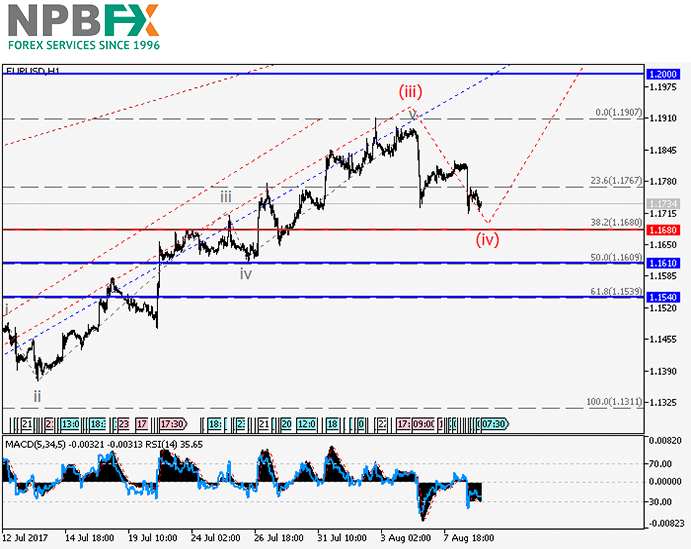

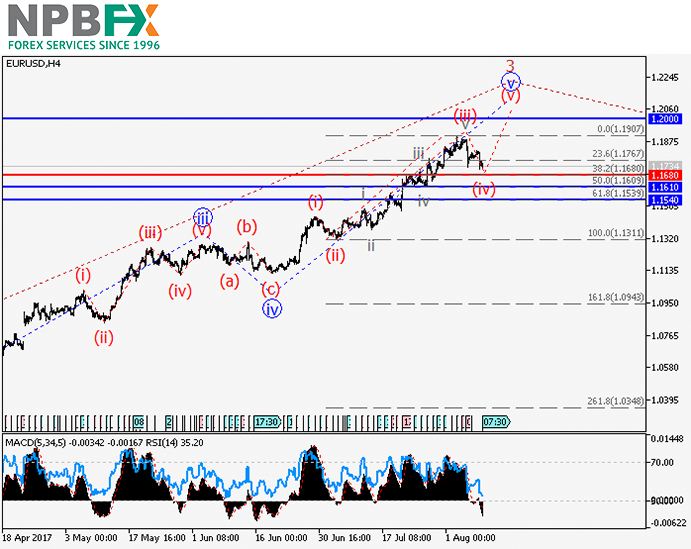

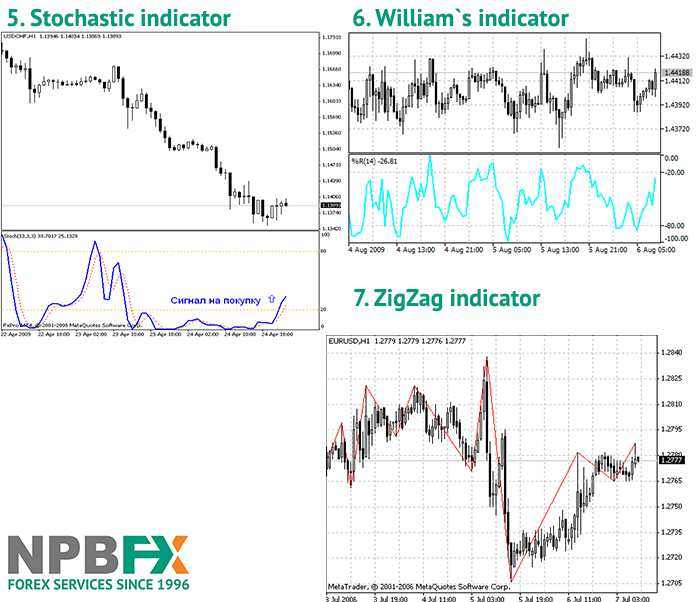

• ZigZag - can be very useful for traders using Eliot waves theory for analysis to establish the main waves and all sorts of corrective kickbacks. The main point of Zigzag's work is to filter out market noise (chaotic price movements). Example: if a trader finds that price movements are less than 5% are insignificant, then Zigzag ignores all price fluctuations less than 5%. However, Zigzag does not make predictions, and only indicates significant price changes in the past. But when used with other analytical tools (for example, Bollinger Bands), it can exactly confirm the signals to the input or output.

2. Oscillators help to identify overbought and oversold conditions on the Forex market. Overbought market is considered when the price is near its upper limit, and its further increase is unlikely. The oversold zone is characterized by such a low price that its further decline is unlikely at the moment. As a rule, traders buy currency during the period of oversold market, and sell during the overbought period. Although the analysis and use of oscillators performs best in a stationary market, they also determine the time of trend revers.

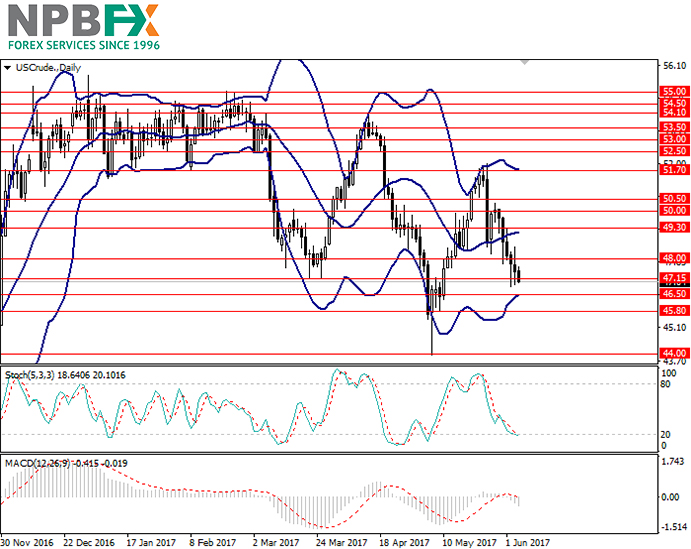

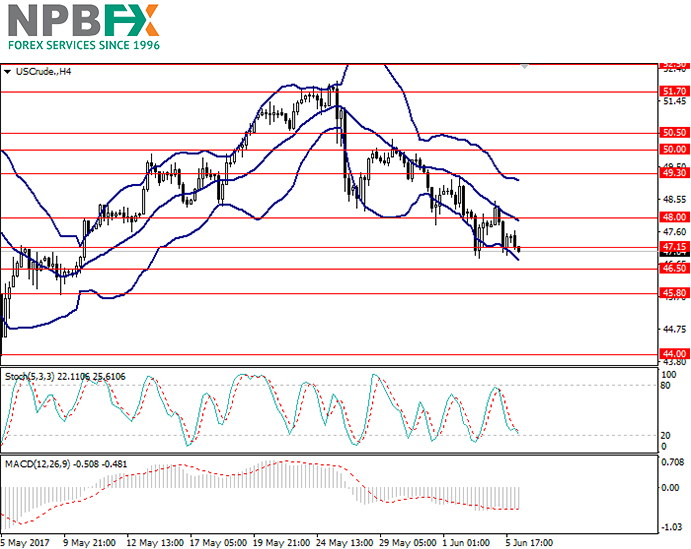

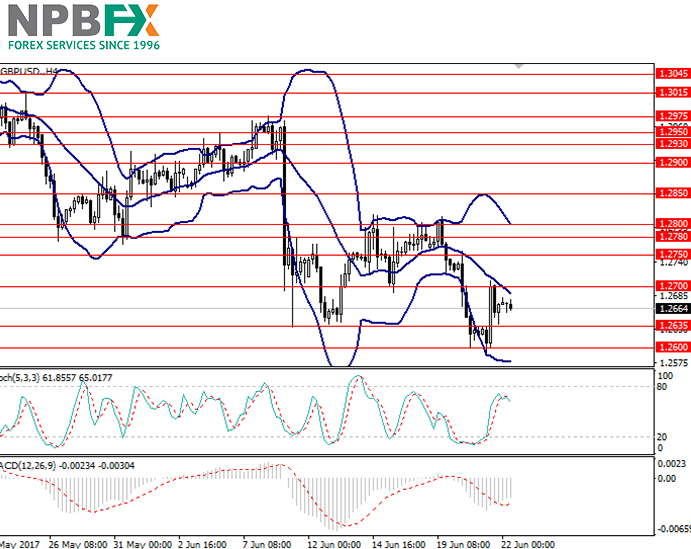

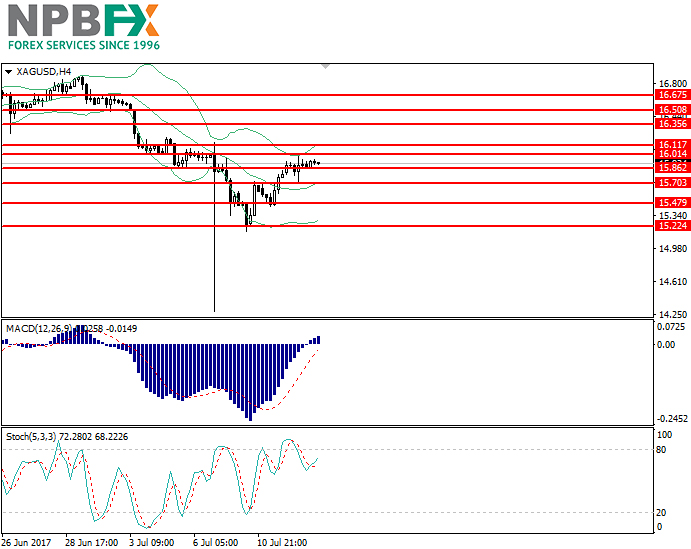

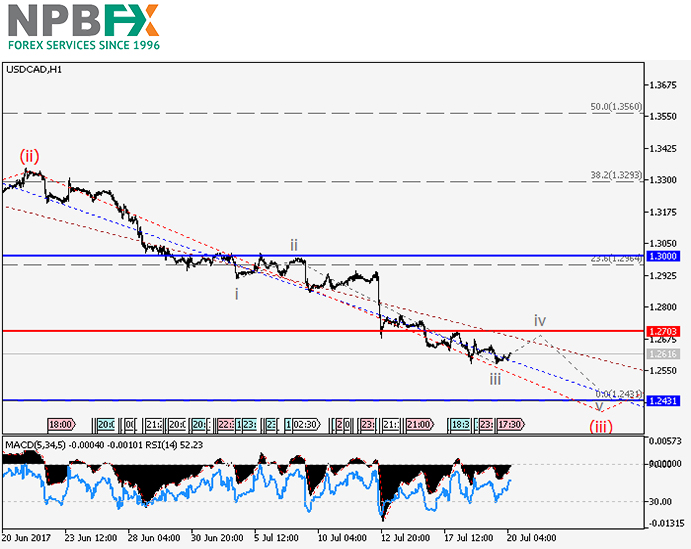

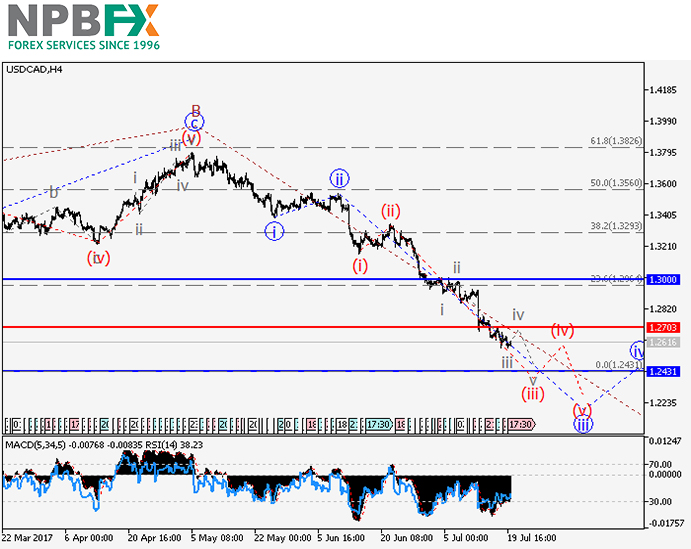

• MACD - gives you an opportunity to enter the trade at the beginning of the trend and exit before it ends. In the settings you will see 3 parameters: 1 and 2 parameters - the periods for calculating the fast and slow moving average, and also the histogram - the number of bars for calculating the difference between the moving averages. Example: crossing of moving averages, i.e. absence of a difference between them, serves as a signal for the beginning of a new trend.

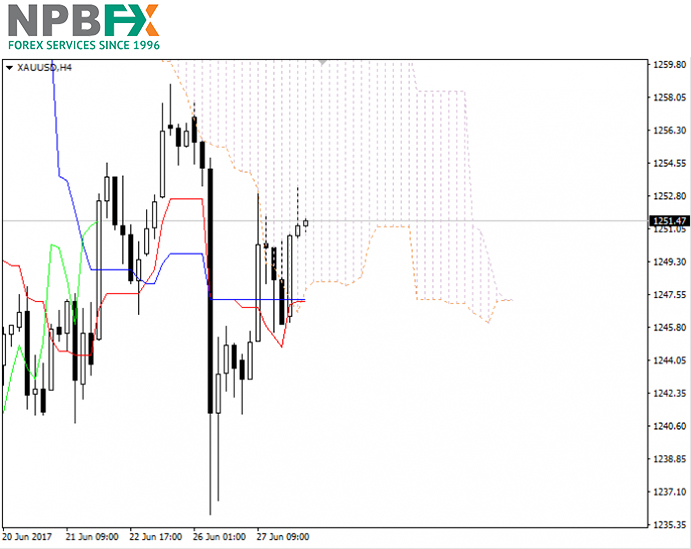

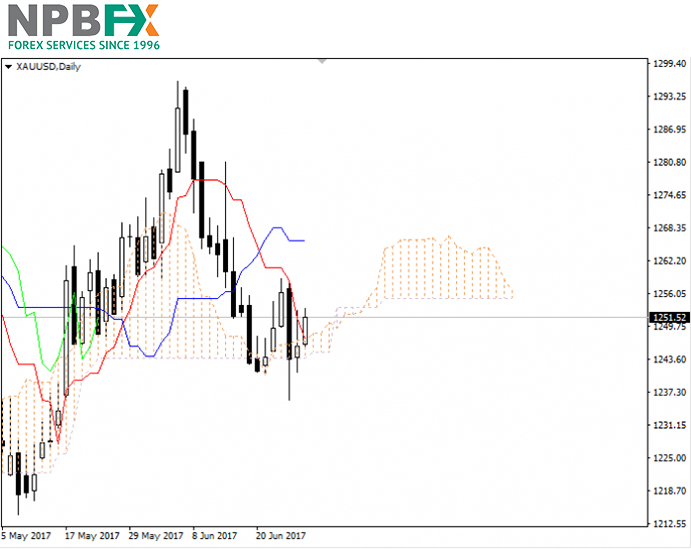

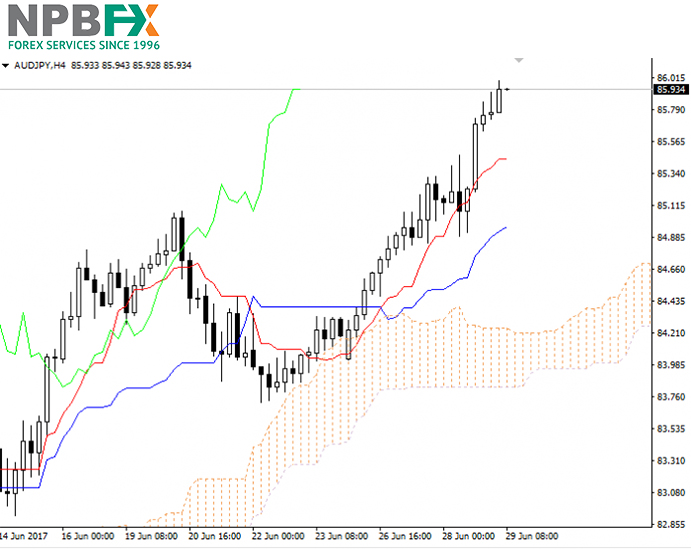

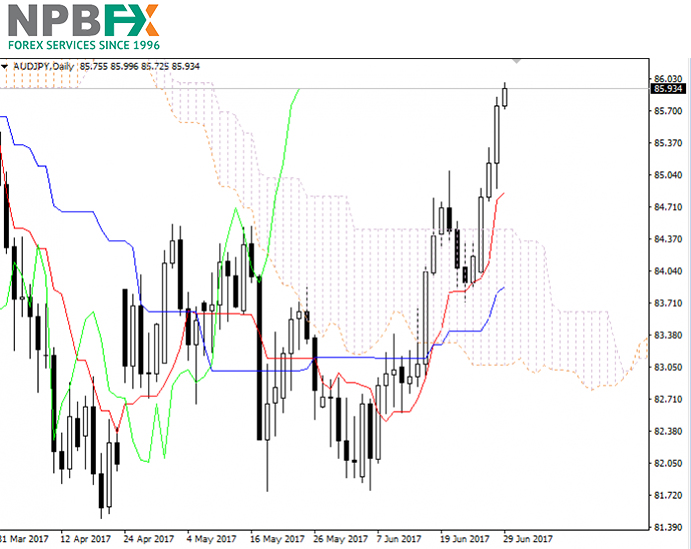

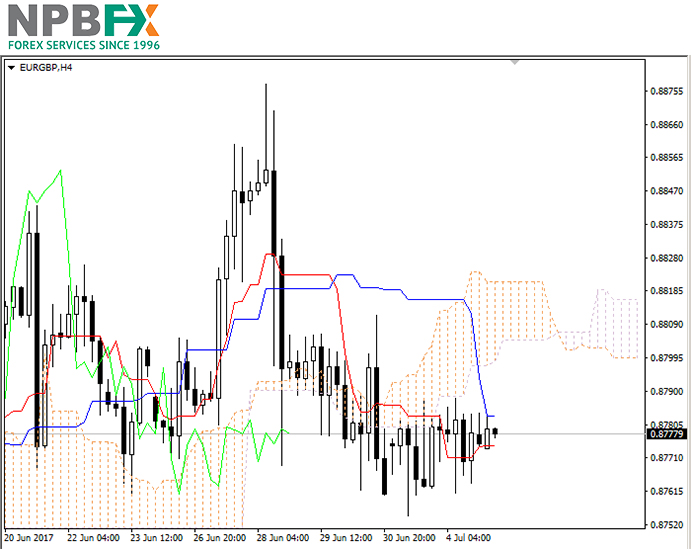

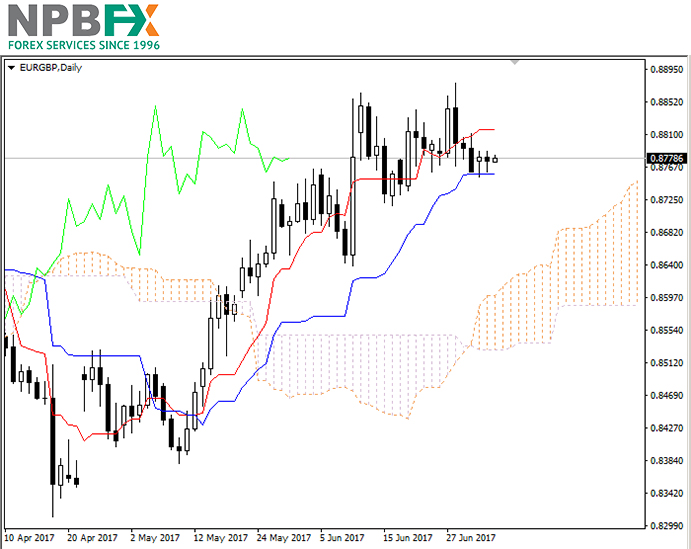

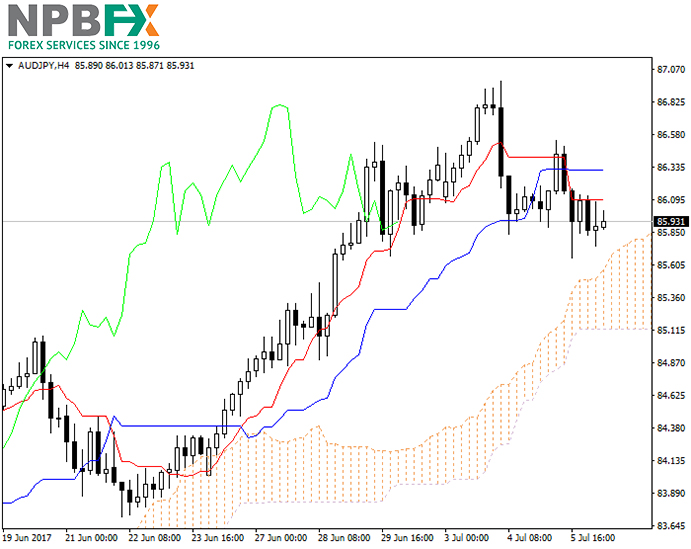

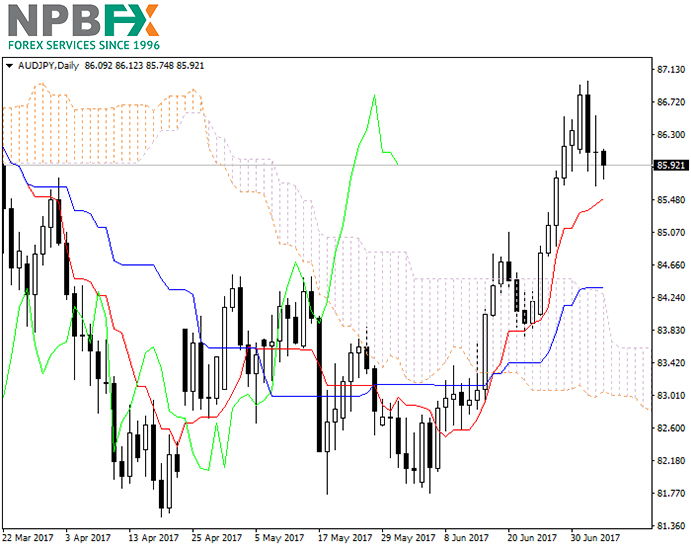

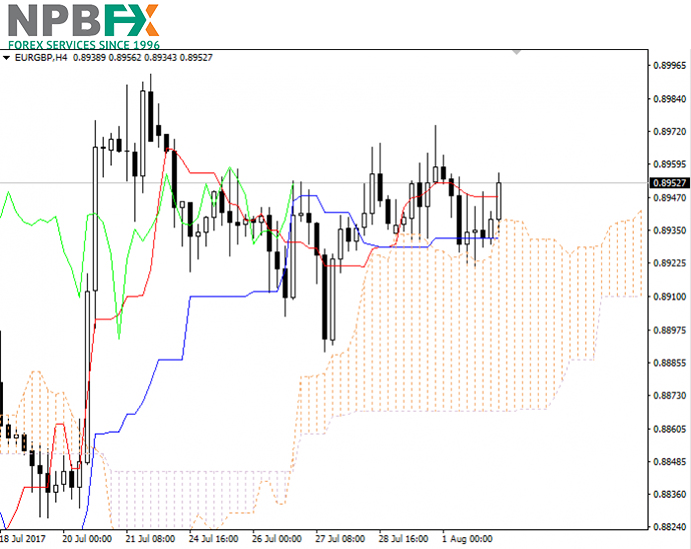

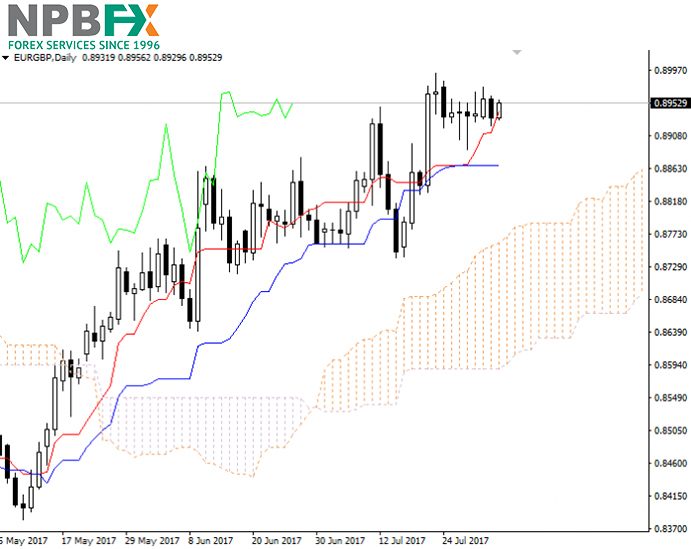

• Ichimoku - Ichimoku indicator consists of 5 lines: Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, Chinkou Span. The distance between the lines of Senkou is hatched on the chart and is called the Ishimoku cloud. If the price is between these lines, the market is considered non-trendy and the edges of the cloud form then the support and the resistance levels. Example: if the Chinkou Span line crosses the price chart from bottom to top, this is a signal to buy, and backwards.

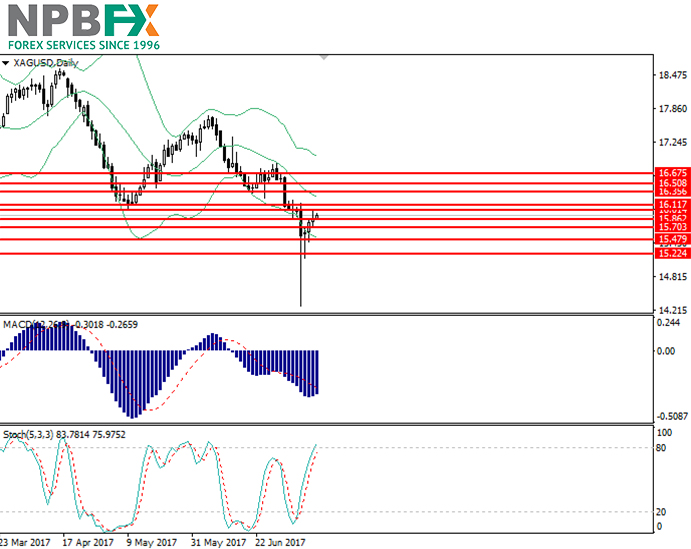

• Stochastic - Stochastic oscillator consists of two lines: fast and slow. The second one is the most significant, because by its dynamics traders can judge on the most important changes in the market. Stochastic has a rating scale from 0 to 100, allowing you to set the percentage place of the last closing price in the total price range for a certain period of time. Example: if the rate is higher than 80, then the closing price is near the upper limit of the range (overbought market), if below 20, then close to the bottom (oversold).

• William`s – William’s Percent Range, a simple but effective indicator, similar to Stochastic. Example: the values of the indicator in the range from -80% to -100% indicate a state of oversold, and in the range from -0% to -20% indicate that the market is overbought. The indicator William’s Percent Range has a curious ability to anticipate price reversals. It almost always forms a peak and turns down for a certain period of time before the price reaches a peak and turns down. Similarly, William’s Percent Range usually forms a depression and turns up in advance.

A useful addition to technical indicators is the indicator "Forex Marker Review", which allows you to determine which positions prevail in the market - to buy or sell.

You can find out more about popular indicators in the section of educational video courses on the NPBFX analytical portal.

Register and receive free and unlimited access to the trading signals, indicators and other useful instruments on the NPBFX online portal to improve the efficiency of your trading.