; Settings keys can be in snake case, camel case, or pascal case.

; All settings can be overwritten by an user settings file or a command option.

; Example: node ./bin/gen.js --settings ./my-settings.ini --collection-capacity 1000

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Data source ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

; Express Generator loads data by either "server", "symbol", and "period" or by "data_file"

; Server is actually the data files folder under the "data" folder.

; Provided by Forex Software Ltd.: Premium, Eightcap, BlackBull, Darwinex, MetaQuotes

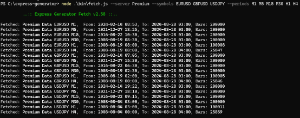

server = Premium

symbol = EURUSD

; Avalable values: M1, M5, M15, M30, H1, H4, D1

period = M30

; Data file from Premium data or exported from Meta Trader

; Example: data_file = ./data/Premium/EURUSD_M30.json

; The usage of "data_file" overrides the "symbol" and the "period" parameters.

data_file =

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Output collection ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

; Collection's filename for a newly generated or a validated Collection.

; Possible placeholders: [SERVER], [SYMBOL], [PERIOD], [YEAR], [MONTH], [DAY], [COUNT], [PROFIT]

; Placeholders can be used as directory names too.

; Example: output = ./collections/[SERVER]/[SYMBOL]/[PERIOD]/collection.json

output = ./collections/Coll_[SYMBOL]_[PERIOD].json

; When 'false' it adds a suffix to the collection file if it already exists.

; When 'true', it overwrites the file.

output_replace = false

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Input collection or directory ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

; Points one or several collections or a collection directory for validation.

; Keep empty to generate a new Collection.

; Possible placeholders: [SERVER], [SYMBOL], [PERIOD], [YEAR], [MONTH], [DAY]

input =

; Filters the input collections by given text phrases.

; It is helpful when we have an "input" directory with many collections.

; Possible placeholders: [SERVER], [SYMBOL], [PERIOD], [YEAR], [MONTH], [DAY]

input_match =./collections

; It validates the "input" strategies and then continues generating new ones

validate_then_generate = false

; Prevent rising an error when an input file cannot be loaded

suppress_input_error = false

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Collection ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

; The Collection will purge the excessive records.

; 0 means 100000

collection_capacity = 1000

; Sort the Collection by one of the following metrics:

; NetBalance, Profit, ProfitFactor, ReturnToDrawdown, RSquared, Stagnation, WinLossRatio

sort_by = Profit

; Correlation analysis threshold

correlation_threshold = 0.98

; Detect balance lines correlation

resolve_correlation = true

; Detect strategies with similar trading rules

resolve_similar_rules = false

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Generator stop ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

; 0 means unlimited for all of the options

max_calculated_strategies = 0

max_ascended_strategies = 0

max_collected_strategies = 0

max_working_minutes = 0

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Acceptance criteria ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

; Set 0 to ignore a criterion (except for min_profit)

max_consecutive_losses = 0

max_drawdown_percent = 0

max_equity_drawdown = 0

max_stagnation_days = 0

max_stagnation_percent = 0

min_count_of_trades = 10

min_profit = 1

min_profit_factor = 0

min_profit_per_day = 0

min_r_squared = 0

min_return_to_drawdown = 0

min_win_loss_ratio = 0

min_m1_count_of_trades = 0

min_m1_profit = 0

min_m1_profit_factor = 0

min_y1_count_of_trades = 0

min_y1_profit = 0

min_y1_profit_factor = 0

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Account settings ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

account_currency = USD

initial_account = 10000

leverage = 100

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Strategy properties ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

entry_lots = 0.10

; Trade direction: LongAndShort, LongOnly

trade_direction_mode = LongAndShort

; Opposite entry signal: Ignore, Reverse, IgnoreOrReverse

opposite_entry_signal = Ignore

; Stop Loss: AlwaysUse, MayUse, DoNotUse

stop_loss_usage = AlwaysUse

; Stop Loss type: Fixed, Trailing, FixedOrTrailing

stop_loss_type = Fixed

stop_loss_range_min = 500

stop_loss_range_max = 500

; Take Profit: AlwaysUse, MayUse, DoNotUse

take_profit_usage = AlwaysUse

take_profit_range_min = 25

take_profit_range_max = 25

take_profit_gte_stop_loss = false

; Max number of indicators to use

max_entry_slots = 8

max_exit_slots = 1

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Backtester ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

; Values: Open, Close. Use Open for EA Studio and Close for FSB Pro

exit_trade_at = Open

close_at_backtest_end = true

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Data Horizon ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

max_data_bars = 100000

; Use these parameters to set the data range between "data_start" and "data_end".

; Set from where the actual trading starts with "trade_start".

; Text: "2023-05-25 00:00 UTC", "2023-05-25 00:00", "2023-05-25" or "25 May 2023 00:00 UTC"

; Negative number as a number of days before the current date: -365, -30, -7

use_data_start = false

data_start = "01 Jan 2020 00:00 UTC"

use_data_end = false

data_end = "30 Jun 2023 00:00 UTC"

use_trade_start = false

trade_start = "01 Jun 2023 00:00 UTC"

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Forward testing ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

; Validate strategies on new unseen data.

use_forward_testing = false

preload_data_bars = 0

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Out of sample ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

; Use these parameters to set the data range.

; The program cuts data after applying Data Horizon.

data_start_percent = 0

data_end_percent = 100

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Trading Session ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

session_open = 00:00

session_close = 24:00

friday_close = 24:00

trade_on_sunday = true

close_at_session_close = false

close_at_friday_close = false

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Symbol info ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

; Set values to override the values coming with the data file.

; Useful for the Premium Data.

; Commission is in Currency applied at Close.

spread =

swap_long =

swap_short =

commission =

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Miscellaneous ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

; When enabled, the generator dynamically updates the best strategy on the console.

update_best = true

; How many strategies to print when finish

show_top = 10

; Prevent showing output in the console (except errors)

silent = false

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Indicators used by the Generator ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Entry indicators

entry_accelerator_oscillator = true

entry_accumulation_distribution = false

entry_adx = true

entry_alligator = true

entry_average_true_range = true

entry_awesome_oscillator = true

entry_bears_power = true

entry_bollinger_bands = true

entry_bulls_power = true

entry_candle_color = true

entry_commodity_channel_index = true

entry_demarker = true

entry_directional_indicators = true

entry_donchian_channel = false

entry_envelopes = true

entry_force_index = false

entry_long_or_short = false

entry_macd = true

entry_macd_signal = true

entry_momentum = true

entry_money_flow_index = false

entry_moving_average = true

entry_moving_average_of_oscillator = true

entry_moving_averages_crossover = true

entry_on_balance_volume = false

entry_pin_bar = true

entry_rsi = true

entry_rvi = false

entry_rvi_signal = false

entry_standard_deviation = true

entry_stochastic = true

entry_stochastic_signal = true

entry_time = false

entry_volumes = false

entry_williams_percent_range = true

;; Exit indicators

exit_accelerator_oscillator = false

exit_accumulation_distribution = false

exit_adx = false

exit_alligator = false

exit_average_true_range = false

exit_awesome_oscillator = false

exit_bears_power = false

exit_bollinger_bands = false

exit_bulls_power = false

exit_candle_color = false

exit_commodity_channel_index = false

exit_demarker = false

exit_directional_indicators = false

exit_do_not_exit = true

exit_donchian_channel = false

exit_envelopes = false

exit_force_index = false

exit_macd = false

exit_macd_signal = false

exit_momentum = false

exit_money_flow_index = false

exit_moving_average = false

exit_moving_average_of_oscillator = false

exit_moving_averages_crossover = false

exit_on_balance_volume = false

exit_rsi = false

exit_rvi = false

exit_rvi_signal = false

exit_standard_deviation = false

exit_stochastic = false

exit_stochastic_signal = false

exit_time = false

exit_volumes = false

exit_williams_percent_range = false

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Indicator options ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

; The following options are used by the Generator for composing new strategies.

; Randomize Moving Average Methods.

; When 'true', the Generator chooses between Simple, Exponential, Weighted and Smoothed.

randomize_ma_method = false

; Maximum period generated by the Generator. Recommended: 50. Recommended max 200.

max_indicator_period = 100

; Shift of the Moving Average indicator. When it is enabled, the Generator may use shift.

randomize_ma_shift = false

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Auto-save collection ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

; Auto-save is useful if you run Express Generator for long time on strict Acceptance Criteria

; Setting 0 disables an option. Choose one of the options only.

; Save the collection at a particular interval in minutes.

; It doesn't clear EG collection.

auto_save_at_minutes = 0

; Save the collection when it reaches the given count.

; It clears EG collection.

auto_save_at_collected = 0

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Optimizer ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

enable_optimizer = false

numeric_values_steps = 20

optimize_protections = false

; Search best strategy by:

; NetBalance, Profit, ProfitFactor, ReturnToDrawdown, RSquared, Stagnation, WinLossRatio

optimize_by = Profit

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

;; Monte Carlo ;;

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

enable_monte_carlo = false

count_of_tests = 20

valid_tests_percent = 80

spread_max = 30

; Execution problems

slippage_max = 20

skip_entries_percent = 2

skip_exits_percent = 2

rand_close_percent = 0

; Strategy variations

ind_params_change_probability = 0

ind_params_max_change_percent = 20

ind_params_min_delta_steps = 20

rand_first_bar_percent = 10

; Monte Carlo validation

mc_max_consecutive_losses = 0

mc_max_drawdown_percent = 0

mc_max_equity_drawdown = 0

mc_max_stagnation_days = 0

mc_max_stagnation_percent = 0

mc_min_count_of_trades = 100

mc_min_profit = 10

mc_min_profit_factor = 0

mc_min_profit_per_day = 0

mc_min_r_squared = 0

mc_min_return_to_drawdown = 0

mc_min_win_loss_ratio = 0