Sidebar

This is an old revision of the document!

Table of Contents

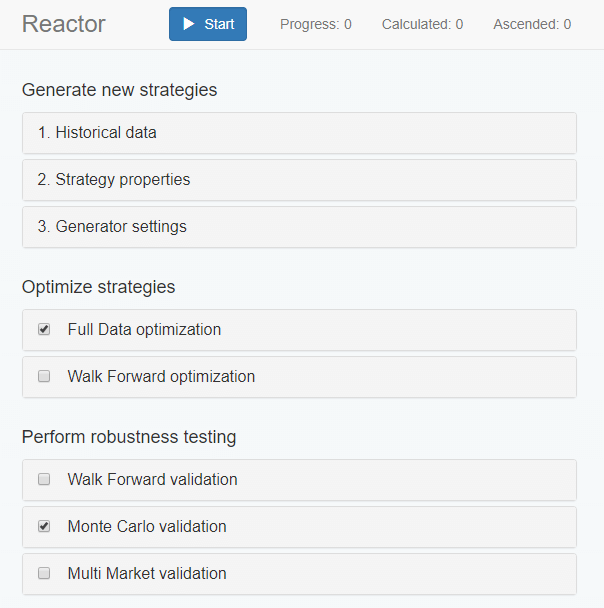

Reactor

The Reactor provides a way to automate the process of generating, optimizing and validation strategies. Ir is also known as an Automated Workflow for creating trading systems.

The Reactor comprises a Generator and additional tools for optimization and validation of the generated strategies. For example, you can enable the Monte Carlo tool in the Reactor and each generated strategy will be validated by number of Monte Carlo tests. It will be added to the Collection only if passes the Monte Carlo tests and all other enabled validation tools.

You can enable or disable each option. When you do it, the Reactor shows the corresponding option stats on the right side of the screen. This tool is extremely powerful and there are many ways to use it.

How it works:

- it generates a strategy (with the corresponding goal, criteria and OOS),

- optionally it can optimize the strategies. You can use separate settings for that.

- the strategies may be additionally validated against the Monte Carlo and the Multi Market tools.

- finally, if the strategy passes all validations successfully the reactor will ascend it to the Collection.

The final goal of the tool is to provide strategies that have passed all robustness tests. So we can start EA Studio for a night and we will have ready for trading strategies set at the morning.

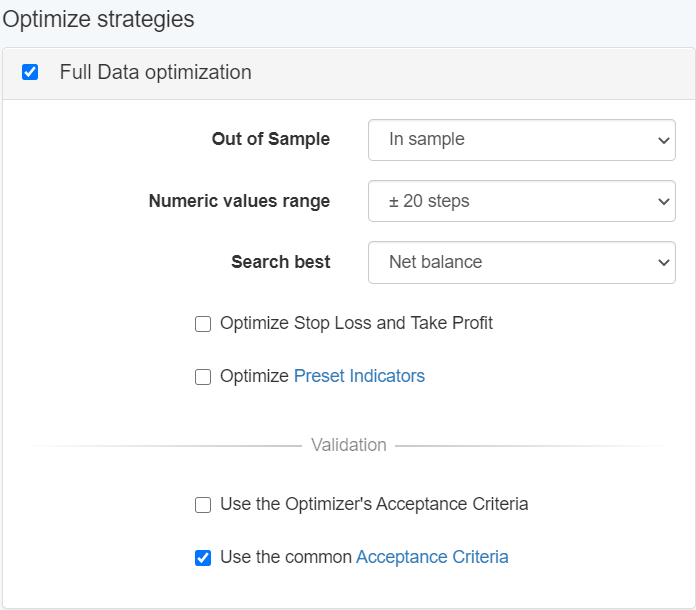

Full Data Optimization

If you “Use optimization”, the Automated Workflow tries to optimize every strategy produced by the Generator. You can use individual settings for this optimization tool different than the main Generator settings. After the optimization is ready, the app validates the best found strategy against the Acceptance Criteria. If the strategy fulfills the criteria, the app continues to the next workflow tool. If no more tools are enabled, the app pushes the strategy to the Collection and runs the Generator. You may find it useful to increase the Generator's working minutes in order to let it run longer

Walk Forward optimization

Walk Forward validation

Walk Forward analysis (WFA) or Walk Forward optimization (WFO) is a sequential optimization applied to an investment strategy. The name of the analysis is called “walk forward” because we have a moving window that progressively traverses the whole period of the data history with a pre-established step. Algorithmic traders apply such analysis to decrease the over-optimized parameters used in the investment strategy as we don’t want only a great looking backtest result, we want also a system that don't fail in live real money account.

Read more about it at Walk Forward

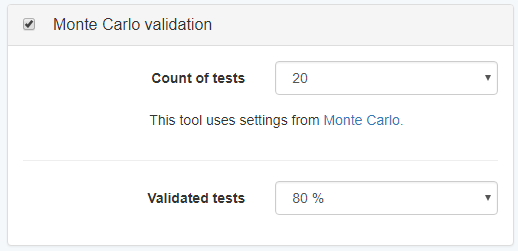

Monte Carlo Validation

The Monte Carlo validation tool performs random test of the strategy and validates the output.

You set the percent rate of the tests on profit. In the shown example, all simulations must finish on profit in order to pass the strategy to the next tool.

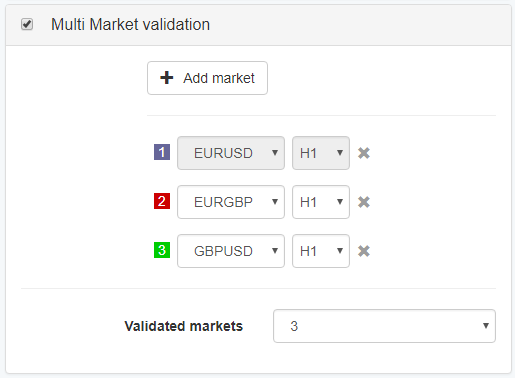

Multi Market Validation

The Multi Market tool tests the strategy against different markets. Your validation criteria is the minimum count of tests that are on profit.

We have 6 markets on the example above and the validation threshold is 3. That means that if 3 or more tests finish on profit, the strategy will ascend to the Collection.