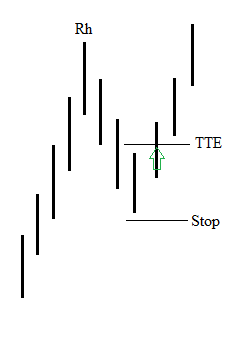

Joe Ross - Trader's Trick Entry (TTE)

Trader's Trick Entry is one of the best concepts in trading that I know, and it is integral part of my trading strategy. The idea behind TTE is very simple. Uptrend is a sequence of higher highs and lows, while the downtrend is a sequence of lower highs and lows. For continuation of the trend, a new high (uptrend) or new low (downtrend) should be made. If we use the terminology of Joe Ross, this means that the price should break beyond the last Ross Hook (Rh). If you are a trend trader you should enter the market after that break of the last Ross Hook.

This sounds pretty easy, but in the real world there are large market participants that engineer price moves to levels where orders are clustered. These price move could be initiated for various reason varying from stop hunting to make extra profits or searching for liquidity. Actually, that's not so important. What we can and must do is to try to guess when such price move will start and enter before the other traders. Remember, that you must have and edge if you want to make money. To beat the insiders in their own game, Joe Ross created the Trader's Trick Entry. As Joe Ross says “For an insider to be able to stop us from shadowing his moves, he would have to sabotage himself”.

TTE is very easy. Once a Ross Hook or point 2 of 1-2-3 pattern is in place, we watch the correction and want to buy a violation of the high of any of the first three after the Ross Hook. For short position, we sell a violation of the low of one of the bars. The initial stop is placed on the opposite side of the bar. The trade can be initiated after more than 3 bars only if a double or triple high/low forms. Also,“there must be sufficient room between our entry price and the Rh point for us to be able to cover costs and take at least some profit.” You can see on the chart below the TTE set up for long position.