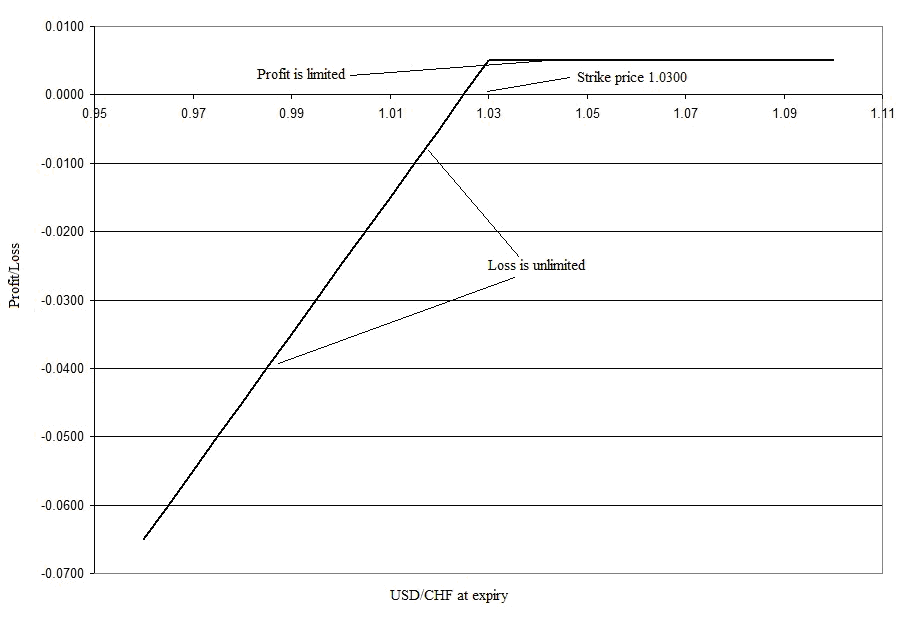

Short put option

The seller of a put option has the obligation to buy the underlying asset at a specified price (strike price) at or before a specified date (expiry of the option), if the option is exercised by the buyer. The risk of the seller of the put option is unlimited. The potential for profit is limited to the amount of the premium received. When selling options there is one factor that is always in our favor - the time decay.

The short put option strategy is most suitable in the following cases:

- When you consider that the price of the underlying asset will not fall below the current levels and do not expect prolonged uptrend;

- When you are absolutely sure that you can strictly apply a system of risk management;

- When market volatility is high and/or seasonal or cyclical decline is expected.

P&L at expiry